[CBSE] Q. 26 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution of Question number 26 of the Death of Partner Chapter of TS Grewal Book 2023-24 Edition CBSE Board.

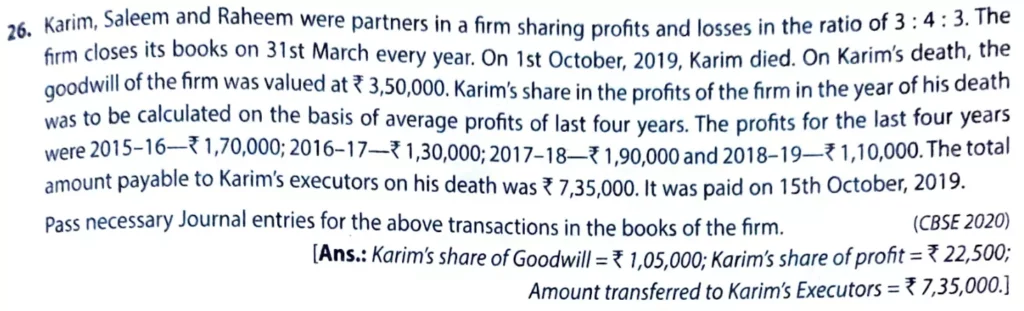

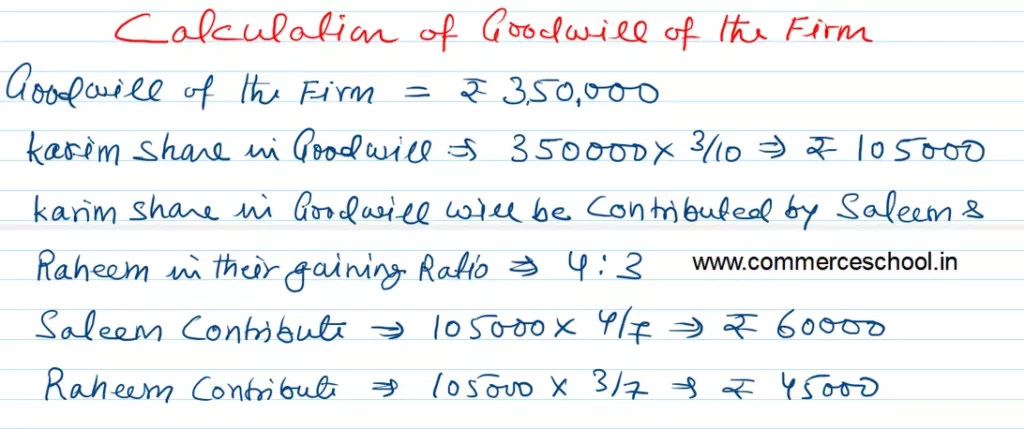

Karim, Saleem and Raheem were partners in a firm sharing profits and losses in the ratio of 3 : 4 : 3. The firm closes its books on 31st March every year. On 1st October, 2019, Karim died. On Karim’s death, the goodwill of the firm was valued at ₹ 3,50,000. karim’s share in the profits of the firm in the year of his death was to be calculated on the basis of average profits of last four years. The profits for the last four years were 2015 – 16 – ₹ 1,70,000; 2016 – 17 – ₹ 1,30,000; 2017 – 18 – ₹ 1,90,000 and 2018-19 – ₹ 1,10,000. The total amount payable to Karim’s executors on his death was ₹ 7,35,000. It was paid on 15th October 2019.

Pass necessary Journal entries for the above transactions in the books of the firm.

[Ans.: Karim’s share of Goodwill = ₹ 1,05,000; Karim’s share of Profit = ₹ 22,500; Amount transferred to Karim’s Executors = ₹ 7,35,000.]

Solution:-

Solutions of Death of Partner chapter 7 of TS Grewal Book class 12 Accountancy 2023-24 CBSE Board

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |