Important Questions of National Income and related aggregates class 12

Looking for important questions of National Income and related aggregates chapter (unit) with answers class 12 Macroeconomics CBSE Board.

I have compiled all important questions and previous years’ questions too with answers for you.

National Income and related aggregates Important questions with answers class 12 Macroeconomics

Let’s have a look at 1 mark questions of the Previous year questions papers

1. Give any two examples of the flow concept.

[Delhi 2019]

Ans:- Income and Expenditure

Read our guide on what is Stock and Flow concept

2. Which of the following is a flow?

[Delhi C 2016]

a) Deposits in a bank

b) Capital

c) Depreciation

d) Wealth

Ans:- Depreciation

3. Define Stocks? [Delhi 2016]

or

Given the Meaning of stock variables? [Delhi C 2013]

or

Define Stock Variable? [Delhi 2012], [All India 2011]

[Delhi 2016]

Ans:- Stock variable refers to that variable, which is measured at a particular point of time. For example, inventory, capital, Money supply, etc.

Stock variables are not time dimensional.

4. Which of the following is a stock?

[All India c 2016]

a) Savings

b) Production

c) Consumption of fixed capital

d) Capital

Ans:- Capital

5. Define Flows? [All India 2016]

or

Give Meaning of flow variables?

or

Define Flow Variables?

Ans:- Flow variable refers to that variable, which is measured over a period of time. for example, Income, expenditure, etc.

Flow variables are time dimensional.

6. Which of the following is not a flow? [Delhi c 2015]

a) Capital

b) Income

c) Investment

d) Depreciation

Ans:- a)

7. Which is the following is a stock? [All India c 2015]

a) Wealth

b) Saving

c) Exports

d) Profits

Ans:- a)

8. Define Investment? [Delhi c 2014], Delhi c 2013]

Ans:- Addition made to the stock of capital during a period is called investment. It is also called capital formation.

For example construction of buildings, purchase of machinery, addition to inventories of goods, etc.

9. Define Capital Goods? [Delhi 2012], [All India 2010]

or

Give the meaning of capital goods. [Delhi c 2014]

Ans:- Capital goods are those final goods that are capable of being used for producing other goods and services. These are goods are used for generating income.

For example:- plant and machinery, equipment, etc.

10. Give two examples of intermediate goods? [Delhi c 2014], [All India 2013]

Ans:- Two examples of intermediate goods are

- Car purchased by car dealer.

- Leather purchasec by shoe maker.

11. Define consumption goods. [Delhi c 2014], [All India 2013]

Ans:- Goods purchased, or own produced, for the satisfaction of wants are called consumption goods.

For example:- purchases of food, clothes, vehicles, furniture, etc, by families (household).

12. What is macroeconomics? [All India c 2019]

Ans:- Macroeconomics is the study of economic aspects of the country as a whole.

for example, studies concerning national income, employment, inflation, government budget, the balance of payment are all macroeconomics studies.

13. Define Final Goods. [All India c 2013]

or

Define Final Product.

Ans:- Goods and services purchased, or own produced, for the purpose of consumption and investment are final goods or products.

For example- machines purchased by producers, food purchased by families.

14. Define Depreciation? [All India 2011]

Ans:- It refers to the fall in the value of fixed capital goods due to normal wear and tear and foreseen obsolescence. It is also called the consumption of fixed capital.

15. Define Intermediate Goods. [Delhi c 2011]

Ans:- Intermediate products refer to those goods and services which are purchased during the year by one production unit from other production units and completely used up, or resold, during the same year.

For example:- raw material purchased by producers, mobile purchased by the mobile dealer.

16. Give one example of a negative externality. [April re-exam 2019]

Ans:- Environmental pollution caused by industrial plants.

17. Which of the following affects national income? [March 2018]

a) Goods and services tax

b) Corporation tax

c) Subsidies

d) None of the above

Ans:- d) None of the above

18. National Income is the sum of factor incomes accruing to [All India 2016]

a) Nationals

b) economic territory

c) residents

d) both residents and non-residents

Ans:- residents

19. Depreciation of fixed capital assets refers to [Delhi 2016]

a) normal wear and tear

b) foreseen obsolescence

c) Both a) and b)

d) unforeseen obsolescence

Ans:- c)

20. Give the meaning of Depreciation. [All India c 2014], [All India 2011]

Ans:- Depreciation can be defined as a fall in the value of fixed assets due to normal wear and tear due to usage, the passage of time, or obsolescence.

21. Define National Income. [Delhi c 2014]

Ans:- National Income can be defined as the sum total of factor incomes accruing to normal residents of a country within the domestic territory and from the rest of the world, in a period of one financial year.

22. Define National product. [Delhi c 2014]

Ans:- National product can be defined as the money value of all goods and services produced by the normal residents of a country during a period of one financial year.

23. Define Domestic Product. [All India c 2014], [2011], [2010]

Ans:- Domestic product can be defined as the money value of all goods and services produced within the domestic territory of a country.

24. What is Nominal Gross Domestic Product? [Delhi 2011]

Ans:- Nominal Gross Domestic Product (GDP) refers to the market value of the final goods and services produced within the domestic territory of a country during a financial year, as estimated using the current year prices. It is also called GDP at current prices.

25. What is meant by Real Gross Domestic Product? [Delhi c 2011]

Ans:- Real Gross Domestic Product refers to the market value of the final goods and services produced within the domestic territory of a country during a financial year, as estimated using the base year prices. It is also called GDP at a constant price.

26. What is transfer payment? [All India 20111]

Ans:- Transfer payments are all those unilateral payments corresponding to which there is no value addition in the economy. For example, gifts, donations, etc.

Let’s have look at 3 marks questions of National Income and related aggregates chapter of Macroeconomics class 12 CBSE Board

27. Define the problem of double counting in the computation of National Income. State any two approaches to correct the problem of double counting. [Delhi 2019]

Ans:- The problem of double counting means, including the value of goods and services more than once while calculating the National Income.

It results in an overestimation of the value of goods and services produced.

The problem of double counting can be avoided in two ways.

1. Take the value of Final products only:-

According to this method, the value of only final goods and services should be added to determine the national income.

2. Take only Value added instead of total output:-

Another method to avoid the problem of double counting is to estimate the total value added at each stage of production.

28. Gross Domestic Product (GDP) does not give us a clear indication of the economic welfare of a country. Defend or refute the given statement with valid reason. [Delhi 2019]

Ans:- I defend this statement. Welfare refers to a sense of material well-being among the people.

There are transactions in the economy which result in welfare but can not be measured in money terms. Such transactions are not included while calculating GDP.

As such there are other factors also. I am listing few more factors that are not considered while calculating GDP but contribute to welfare.

Distribution of GDP:- GDP does not take into account changes in inequalities in the distribution of income. So, the welfare of the people may not rise as much as the rise in GDP.

Non-Monetary Exchanges:- GDP does not take into account non-monetary transactions due to the unavailability of data. But such transactions contribute in welfare.

Externalities:- It doesn’t take into account negative and positive externalities. negative externalities reduce welfare and positive increases.

Contributions of some products may be negative:- GDP includes all final products whether it is grain or liquor. grain contributes to welfare but liquor results in health hazards.

29. Given Nominal Income, How can we find real Income? Explain. [March 2018]

Ans:- Nominal Income is the money value of goods and services produced at the current year price. While Real income is calculated at the base year price to eliminate the effect of inflation.

Real Income shows actual growth and decline in the economy.

We can easily convert nominal income into real income with the GDP deflator (price index) formula.

Let’s have an example to demonstrate it.

Assume

Nominal Income = 300

Price index 150

Real Income = Nominal Income/Price index * 100

Real Income = 300/150 * 100

Real Income = ₹ 200 crore.

30. If the real GDP is ₹ 400 and the Nominal GDP is ₹ 450, calculate the Price Index (base = 100). [All India 2015]

Ans:- Price Index = Nominal GDP/Real GDP * 100

Price Index = 450/400 * 100

Price Index = ₹ 112.5

31. Distinguish between stock and flow variables with suitable examples. [April re-exam 2018], [All India c 2014]

Ans:- Difference between stock and flow is.

| Basis | Stock | Flow |

| Time | It relates to a point of time | It relates to the period of time |

| Dimension | It is not time dimensional | It is time dimensional as per hour, per month, per year. |

| Impact | It influences the flow. for example, more is capital, greater is the flow of goods and services. | It influences the stock, for example, the more is the flow of investment, the greater would be the capital. |

| Concept | Static concept | Dynamic concept |

| Example | capital, wealth, bank balance | Income, expenditure, profit |

32. What are capital goods? How are they different from consumption goods? [April re-exam 2018]

Ans:- Capital goods are those final goods that are capable of being used for producing other goods and services. These are goods are used for generating income.

For example:- plant and machinery, equipment, etc.

| Basis | Consumption Goods | Capital Goods |

| Meaning | These goods are purchased or own produced by consumers to satisfy their wants and not for resale | These goods are purchased or own produced by producers for the production of other goods. such goods are not meant for resale. |

| Use | used by consumers for consumption purposes. | Used by producers to produce other goods and services |

| Demand | High | Less |

| Example | bread, butter, tv fridge by consumers. | equipment, machinery, plant by producers |

33. Which among the following are final goods and which are intermediate goods? Give reasons. [March 2018]

a) Milk purchased by a tea stall

b) Bus purchased by a school

c) Juice purchased by a student from the school canteen.

Ans:-

a) Milk purchased by a tea stall is an intermediate consumption. As milk will be used as a raw material to make tea (final goods) within a year.

b) Bus purchased by a school is the final goods. As it would be used by schools for the long term and not meant for resale.

c) Juice purchased by a student from the school canteen is the final good. As it is purchased by a consumer (student) for the satisfaction of his own wants not for resale.

34. Explain with the help of an example. the basis of classifying goods into final goods and intermediate goods. [All India 2017]

Ans:- The basis of classification of final goods and intermediate goods is the end-user or end use of the product.

If the goods are in the hand of the end-user (final user) and not going to be sold further. It is termed as final goods. For example, machines purchased by producers, food purchased by households. such goods have come out of the production boundary line and are in the hand of the final user.

On the other hand, if the goods are within the production boundary line and will still be used as raw material in making further goods or if it is final goods but meant for resale. Such products are not in the hand of end-users and are termed as intermediate goods.

35. Distinguish between final goods and intermediate goods. Give an example of each. [All India 2017]

Ans:- difference between intermediate goods and final goods.

| Basis | Intermediate Goods | Final Goods |

| end-user | end-user is a producer | end-user may producer or consumer |

| Purpose | used as raw material in producing other goods. | is used as consumption goods by consumer or capital goods by producer |

| Production Boundary | is still within the production boundary | is outside the production boundary |

| Examples | leather used in the shoe industry, the steel used in the production of kitchen utensils | fridge purchased by households, Machine purchased by producers |

36. Explain the circular flow of Income. [All India 2017], [Delhi c 2014], [All India C 2012]

Ans:- Circular flow of Income refers to unending flows of production of goods and services and income and expenditure in an economy.

It show the redistribution of income in a circular manner between production units and households

It comprises of three phases:-

Production Phase:- This phase is also called the income generation phase. In this phase, households provide factor services to production units and produce goods and services. Income is generated.

Income Distribution Phase:- Production units distribute this income to the factor owners.

Expenditure Phase:- Income received by households, spent on goods and services produced by those units. In this phase, all income received by households returns to production units.

Once, the goods and services purchased by households are completely consumed. They again demand goods. Now again producer has the opportunity to produce goods and these three phases go on in circular format again & again.

It can be better understood with the diagram given below.

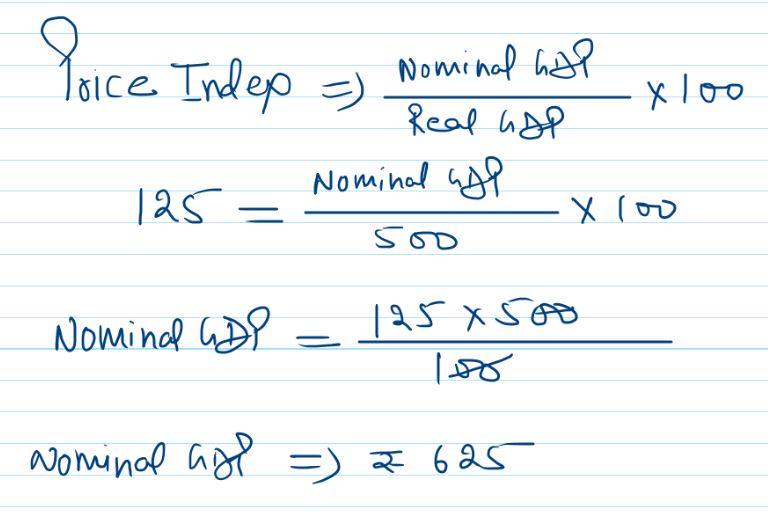

37. If the Real GDP is ₹ 500 and Price Index (base = 100) is 125, Calculate the Nominal GDP. [All India 2015]

Ans:- Real GDP = ₹ 500, Price Index = 125

Nomical GDP = ?

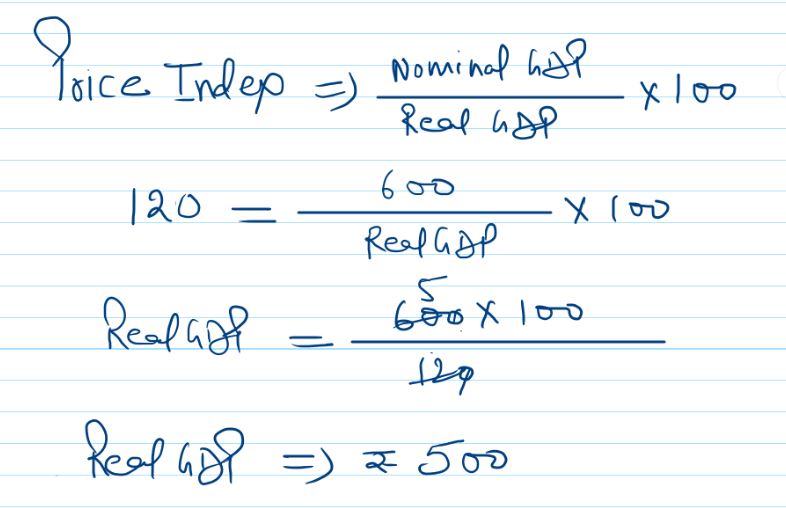

38. If the Nominal GDP is ₹ 600 and Price Index (base = 100) is 120. Calculate the Real GDP. [All India 2015]

Ans:- Nominal GDP = ₹ 600

Price Index = 120

Real GDP = ?

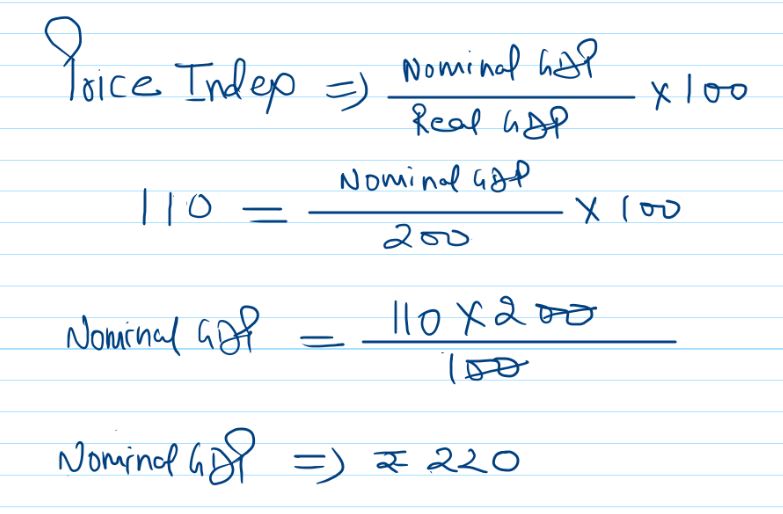

39. If Real GDP is ₹ 200 and Price Index (with base = 100) is 110. Calculate Nominal GDP. [Delhi 2015]

Ans:-

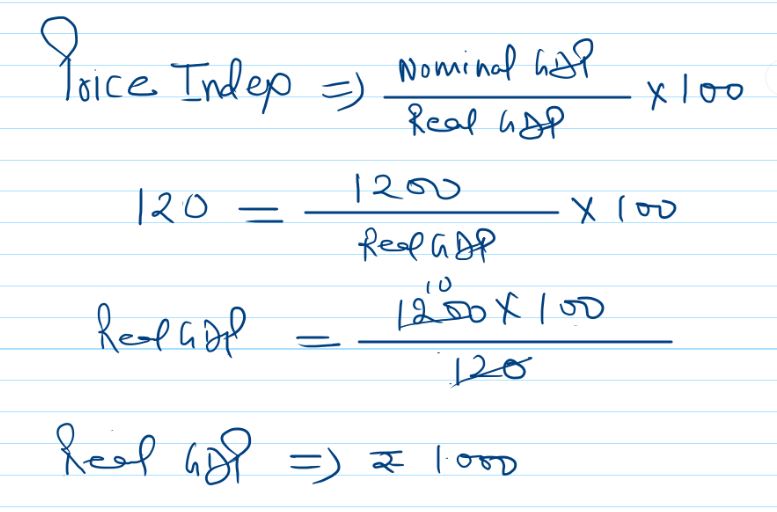

40. If the Nominal GDP is ₹ 1200 and the Price Index (with base = 100) is 120, calculate Real GDP. [Delhi 2015]

Ans:-

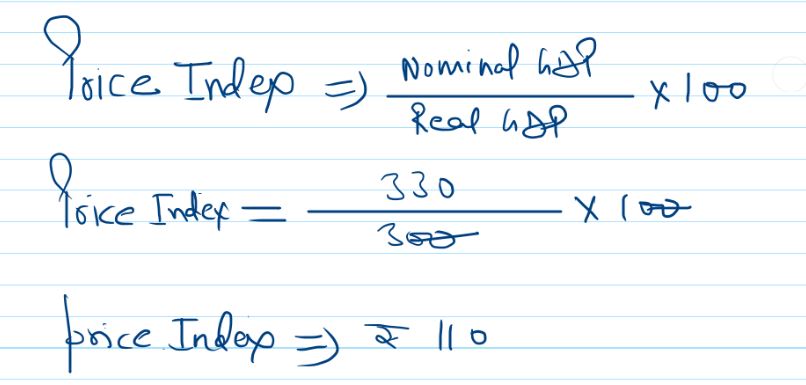

41. If the Real GDP is ₹ 300 and the Nominal GDP is ₹ 330, calculate Price Index (base = 100). [Delhi 2015]

Ans:-

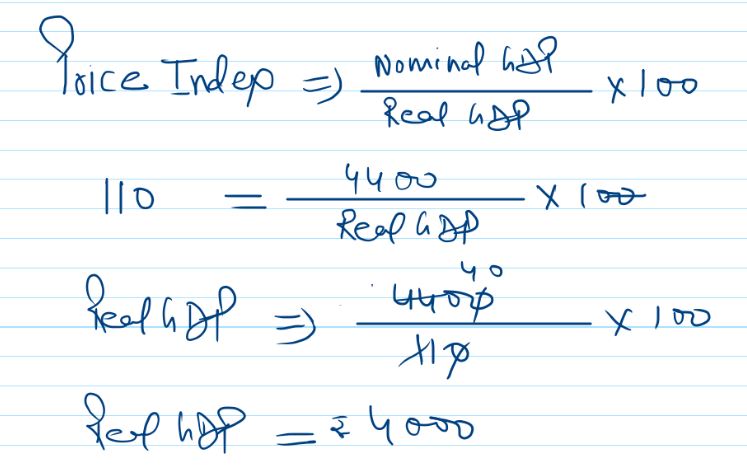

42. If the Nominal Gross Domestic Product = ₹ 4400 and the Price Index (base = 100) = ₹ 110, Calculate the Real Gross Domestic Product. [Foreign 2015]

Ans:-

43. Distinguish between real and nominal gross domestic product. [All India c 2014], [All India 2010]

Ans:- Difference between the Real and Gross domestic product is.

| Basis | Real GDP | Nominal GDP |

| Other Name | It is also called GDP at a constant price | It is also called GDP at the current year price. |

| Definition | It is the market value of the final goods and services produced within the domestic territory of a country during an accounting year, as estimated at base-year prices. | It is the market value of the final goods and services produced within the domestic territory of a country during an accounting year, as estimated at current year prices. |

| Welfare | It is a better measure of the welfare of people than Nominal GDP | It is not a good measure of the welfare of people |

| Changes | Its value changes, when the quantity of output changes. | Its value can changes either quantity of output or price changes. |

44. Find Net Value Added at Factor Cost. [Delhi 2016]

| Items | (₹ in lakh) |

| i) Durable use producer goods with a life span of 10 years | 10 |

| ii) Single-use producer goods | 5 |

| iii) Sales | 20 |

| iv) Unsold output produced during the year | 2 |

| v) Taxes on production | 1 |

Ans:-

Value of Output = Sales + Change in Stock

Value of Output = iii) + iv) = ₹ 20 + ₹ 2 = ₹ 22

GVA at MP = Value of Output – Intermediate Consumption

Intermediate Consumption = Single use producer goods = ₹ 5

GVA at MP = ₹ 22 – ₹ 5 = ₹ 17

Consumption of fixed capital = Total value of durable use goods/Total life span = ₹10/₹10 = ₹ 1 lakh

Net Indirect tax = Taxes on production – subsidy of production = ₹ 1 – ₹ 0 = ₹ 1

Net Value added at FC = GVA at MP – consumption of fixed capital – Net Indirect tax (Indirect Tax – Subsidy)

NVA at FC = ₹ 17 – ₹ 1 – ₹ 1 = ₹ 15

45. Find Net Value added at Market Price. [Delhi 2016]

| Items | (₹ in lakh) |

| i) Fixed capital good with a life span of 5 years | 15 |

| ii) Raw Materials | 6 |

| iii) Sales | 25 |

| iv) Net Change in Stock | (-) 2 |

| v) Taxes on production | 1 |

Ans:-

Solution:-

Value of Output = Sales + Change in Stock

Value of Output = iii) + iv) = 25 + ( – 2) = 23

Gross Value Added at MP = Value of Output – Intermediate Consumption

GVA at MP = ₹ 23 – ₹ 6 = ₹ 17

Net Value Added at MP = GVA at MP – Consumption of fixed Capital

Consumption of Fixed Capital = Total value of fixed Capital/life span = 15/5 = ₹ 3 lakh

NVA at MP = ₹ 17 – ₹ 3 = ₹ 14

46. Find Gross Value Added at Market Price. [Delhi 2016]

| Items | (₹ in lakh) |

| i) Depreciation | 20 |

| ii) Domestic Sales | 200 |

| iii) Net Change in Stocks | (-) 10 |

| iv) Exports | 10 |

| v) Single use producer goods | 120 |

Ans:-

Solutions:-

Sales = Domestic Sales + Exports

Sales – ii) + iv) = ₹200 + ₹10 = ₹210

Change in stock = Net Change in Stocks = (-) 10

Intermediate Consumption = ₹ 120

Gross Value Added at MP = Sales + Change in stock – Intermediate Consumption

GVA at MP = ₹210 + ( – ₹10) – ₹120 = ₹80

Note: Single-use producer goods are intermediate consumption

47. Calculate Gross Value Added at Factor Cost. [Delhi 2012]

| Items | (₹ in crores) |

| 1. Units of Output Sold | 1000 |

| 2. Price Per Unit of Output | 30 |

| 3. Depreciation | 1000 |

| 4. Intermediate cost | 12000 |

| 5. Closing Stock | 3000 |

| 6. Opening Stock | 2000 |

| 7. Excise duty | 2500 |

| 8. Sales tax | 3500 |

Ans:-

Sales = Quantity * Price

Sales = 1000 * 30 = ₹ 30,000

Value of Output = Sales + Change in Stock (Closing stock – Opening stock)

Value of Output = 30000 + (3000 – 2000)

Value of Output = ₹ 31000

GDP at MP = Value of Output – Intermediate consumption

GDP at MP = 31000 – 12000 = ₹ ₹ 19000

GDP at FC = GDP at MP – Net Indirect tax (Sales tax + Excise duty – subsidy)

GDP at FC = 19000 – (2500 + 3500 – 0)

GDP at FC = 19000 – 6000

GDP at FC = ₹ 13000

48. Calculate Net Value Added at Factor Cost. [Delhi 2012]

| Items | (₹ in crore) |

| 1. Consumption of Fixed Capital | 600 |

| 2. Import Duty | 400 |

| 3. Output Sold (units) | 2000 |

| 4. Price Per Unit of Output | 10 |

| 5. Net Change in stocks | – 50 |

| 6. Intermediate cost | 10000 |

| 7. Subsidy | 500 |

Ans:-

Sales = Quantity * Price = 2000 * 10 = ₹ 20000

Value of output = Sales + Change in stock

Value of Output = 20000 + (-50) = ₹ 19950 crore

GDP at MP = Value of Output – Intermediate cost

GDP at MP = 19950 – 10000 = ₹ 9950 crore

NDP at FC = GDP at MP – consumption of fixed capital – Net Indirect tax (Import Duty – Subsidy)

NDP at FC = 9950 – 600 – (400 – 500) = 9950 – 500

NDP at FC = ₹ 9450 crore

49. Find the Net Value Added at Market Price. [Delhi 2012]

| Items | (₹ in crore) |

| 1. Output Sold (units) | 800 |

| 2. Price per unit of output | 20 |

| 3. Excise | 1600 |

| 4. Import Duty | 400 |

| 5. Net Change in Stock | – 500 |

| 6. Depreciation | 1000 |

| 7. Intermediate cost | 8000 |

Ans:-

Sales = Quantitiy * Price

Sales = 800 * 20 = ₹ 16000 crore.

Value of Output = Sales + Change in Stock

Value of Output = 16000 + (- 500)

Value of Output = ₹ 15500

GDP at MP = Value of Output – Intermeciate cost

GDP at MP = 15500 – 8000

GDP at MP = ₹ 7500 crore

NDP at MP = GDP at MP – Depreciation

NDP at MP = 7500 – 1000

NDP at MP = ₹ 6500 crore

50. Find Net Value Added at Market Price. [All India 2012]

| Items | (₹ in crore) |

| 1. Depreciation | 700 |

| 2. Output Sold (Units) | 900 |

| 3. Price per nit of Output | 40 |

| 4. Closing Stock | 1000 |

| 5. Opening Stock | 800 |

| 6. Sales tax | 3000 |

| 7. Intermediate cost | 20000 |

Ans:-

Sales = Quantity * Price

Sales = 900 * 40 = 36000

Value of Output = Sales + Change in Stock (Closing stock – Opening stock)

Value of Output = 36000 + (1000 – 800)

Value of Output = 36200

GDP at MP = Value of Output – Intermediate cost

GDP at MP = 36200 – 20000 = 16200

NDP at MP = GDP at MP – Depreciation

NDP at MP = 16200 – 700

NDP at MP = ₹ 15500 crore