[ISC] Q. 7 Goodwill Solution TS Grewal Class 12 (2023-24)

Solution to Question number 7 of the Goodwill chapter 2 TS Grewal Book ISC Board 2023-24 Edition.

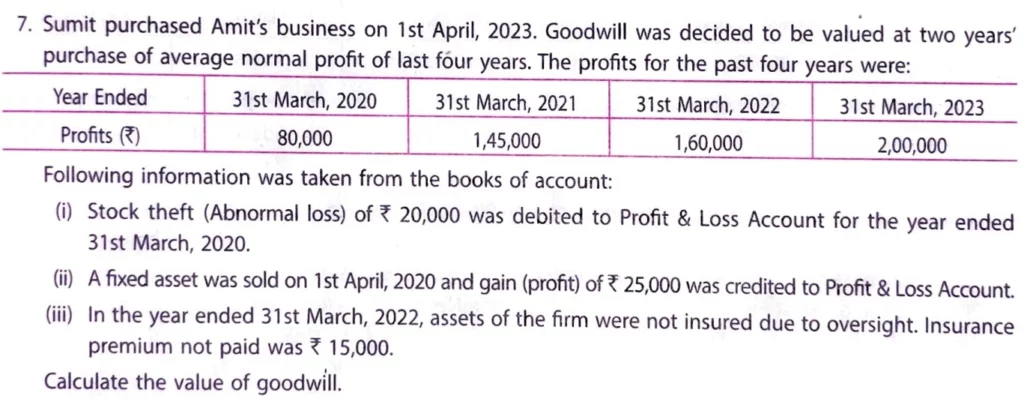

Sumit purchased Amit’s business on 1st April, 2023. Goodwill was decided to be valued at two year’s purchase of average normal profit of last four years. The profits for the past four years were:

| Year Ended | Profits (₹) |

| 31st March, 2020 | 80,000 |

| 31st March, 2021 | 1,45,000 |

| 31st March, 2022 | 1,60,000 |

| 31st March, 2023 | 2,00,000 |

Following information was taken from the books of account:

i) Stock theft (Abnormal loss) of ₹ 20,000 was debited to Profit & Loss Account for the year ended 31st March, 2020.

ii) A fixed asset was sold on 1st April, 2020 and gain (profit) of ₹ 25,000 was credited to Profit & Loss Account.

iii) In the year ended 31st March, 2022, assets of the firm were not insured due to oversight. Insurance premium not paid was ₹ 15,000.

Calculate the value of goodwill.

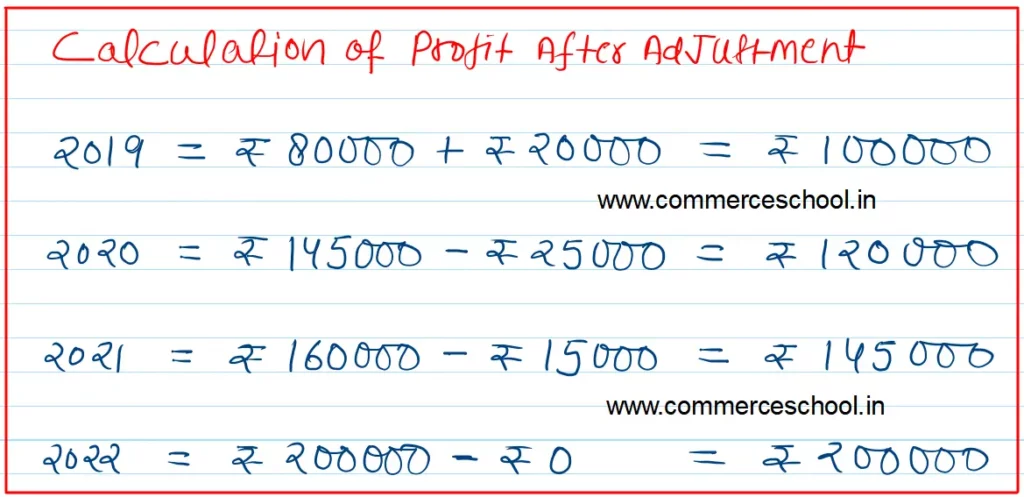

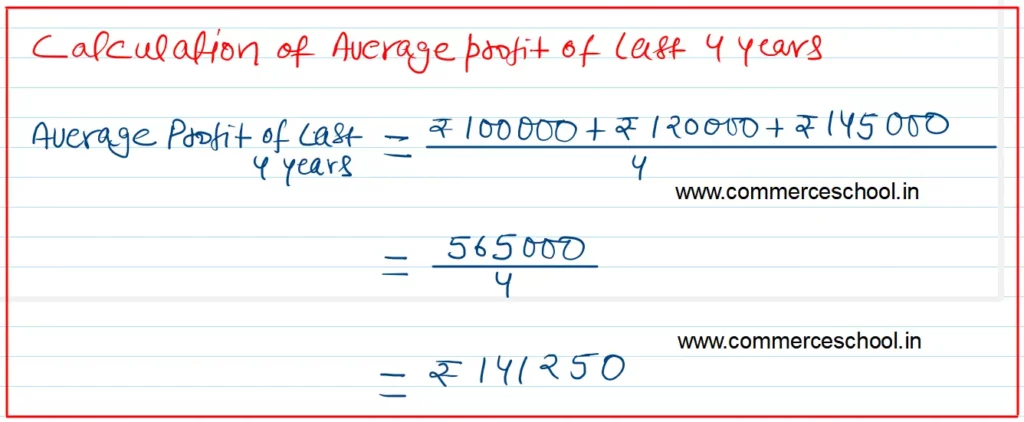

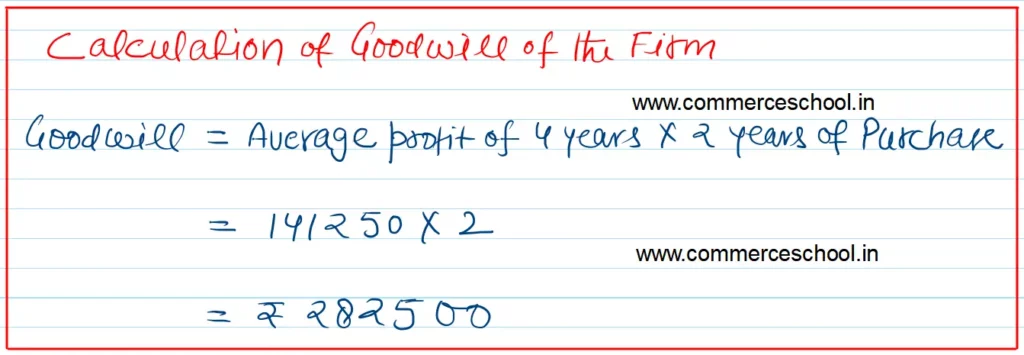

Solution:-

List of all solutions of Goodwill chapter TS Grewal ISC Board class 12 (2023-24)

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |