[CBSE] Q 79 Solution Accounting Ratios of TS Grewal (2023-24)

Solution of Question number 79 of the Accounting Ratios of TS Grewal Book 2023-24 CBSE Board?

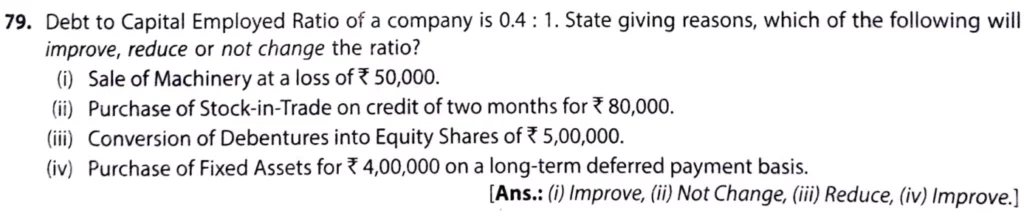

Debt to Capital Employed Ratio of a Company is 0.4 : 1. State giving reasons, which of the following will improve, reduce or not change the ratio?

(i) Sale of Machinery at a loss of ₹ 50,000.

(ii) Purchase of Stock-in-Trade on Credit of two months for ₹ 80,000.

(iii) Conversion of Debentures into Equity Shares of ₹ 5,00,000.

(iv) Purchase of Fixed Assets for ₹ 4,00,000 on a long term deferred payment basis.

[Ans.: (i) Improve, (ii) Not Change, (iii) Reduce, (iv) Improve.]

Solution:-

Solution:-

(i) Sale of Machinery at a loss of ₹ 50,000.

Let’s analyze the impact of selling machinery at a loss of ₹ 50,000 on the debt-to-capital employed ratio

Debt-to-Capital Employed Ratio Formula

Debt-to-Capital Employed Ratio

= Long-Term Debt\Capital Employed

Long-Term Debt = ₹ 80,000

Capital Employed:- ₹ 2,00,000 Includes shareholders’ funds and long-term liabilities (total equity + total debt).

= 80,000/2,00,000 = 0.4 : 1

Impact of Selling Machinery

1. Loss of ₹ 50,000:-

- A loss of ₹ 50,000 reduces shareholders’ funds (reserves or retained earnings), which are part of capital employed.

- The long-term debt remains unchanged.

- Revised Values

- Initial Capital Employed: ₹ 2,00,000

- Reduction in Shareholders’ Funds: ₹ 50,000

- Revised Capital Employed: 2,00,000 – 50,000 = ₹ 1,50,000

1. Recalculate Debt-to-Capital Employed Ratio:

Debt-to-Capital Employed Ratio

= Long-Term Debt\Capital Employed

= 80,000/1,50,000 = 0.533 : 1 (approx.)

Impact

The debt-to-capital employed ratio Improves from 0.4 : 1 (before the sale) to approximately 0.533 : 1, reflecting higher reliance on debt compared to capital employed.

(ii) Purchase of Stock-in-Trade on Credit of two months for ₹ 80,000.

If we consider debt only as long-term liabilities, the purchase of stock-in-trade on credit for two months typically does not directly impact the debt-to-capital employed ratio. Here’s the reasoning:

Debt-to-Capital Employed Ratio Formula:

= Long-Term Debt\Capital Employed

- Long-Term Debt: ₹ 1,20,000

- Capital Employed: ₹ 3,00,000 (includes shareholders’ equity and long-term debt)

= 1,20,000/3,00,000 = 0.4 : 1

Impact of the Transaction:

1. Credit Purchase:

The purchase of stock-in-trade on credit creates current liabilities (accounts payable), which are not part of long-term debt.

Therefore, long-term debt remains unchanged.

2. Capital Employed Unaffected:

- Since the transaction does not impact long-term liabilities or shareholders’ funds, Capital employed remains unchanged.

Final Impact:

- With long-term debt and capital employed staying constant, the debt-to-capital employed ratio remains unchanged at:

Debt-to-Capital Employed Ratio

= 1,20,000/3,00,000} = 0.4 : 1

(iii) Conversion of Debentures into Equity Shares of ₹ 5,00,000.

The conversion of ₹ 5,00,000 worth of debentures into equity shares will reduce the debt-to-capital employed ratio, and here’s why:

Debt-to-Capital Employed Ratio Formula:

Debt-to-Capital Employed Ratio

= Long-Term Debt\Capital Employed

- Initial Values:

- Long-Term Debt (before conversion): ₹ 6,00,000

- Capital Employed (before conversion): ₹ 15,00,000

- Debt-to-Capital Employed Ratio: = 6,00,000/15,00,000} = 0.4 : 1

1. Impact of Conversion:

- Converting debentures (a long-term liability) into equity reduces long-term debt by ₹ 5,00,000, leaving: 6,00,000 – 5,00,000 = ₹ 1,00,000

- The same amount is added to shareholders’ equity, but capital employed (the sum of long-term debt and shareholders’ funds) remains unchanged at ₹ 15,00,000.

2. Revised Values:

- Long-Term Debt (after conversion): ₹ 1,00,000

- Capital Employed (unchanged): ₹ 15,00,000

New Debt-to-Capital Employed Ratio:

Debt-to-Capital Employed Ratio

= 1,00,000/15,00,000 = 0.067 : 1 (approx)

Impact:

- The ratio decreases from 0.4 : 1 to approximately 0.067 : 1, indicating a significantly lower reliance on debt compared to total capital employed.

(iv) Purchase of Fixed Assets for ₹ 4,00,000 on a long term deferred payment basis.

The purchase of fixed assets for ₹ 4,00,000 on a long-term deferred payment basis will impact the debt-to-capital employed ratio as follows:

Debt-to-Capital Employed Ratio Formula:

Debt-to-Capital Employed Ratio = Long-Term Debt\Capital Employed

1. Initial Values:

- Long-Term Debt (before transaction): ₹ 6,00,000

- Capital Employed (before transaction): ₹ 15,00,000

- Debt-to-Capital Employed Ratio:

= 6,00,000/15,00,000} = 0.4 : 1

2. Impact of the Transaction:

- Since the fixed assets are purchased on a long-term deferred payment basis, the long-term debt increases by ₹ 4,00,000.

- The new long-term debt becomes: = 6,00,000 + 4,00,000 = ₹ 10,00,000

- Capital Employed also increases because long-term debt is included in capital employed. The new capital employed becomes: = 15,00,000 + 4,00,000 = ₹ 19,00,000

3. Revised Debt-to-Capital Employed Ratio:

Debt-to-Capital Employed Ratio

= Long-Term Debt\Capital Employed

= 10,00,000/19,00,000 = 0.526 : 1 (approx.)

Impact:

- The debt-to-capital employed ratio improves from 0.4 : 1 to approximately 0.526 : 1, reflecting higher reliance on debt compared to capital employed.

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |

| 96 | Question – 96 |

| 97 | Question – 97 |

| 98 | Question – 98 |

| 99 | Question – 99 |

| 100 | Question – 100 |

| S.N | Questions |

| 101 | Question – 101 |

| 102 | Question – 102 |

| 103 | Question – 103 |

| 104 | Question – 104 |

| 105 | Question – 105 |

| 106 | Question – 106 |

| 107 | Question – 107 |

| 108 | Question – 108 |

| 109 | Question – 109 |

| 110 | Question – 110 |

| S.N | Questions |

| 111 | Question – 111 |

| 112 | Question – 112 |

| 113 | Question – 113 |

| 114 | Question – 114 |

| 115 | Question – 115 |

| 116 | Question – 116 |

| 117 | Question – 117 |

| 118 | Question – 118 |

| 119 | Question – 119 |

| 120 | Question – 120 |

| S.N | Questions |

| 121 | Question – 121 |

| 122 | Question – 122 |

| 123 | Question – 123 |

| 124 | Question – 124 |

| 125 | Question – 125 |

| 126 | Question – 126 |

| 127 | Question – 127 |

| 128 | Question – 128 |

| 129 | Question – 129 |

| 130 | Question – 130 |

| S.N | Questions |

| 131 | Question – 131 |

| 132 | Question – 132 |

| 133 | Question – 133 |

| 134 | Question – 134 |

| 135 | Question – 135 |

| 136 | Question – 136 |

| 137 | Question – 137 |

| 138 | Question – 138 |

| 139 | Question – 139 |

| 140 | Question – 140 |

| S.N | Questions |

| 141 | Question – 141 |

| 142 | Question – 142 |

| 143 | Question – 143 |

| 144 | Question – 144 |

| 145 | Question – 145 |

| 146 | Question – 146 |

| 147 | Question – 147 |

| 148 | Question – 148 |

| 149 | Question – 149 |

| 150 | Question – 150 |

| S.N | Questions |

| 151 | Question – 151 |

| 152 | Question – 152 |

| 153 | Question – 153 |

| 154 | Question – 154 |

| 155 | Question – 155 |

| 156 | Question – 156 |

| 157 | Question – 157 |

| 158 | Question – 158 |

| 159 | Question – 159 |

| 160 | Question – 160 |

| S.N | Questions |

| 161 | Question – 161 |

| 162 | Question – 162 |

| 163 | Question – 163 |

| 164 | Question – 164 |

| 165 | Question – 165 |

| 166 | Question – 166 |

| 167 | Question – 167 |

| 168 | Question – 168 |

| 169 | Question – 169 |

| 170 | Question – 170 |

| S.N | Questions |

| 171 | Question – 171 |

| 172 | Question – 172 |

| 173 | Question – 173 |

| 174 | Question – 174 |

| 175 | Question – 175 |

| 176 | Question – 176 |

| 177 | Question – 177 |

| 178 | Question – 178 |

| 179 | Question – 179 |

| 180 | Question – 180 |

| 181 | Question – 181 |

| 182 | Question – 182 |

Thanks