[ISC] Q. 12 Death of Partner Solution TS Grewal Class 12 (2022-23)

Are you looking for the solution to Question number 12 of the Death of Partner Chapter of TS Grewal Book ISC Board 2022-23 Edition?

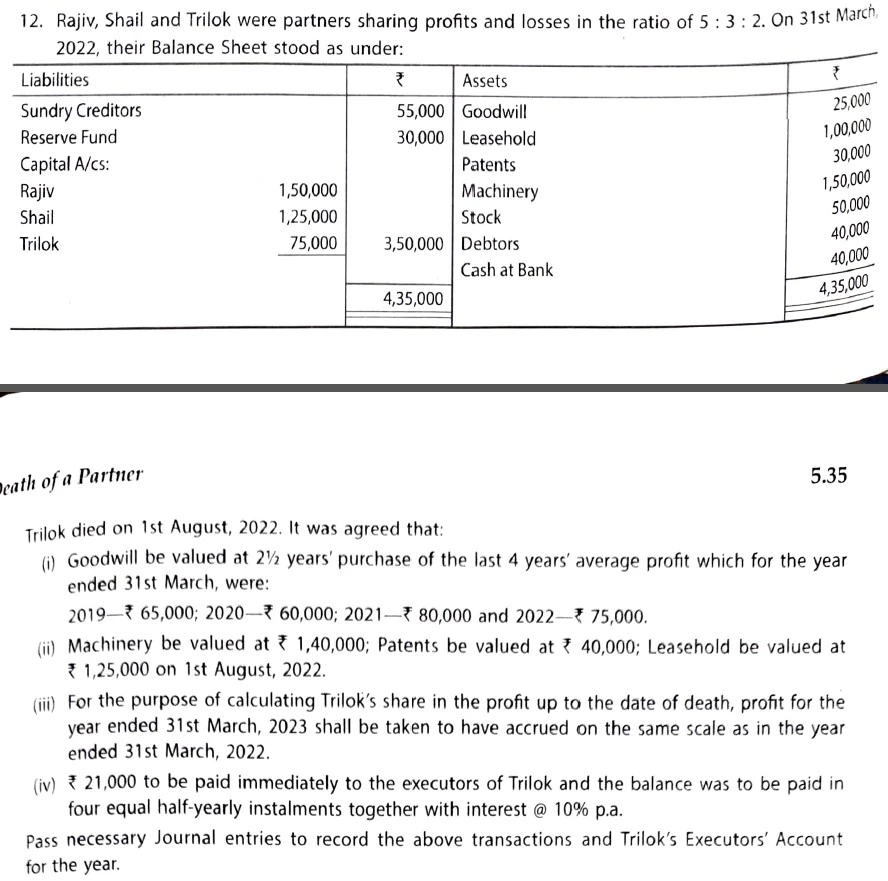

Rajiv, Shail and Trilok were partners sharing profits and losses in the ratio of 5 : 3 : 2. On 31st March, 2022, their Balance Sheet stood as under:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors Reserve Fund Capital A/cs: Rajiv Shail Trilok | 55,000 30,000 1,50,000 1,25,000 75,000 | Goodwill Leashold Patents Machinery Stock Debtors Cash at Bank | 25,000 1,00,000 30,000 1,50,000 50,000 40,000 40,000 |

| 4,35,000 | 4,35,000 |

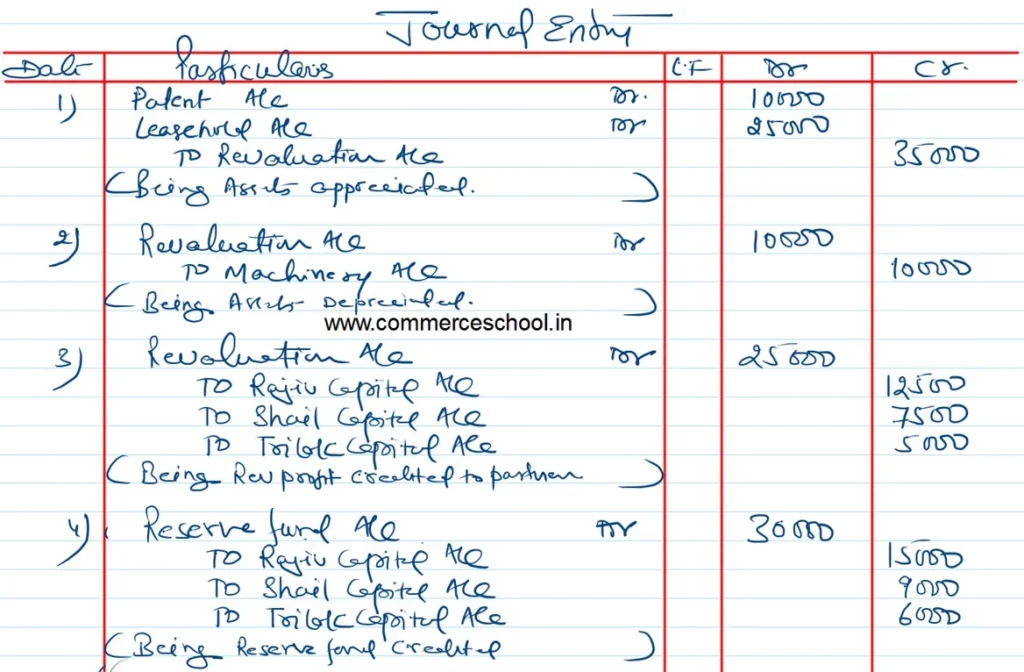

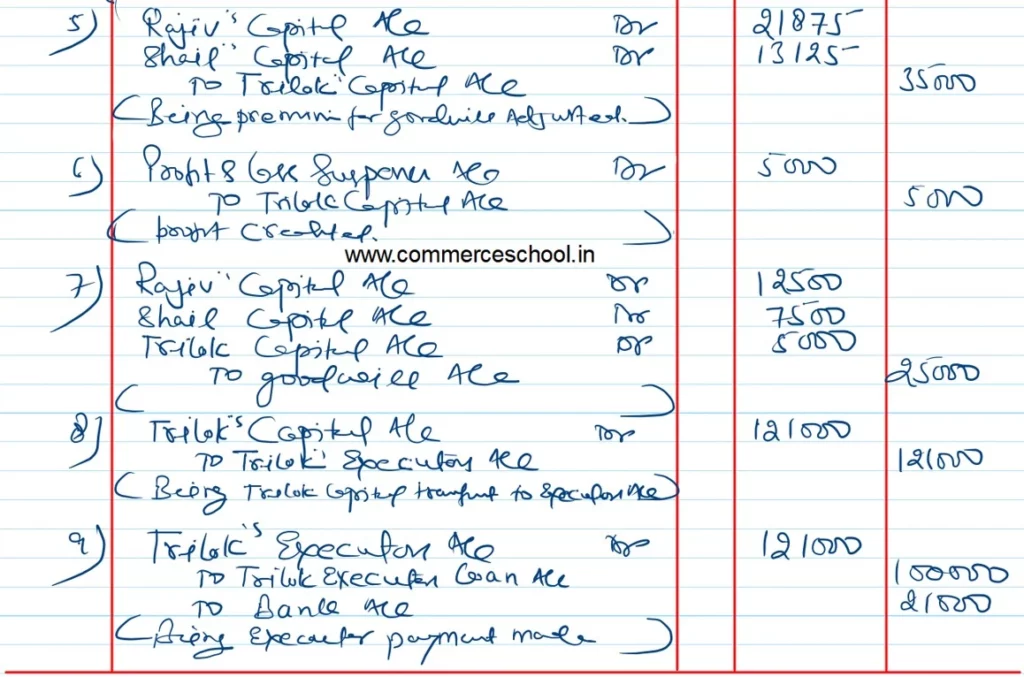

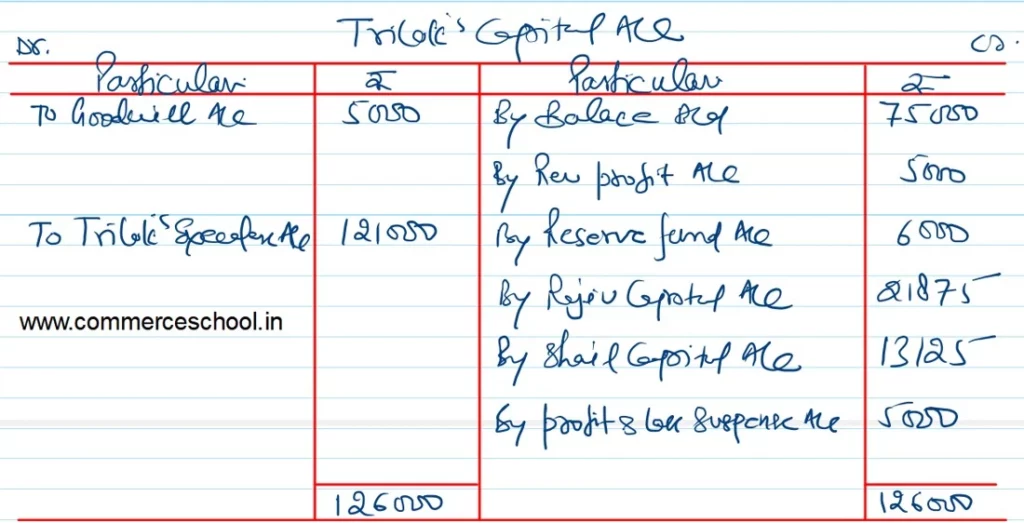

Trilok died on 1st August, 2022. It was agreed that:

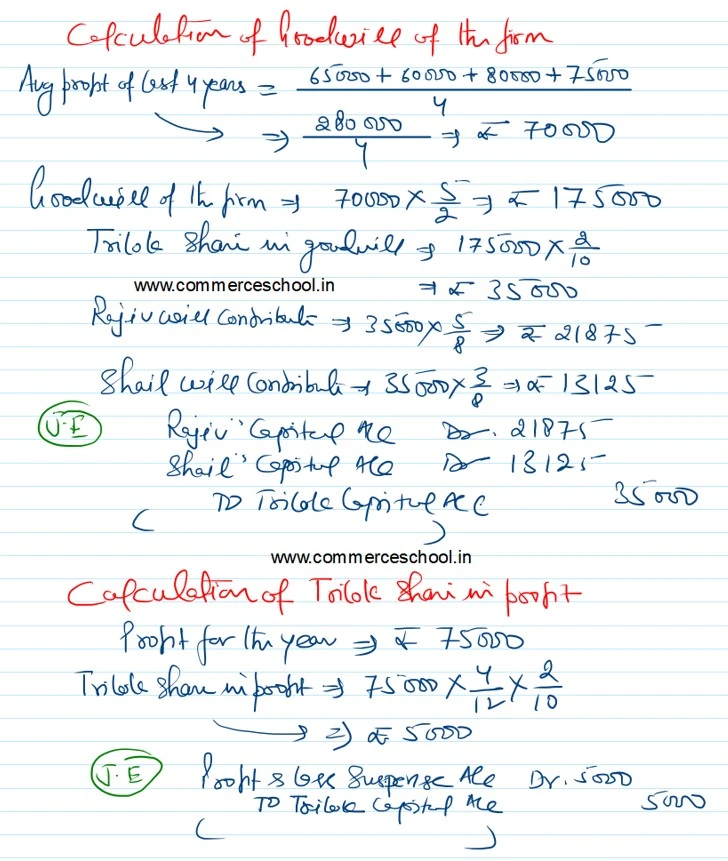

(i) Goodwill be valued at 2 and 1/2 years purchase of the last 4 year’s average profit which for the year ended 31st March, were:

2019 – ₹ 65,000; 2020 – ₹ 60,000; 2021 – ₹ 80,000 and 2022 – ₹ 75,000.

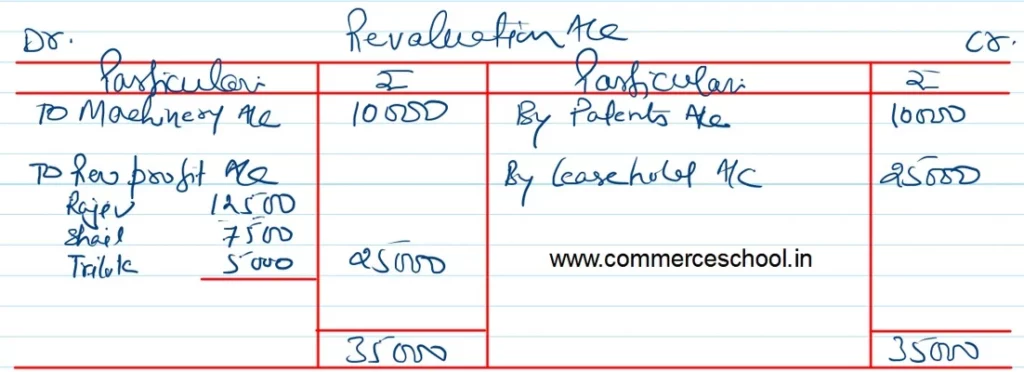

(ii) Machinery be valued at ₹ 1,40,000; Patents be valued at ₹ 40,000; Leasehold be valued at ₹ 1,25,000 on 1st August, 2022.

(iii) For the purpose of calculating Trilok’s share in the profit up to the date of death, profit for the year ended 31st March, 2023 shall be taken to have accrued on the same scale as in the year ended 31st March, 2022.

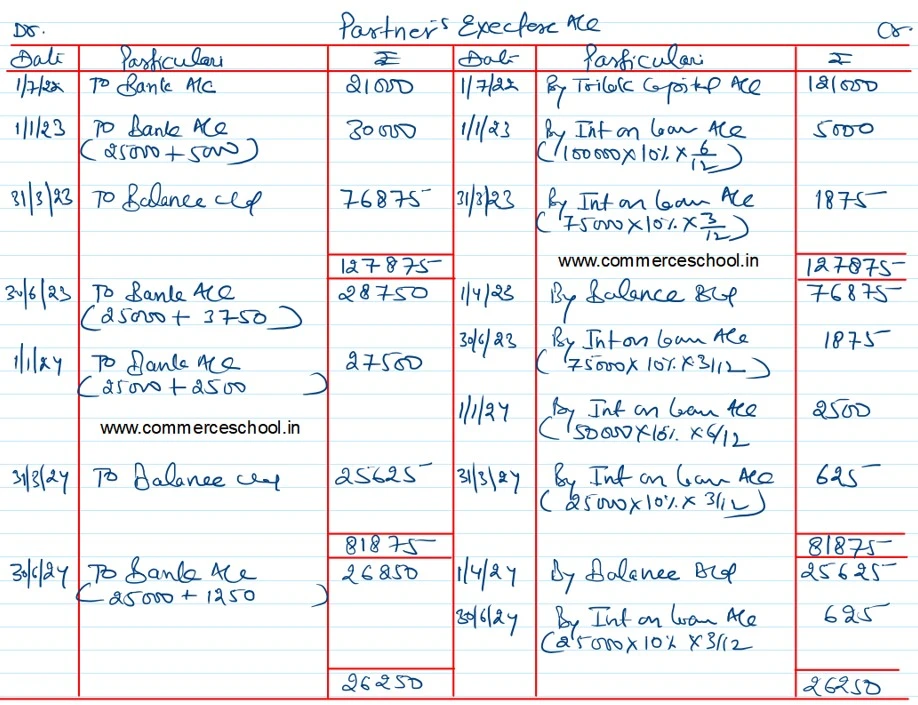

(iv) ₹ 21,000 to be paid immediately to the executors of Trilok and the balance was to be paid in four equal half-yearly instalments together with interest @ 10% p.a.

Pass necessary Journal entries to record the above transactions and Trilok’s Executors’ Account for the year.

Solution:-

Working Notes:-

Here is the list of Solutions

Namesthe ji, I am natarajan pgt accountancy in Maharishi school of excellence chennai 77. When ever I have doubts I simply refer your solutions i got my clarification that’s the way you preferred just like a guide thank you very much sir.

Natarajan V