[ISC] Q. 47 Solution of Accounting for Share Capital TS Grewal Class 12 (2022-23)

Solution to Question number 47 of the Accounting for Share Capital chapter of TS Grewal Book 2022-23 Edition ISC Board?

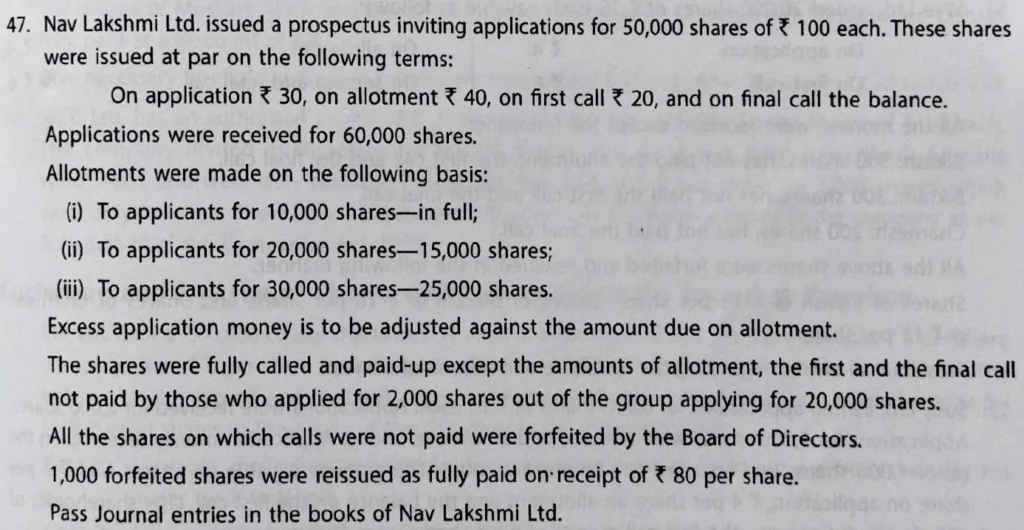

Nav Lakshmi Ltd. issued a prospectus inviting applications for 50,000 shares of ₹ 100 each. These shares were issued at par on the following terms:

On application ₹ 30, on allotment ₹ 40, on first call ₹ 20, and on final call the balance.

Applications were received for 60,000 shares.

Allotments were made on the following basis:

(i) To applicants for 10,000 shares – in full;

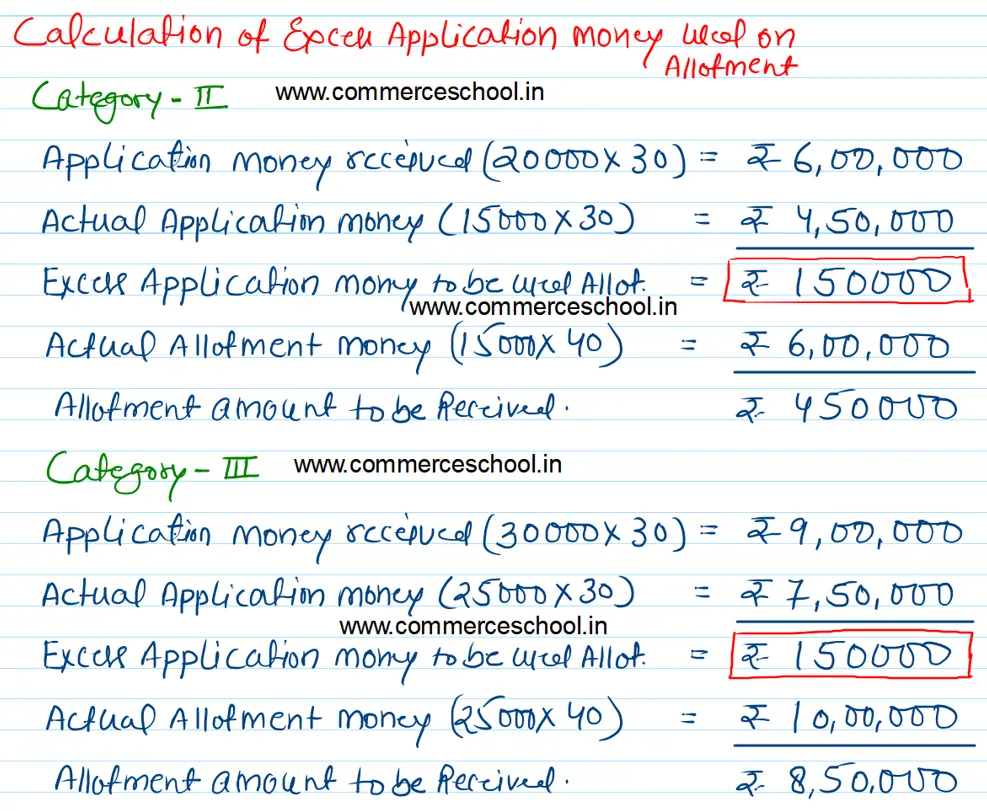

(ii) To applicants for 20,000 shares – 15,000 shares;

(iii) To applicants for 30,000 shares – 25,000 shares.

Excess application money is to be adjused against the amount due on allotment.

The shares were fully called and paid-up except the amount of allotment, the first and the final call not paid by those who applied for 2,000 shares out of the group applying for 20,000 shares.

All the shares on which calls were not paid were forfeited by the Board of Directors.

1,000 forfeited shares were reissued as fully paid on receipt of ₹ 80 per share.

Pass Journal entries in the books of Nav Lakshmi Ltd.

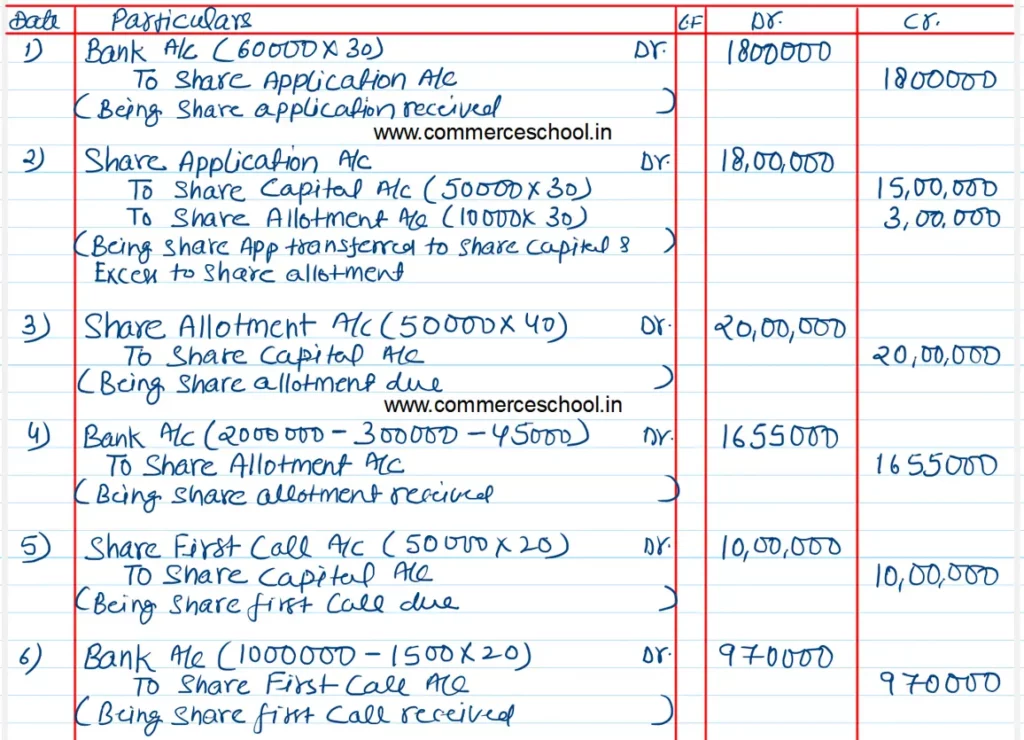

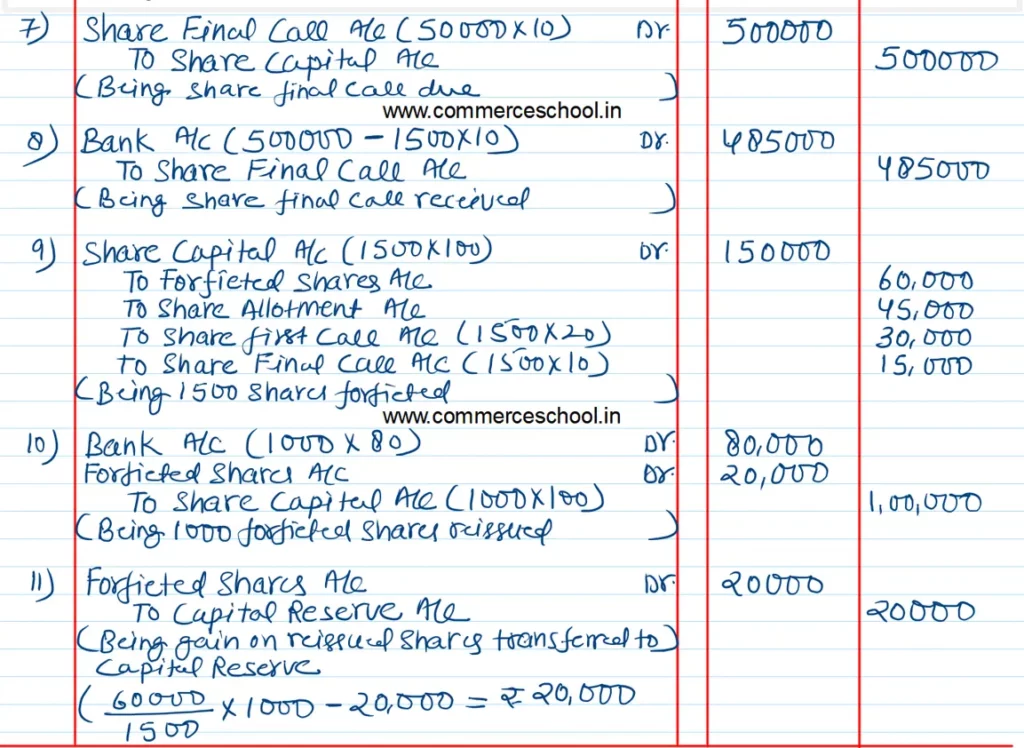

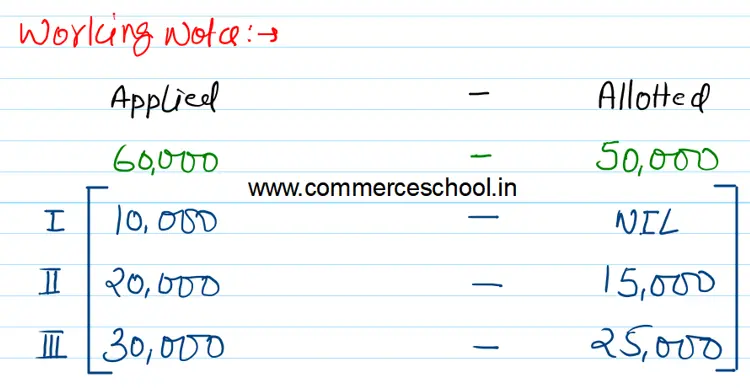

Solution:-

Issue of Share chapter Solutions of TS Grewal Class 12 Accountancy ISC 2022-23

Let’s Practice

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Solutions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |