[CBSE] Q. 65 Solution of Admission of Partner TS Grewal Accounts Class 12 (2023-24)

Solution to Question number 65 of the Admission of Partner chapter 5 of TS Grewal Book 2023-24 Edition CBSE Board?

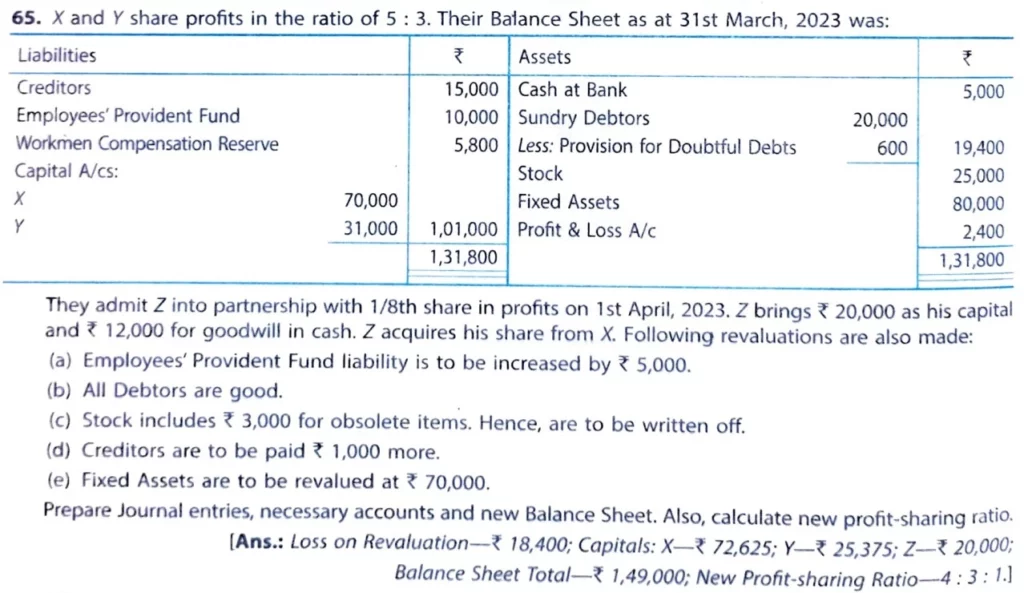

X and Y share profits in the ratio of 5 : 3. Their Balance Sheet as at 31st March, 2023 was:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors Employee’s Provident Fund Workmen Compensation Reserve Capital A/cs: X Y | 15,000 10,000 5,800 70,000 31,000 | Cash at Bank Sundry Debtors Less: Provision for Doubtful Debts Stock Fixed Assets Profit & Loss A/c | 20,000 600 | 5,000 19,400 25,000 80,000 2,400 |

| 1,31,800 | 1,31,800 |

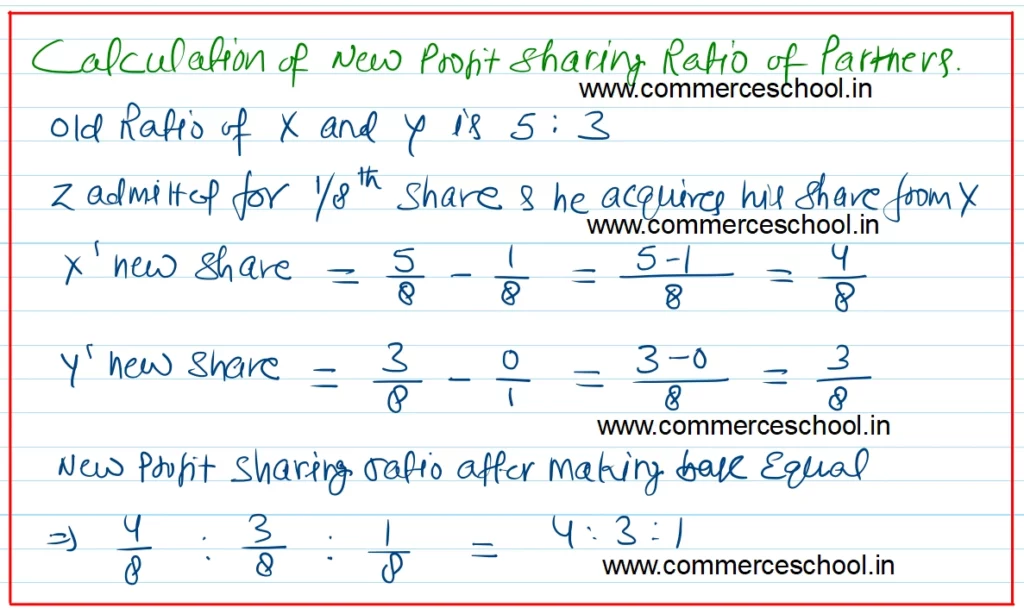

They admit Z into partnership with 1/8th share in profits on 1st April, 2023. Z brings ₹ 20,000 as his capital and ₹ 12,000 for goodwill in cash. Z acquires his share from X. Following revaluations are also made:

(a) Employee’s Provident Fund liability is to be increased by ₹ 5,000.

(b) All debtors are good.

(c) Stock includes ₹ 3,000 for obsolete items. Hence, are to be written off.

(d) Creditors are to be paid ₹ 1,000 more.

(e) Fixed Assets are to be revalued at ₹ 70,000.

Prepare Journal entries, necessary accounts and new Balance Sheet. Also, calculate new profit-sharing ratio.

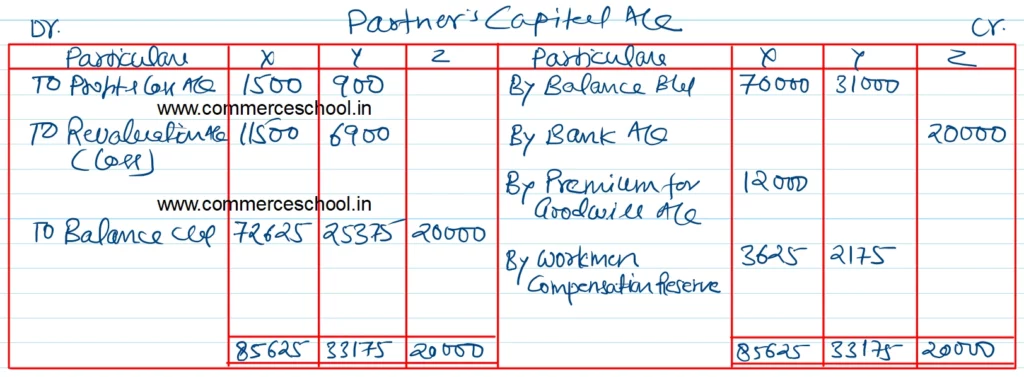

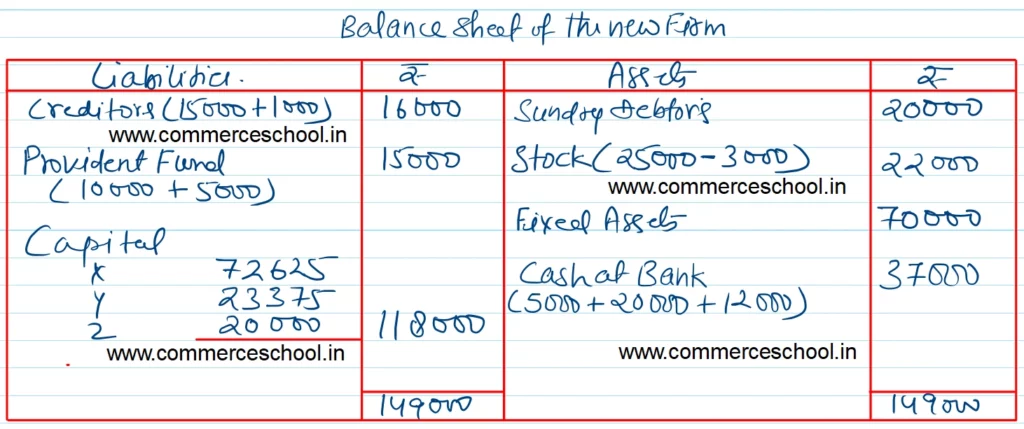

[Ans.: Loss on Revaluation – ₹ 18,400; Capitals: X – ₹ 72,625; Y – ₹ 25,375; Z – ₹ 20,000; Balance Sheet Total – ₹ 1,49,000; New Profit sharing ratio – 4 : 3 : 1.]

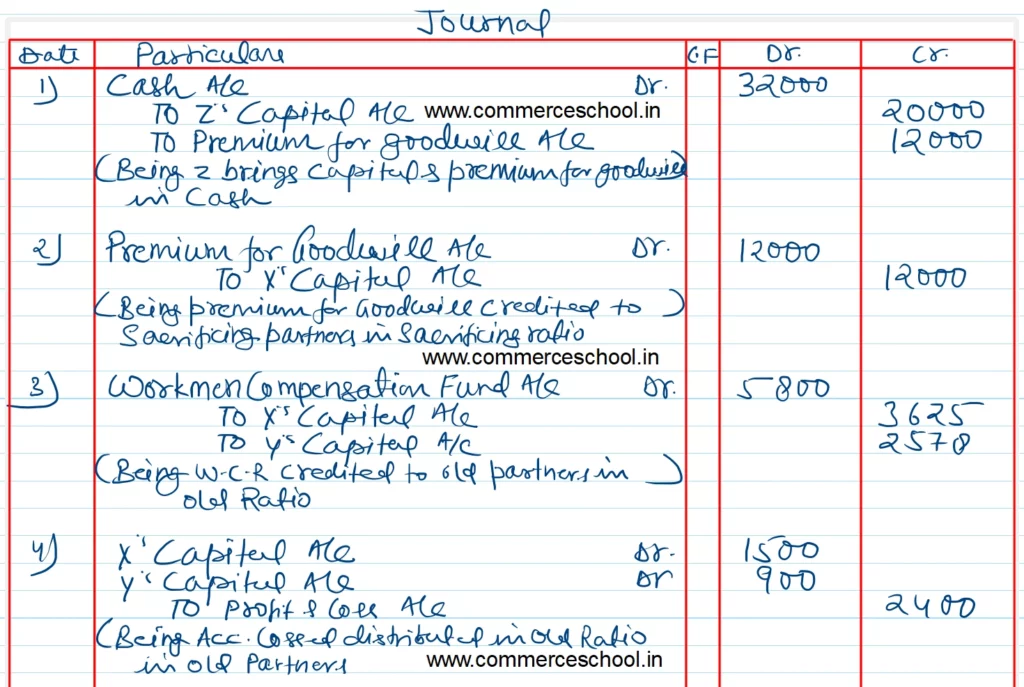

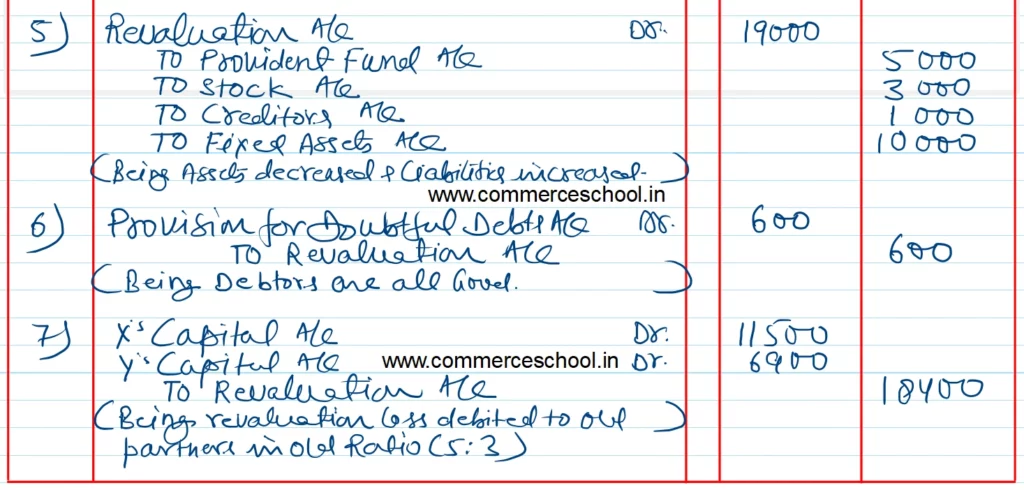

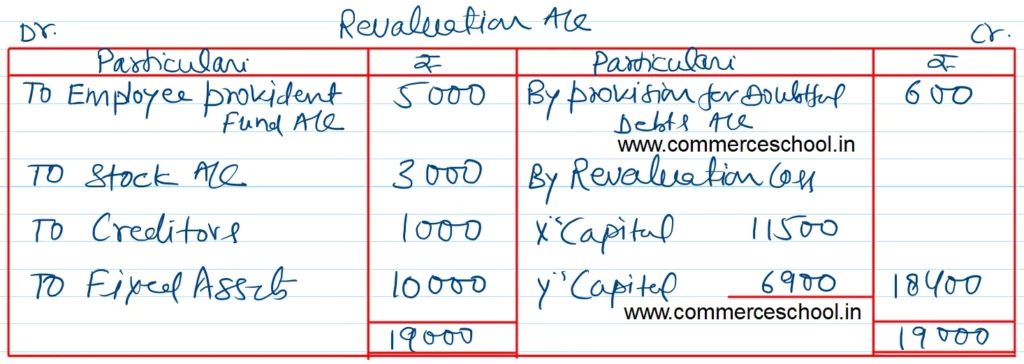

Solution:-

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |