[ISC] Q. 18 Death of Partner Solution TS Grewal Class 12 (2022-23)

Are you looking for the solution to Question number 18 of the Death of Partner Chapter of TS Grewal Book ISC Board 2022-23 Edition?

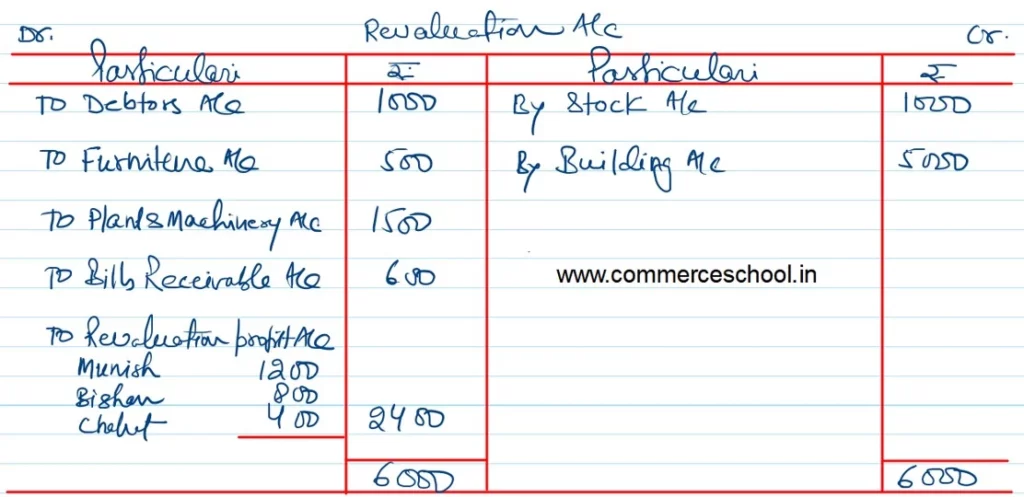

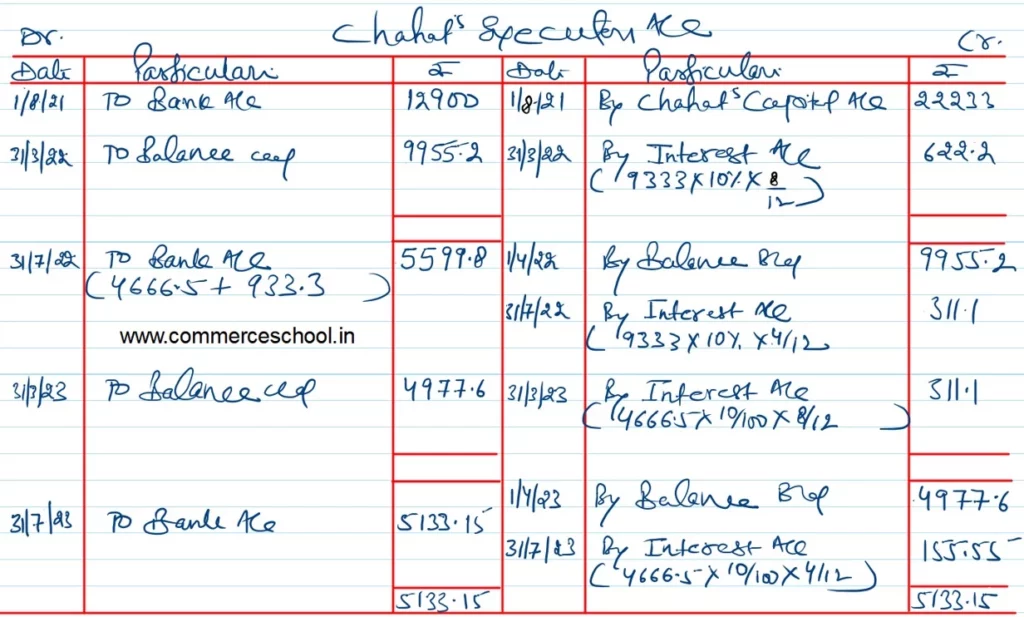

Munish, Bishan and Chahat were partners sharing profits in the ratio of 3 : 2 : 1. Balance Sheet of the firm is given below as at 31st March, 2021:

| Liabilities | ₹ | Assets | ₹ |

| Bills Payable Creditors Reserve Loans Capital A/cs: Munish Bishan Chahat | 2,000 5,000 6,000 7,100 22,750 15,250 12,000 | Cash at Bank Bills Receivable Stock Debtors Furniture Plant and Machinery Building | 5,800 800 9,000 16,000 2,000 6,500 30,000 |

| 70,100 | 70,100 |

Chahat died on 31st July, 2021. Partnership Deed provides that:

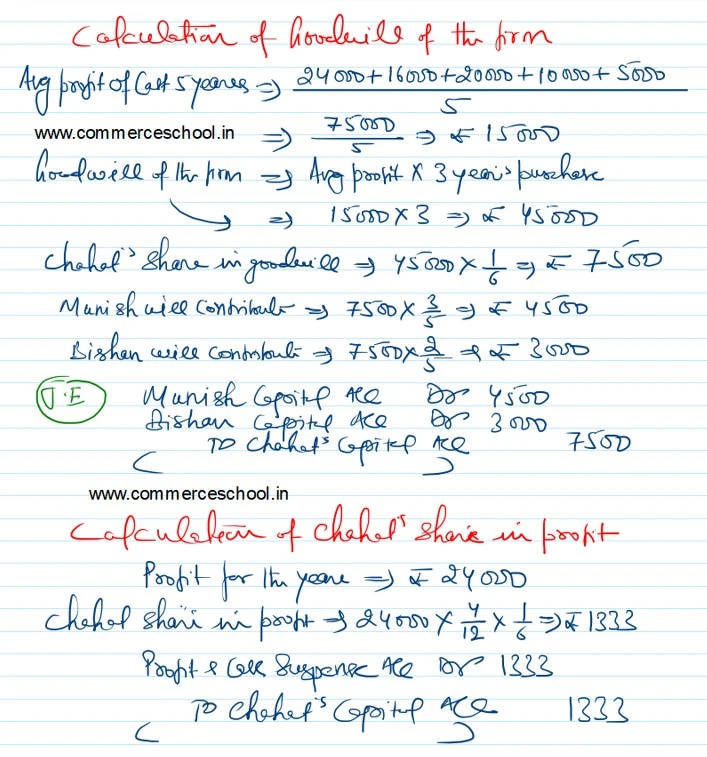

(i) Share of deceased partner’s Goodwill is to be valued on the basis of 3 year’s purchsae of last 5 years’ average profits.

Profits for the last 5 years (ended 31st March) were:

2021 – ₹ 24,000; 2020 – ₹ 16,000; 2019 – ₹ 20,000; 2018 – ₹ 10,000 and 2017 – ₹ 5,000.

(ii) Deceased partner to be given share of profits up to the date of death on the basis of profits for previous year.

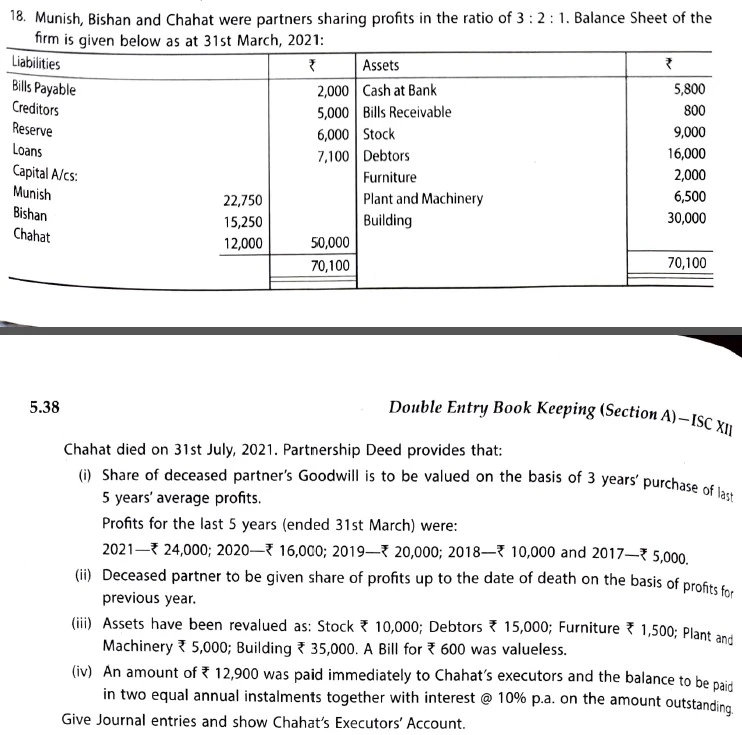

(iii) Assets have been revalued as: Stock ₹ 10,000; Debtors ₹ 15,000; Furniture ₹ 1,500; Plant and Machinery ₹ 5,000; Building ₹ 35,000. A Bill for ₹ 600 was valueless.

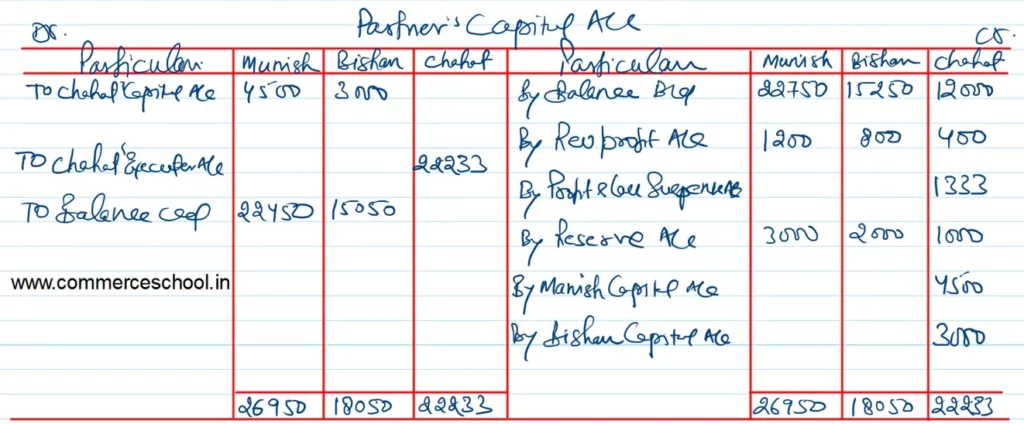

(iv) An amount of ₹ 12,900 was paid immediately to Chahat’s executors and the balance to be paid in two equal annual instalments together with interest @ 10% p.a. on the amount outstanding.

Give Journal entries and show Chahat’s Executors’ Account.

Solution:-

Here is the list of Solutions

Thank you for sharing these!! Just wanted to know whether the number of months u take in calculations is correct? Like I think you take 1 month extra while calculating these . For example in 18th sum ,while calculating interest in executor account, you took 9 months. Whereas from 1 August to 31 March there should be 8 months. Then there are few miscalculations like these.

Yes, it is 8 months, corrected, plz inform me if you find other calculation mistakes.