[CBSE] Q. 14 Solution of Dissolution of Partnership Firm Chapter TS Grewal Book Class 12 (2023-24)

Solution to Question number 14 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the CBSE Board?

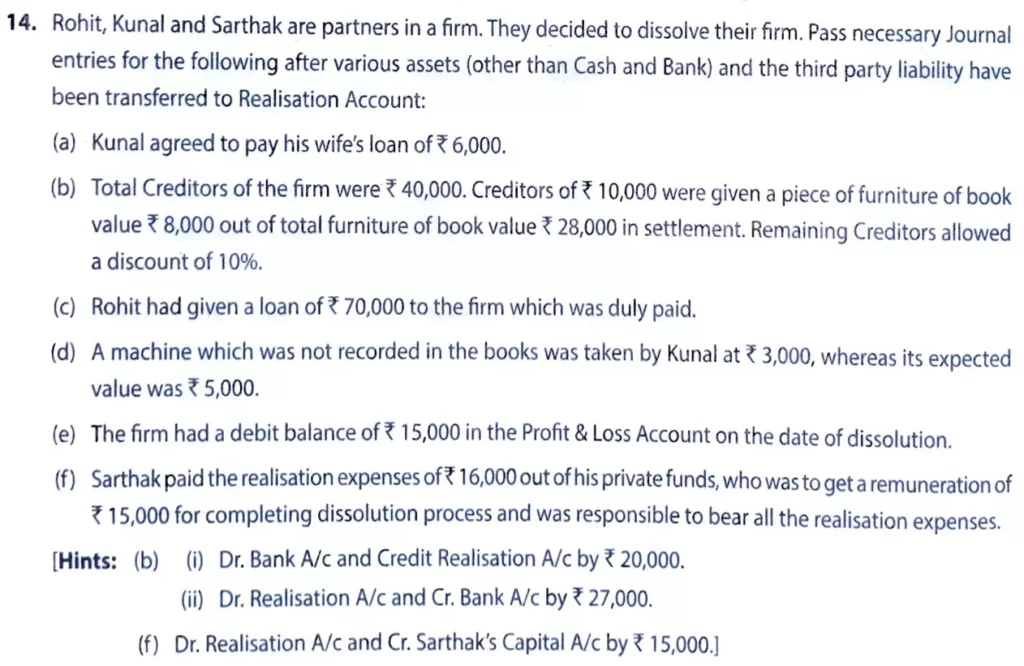

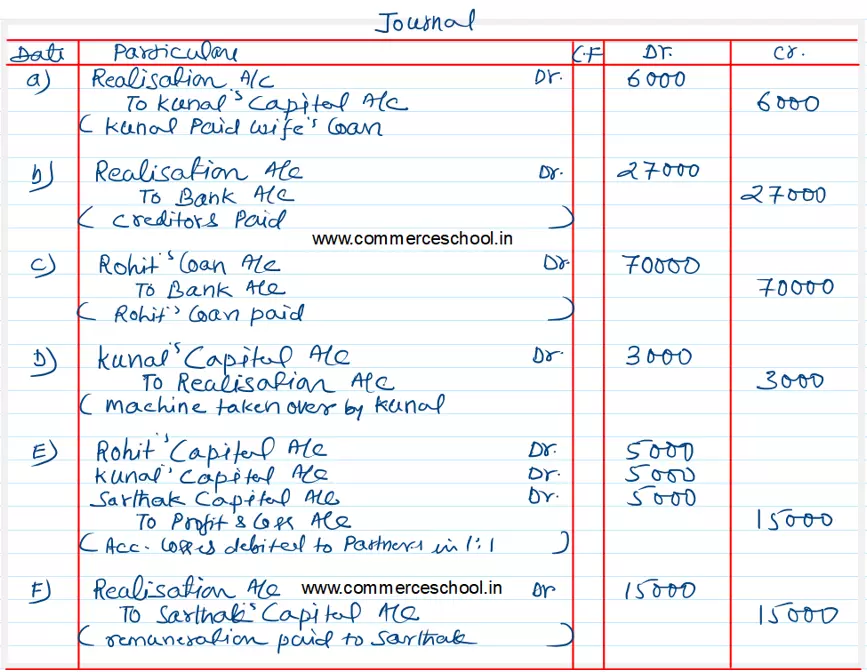

Rohit, Kunal and Sarthak are partners in a firm. They decided to dissolve their firm. Pass necessary Journal entries for the following after various assets (other than Cash and Bank) and the third-party liability have been transferred to Realisation Account:

(a) kanal agreed to pay his wife’s loan of ₹ 6,000.

(b) Total Creditors of the firm were ₹ 40,000. Creditors of ₹ 10,000 were given a piece of furniture of book value ₹ 8,000 out of total furniture of book value ₹ 28,000 in settlement. Remaining Creditors allowed a discount of 1%.

(c) Rohit had given a loan of ₹ 70,000 to the firm which was duly paid.

(d) A machine which was not recorded in the books was taken by Kunal at ₹ 3,000, whereas its expected value was ₹ 5,000.

(e) The firm had a debit balance of ₹ 15,000 in the Profit & Loss Account on the date of dissolution.

(f) Sarthak paid the realisation expenses of ₹ 16,000 out of his private funds, who was to get a remuneration of ₹ 15,000 for completing dissolution process and was responsible to bear all the realisation expenses.

Solution:-

Here is the list of solutions

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |