[CBSE] Q. 5 Solution Fundamentals of Partnership Firms DK Goel [2023-24]

Are you looking for the solution of Question Number 5 of the Fundamentals of partnership firm chapter DK Goel Book 2023-24 Edition?

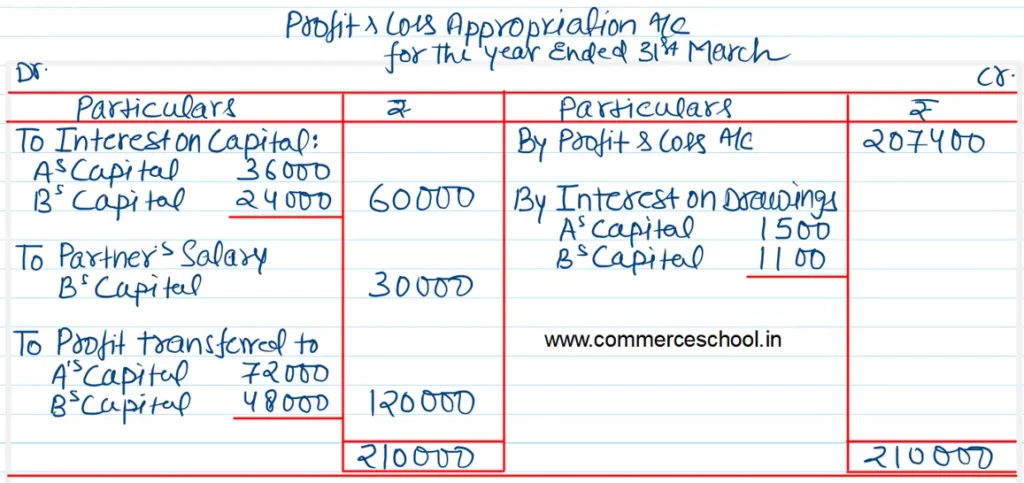

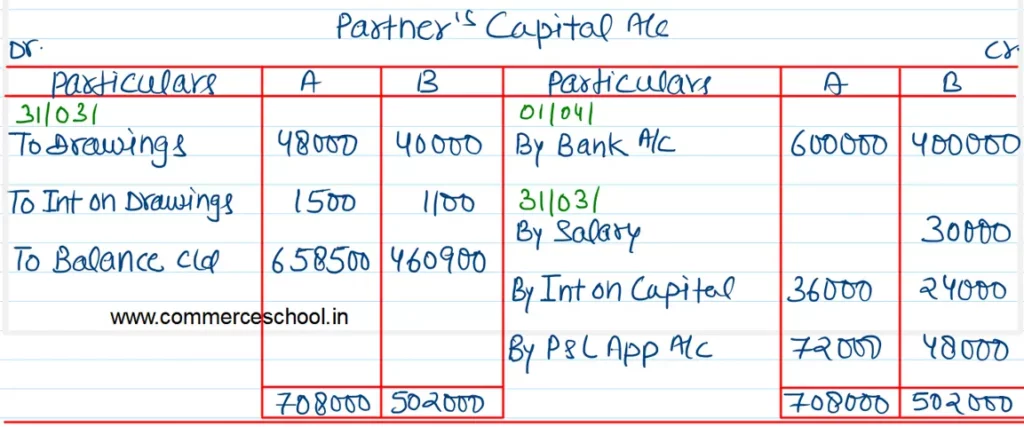

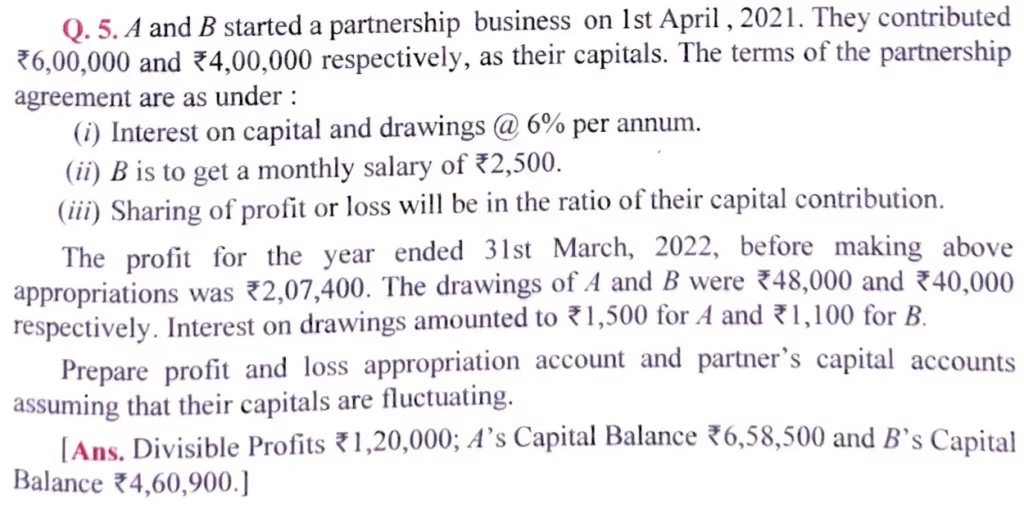

A and B started a partnership business on 1st April 2021. They contributed ₹ 6,00,000 and ₹ 4,00,000 respectively, as their capitals. The terms of the partnership agreement are as under:

(i) Interest on capital and drawings @ 6% p.a.

(ii) B is to get a monthly salary of ₹ 2,500.

(iii) Sharing of profit or loss will be in the ratio of their capital contribution.

The profit for the year ended 31st March 2022, before making the above appropriations was ₹ 2,07,400. The drawings of A and B were ₹ 48,000 and ₹ 40,000 respectively. Interest on drawings amounted to ₹ 1,500 for A and ₹ 1,100 for B.

Prepare Profit and Loss Appropriation Account and Partner’s Capital Accounts assuming that their capitals are fluctuating.

[Ans. Divisible Profits ₹ 1,20,000; A’s Capital Balance ₹ 6,58,500 and B’s Capital Balance ₹ 4,60,900.]

Solution:-