[ISC] Q 44 Non Trading Organisation Solution TS Grewal (2022-23) Class 11

Solution of Question number 44 Non Trading Organisation Chapter TS Grewal class 11 ISC Board for 2022-23 Session?

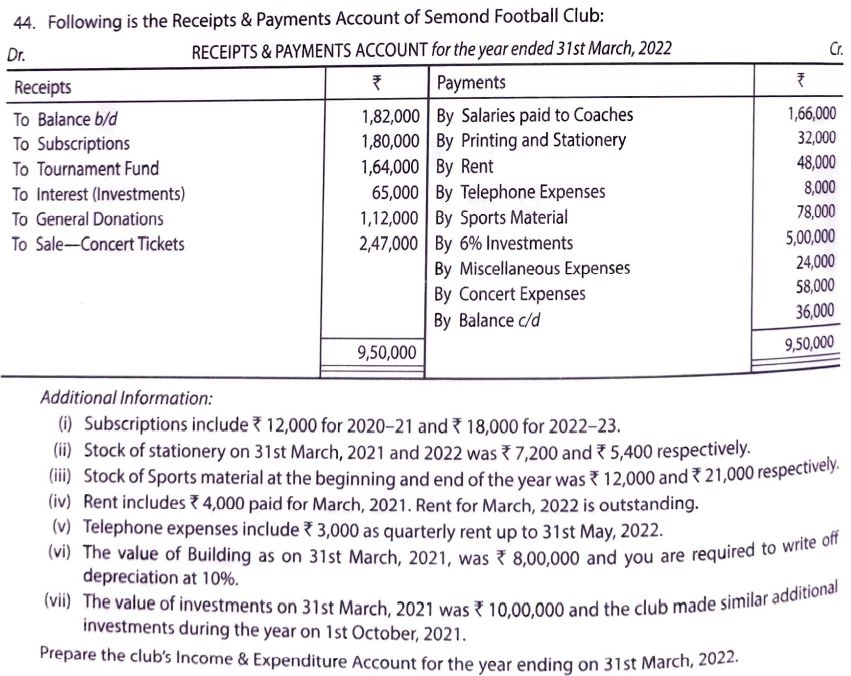

Following is the Receipts & Payments Account of Semond Football Club:

Receipts & Payments Account for the year ended 31st March, 2022

| Receipts | ₹ | Payments | ₹ |

| To Balance b/d To Subscriptions To Tournament Fund To Interest (Investments) To General Donations To Sale – Concert Tickets | 1,82,000 1,80,000 1,64,000 65,000 1,12,000 2,47,000 | By Salaries paid to Coaches By Printing and Stationery By Rent By Telephone Expenses By Sports Material By 6% Investments By Miscellanous Expenses By Concert Expenses By Balance c/d | 1,66,000 32,000 48,000 8,000 78,000 5,00,000 24,000 58,000 36,000 |

| 9,50,000 | 9,50,000 |

Additional Information:

(i) Subscriptions include ₹ 12,000 for 2021 – 21 and ₹ 18,000 for 2022 – 23.

(ii) Stock of stationery on 31st March, 2021 and 2022 was ₹ 7,200 and ₹ 5,400 respectively.

(iii) Stock of Sports Material at the beginning and end of the year was ₹ 12,000 and ₹ 21,000 respectively.

(iv) Rent includes ₹ 4,000 paid for March, 2021. Rent for March, 2022 is outstanding.

(v) Telephone expenses include ₹ 3,000 as quarterly rent up to 31st May, 2022.

(vi) The value of Building as on 31st March, 2021, was ₹ 8,00,000 and you are required to write off depreciation at 10%.

(vii) The value of investments on 31st March, 2021 was ₹ 10,00,000 and the club made similar additional investments during the year on 1st October, 2021.

Prepare the club’s Income & Expenditure Account for the year ending on 31st March, 2022.

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |