[CBSE]Q. 4 (a) solution of Fundamentals of Partnership Firms DK Goel 2022-23

Solution to Question number 4 (a) of the Fundamentals of partnership firm chapter DK Goel Book 2022-23 Edition?

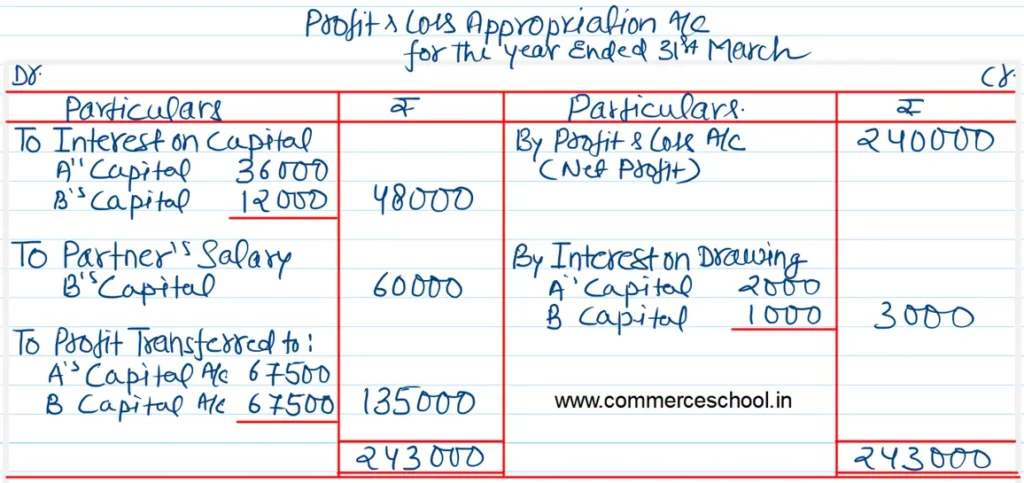

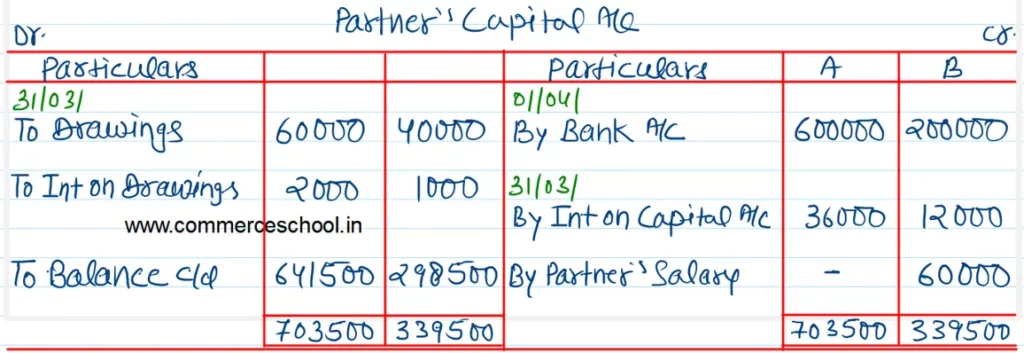

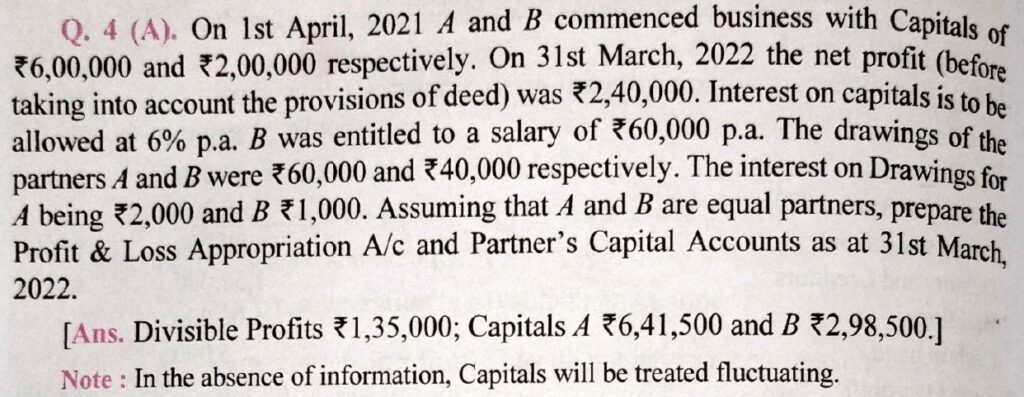

On 1st April, 2021 A and B commenced business with Capitals of ₹ 6,00,000 and ₹ 2,00,000 respectively. On 31st March, 2022 the net profit (before taking into account the provisions of deed) was ₹ 2,40,000. Interest on capitals is to be allowed at 6% p.a. B was entitled to a salary of ₹ 60,000 p.a. The drawings of the partners A and B were ₹ 60,000 and ₹ 40,000 respectively. The interest on Drawings for A being ₹ 2,000 and B ₹ 1,000. Assuming that A and B are equal partners, prepare the Profit & Loss Appropriation A/c and Partner’s Capital Accounts as at 31st March, 2022.

[Ans. Divisible Profits ₹ 1,35,000; Capitals A ₹ 6,41,500 and B ₹ 2,98,500.]

Solution:-