Balance of Payments – Meaning, definition, components class 12

Looking, What is Balance of Payments, its definition, and components as per the syllabus of class 12.

I have explained this topic in detail.

What is Balance of Payments (Class 12)

In simplest words, Balance of Payments is an accounting statement that records sources and uses of foreign exchange in a country.

As all transactions between two countries are carried out in foreign exchange.

In other words, you also can say, Balance of payments is a statement that records all transactions between a country and the rest of the world

Most of these transactions arise from international trade and financial dealings between countries.

Definition of Balance of Payments

Let’s define Balance of Payments

Balance of Payment is an accounting statement that provides a systematic record of all the economic transactions, between Residents of a country and the rest of the world, in a given period of time.

Sandeep Garg

Economics transactions:- refer to those transactions which involve the transfer of the title or ownership of goods, services, money, and assets.

Residents:- of a country include individuals, firms, and government agencies.

Balance of Payments is a statement of accounts showing all monetary transactions (or economic transactions) of a country with the rest of the world during a period of time

TR Jain

Structure of Balance of Payments Account

Like a Business Account, BoP also has two sides.

The credit side and the Debit side.

All inflows (sources) of foreign exchange are recorded on the credit side.

All Outflows (uses) of foreign exchange are recorded on the debit side.

Structure of Balance of Payment.

| Credit | Debit |

| Inflows of Foreign Exchange | Outflows of Foreign Exchange |

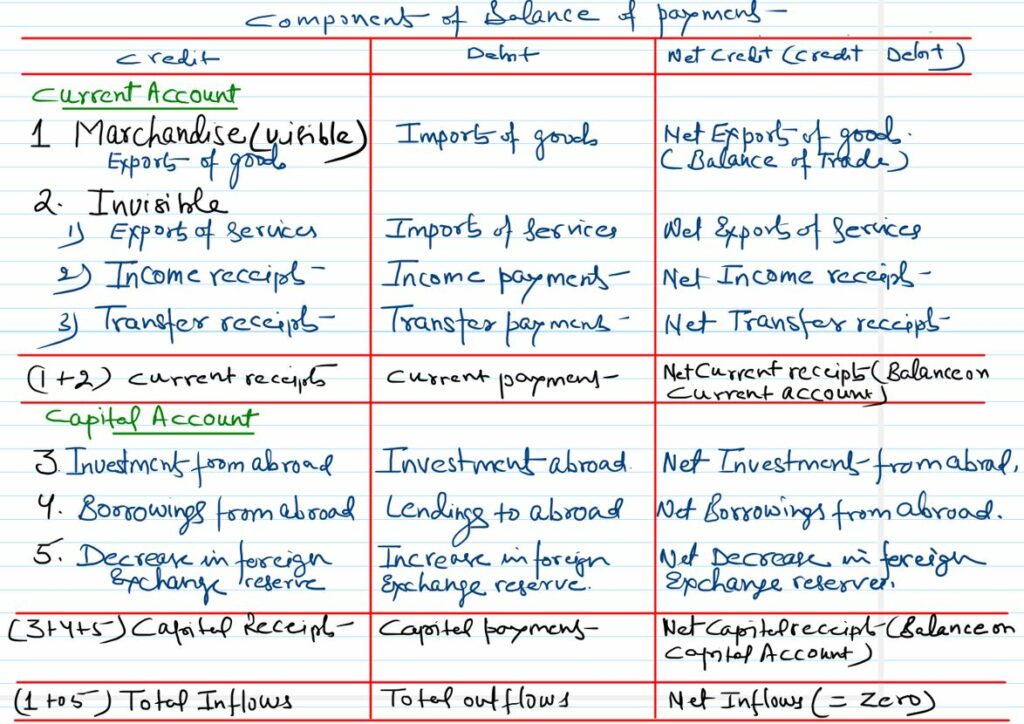

Components of Balance of Payments Account

Bop account is divided into two sub-accounts.

- Current Account

- Capital Account

Current Account

Records all those flows of foreign exchange which neither lead to any foreign exchange liabilities nor create any foreign exchange assets abroad.

In short, current account records receipts and payments of foreign exchange which do not impact the asset-liability status of a country in relation to the rest of the world.

Detail Components of Current Account

The Components of the current account are as follows

The current account is broadly divided into.

- Visibles (Marchandise)

- Invisibles.

Both above components are further subdivided into many items as explained below.

Visibles (Marchandise):-

Visibles means goods. Exports of goods result in an inflow of foreign exchange. Thus it is recorded on the credit side.

Imports of goods result in outflows of foreign exchange and are recorded on the debit side.

The net column records net exports of goods. Net exports of goods are also called Balance of Trade.

Invisibles:-

Invisibles are further sub-classified into three groups.

Services:-

It includes

- tourism

- Transportation,

- insurance

In various reference books, such services are classified as Shipping, Banking, and Insurance.

Receipts of these services in foreign exchange from the rest of the world to residents of a country are recorded on the credit side.

Payments of these services by residents to the rest of the world are recorded on the debit side.

Income:-

It includes

- Investment income

- Compensation of employees.

Investment income includes earnings received by residents from the rest of the world in the form of rent, interest, and profits and is recorded on the credit side.

Investment earnings paid by residents to the rest of the world in the form of rent, interest, and profit are recorded on the debit side.

The compensation of employees includes wages and salaries received by residents from the rest of the world.

Transfers:-

Transfers also known as unilateral transfers are the transactions between residents and non-residents for which the provider does not receive a quid pro quo in return.

In short, the one party does not receive anything in return from the other party for providing goods, services, and assets, etc,

It includes

- Gifts

- Donations

- Personal remittances

- othe one way transactions.

Capital Account

Records all those flows of foreign exchange which either lead to foreign exchange liabilities towards the rest of the world or create foreign exchange assets abroad.

In short, a capital account records receipts and payments of foreign exchange which either which causes a change in the assets or liabilities of the residents of the country or its government.

Capital Account only records the foreign exchange transactions of financial nature only

Investments to and from abroad:-

Investments by the rest of the world in shares of Indian companies, real estate, etc.

Such investment results in an inflow of foreign exchange and is recorded at the credit side of the capital account.

Investments by Indian residents in shares of foreign companies, real state abroad, etc. Such investments result in an outflow of foreign exchange and are recorded at the debit side of the capital account.

Borrowings and lendings to and from abroad:-

All transactions relating to borrowings from abroad by the private sector, government, etc. Receipts of such loans and repayment of loans by foreigners are recorded on the positive (credit) side.

All transactions of lending abroad by private and government. Lending abroad and repayment of loans to abroad is recorded as negative or debit item.

Change in Foreign Exchange Reserves:-

The foreign exchange reserves are the financial assets of the government held in the central bank.

A change in reserves serves as the financing item in India’s BOP.

So any withdrawal from the reserves is recorded on the positive (credit) side and any addition to these reserves is recorded on the negative (debit) side.

Note:- Only the change in reserves is recorded in the BOP account and not ‘reserves’.