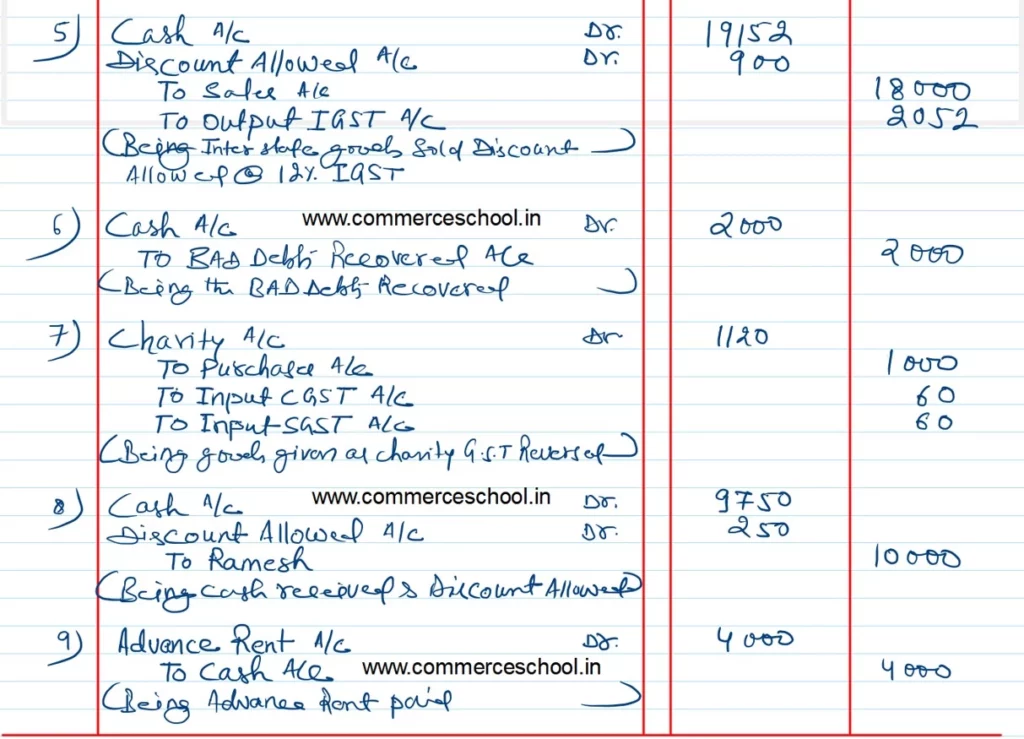

[CBSE] Q 3 Accounting for Goods and Services Tax (GST) TS Grewal class 11 (2023-24)

Are you looking for solutions of Question number 3 of Accounting for Goods and Services Tax (GST) of TS Grewal class 11 CBSE Board 2023-24

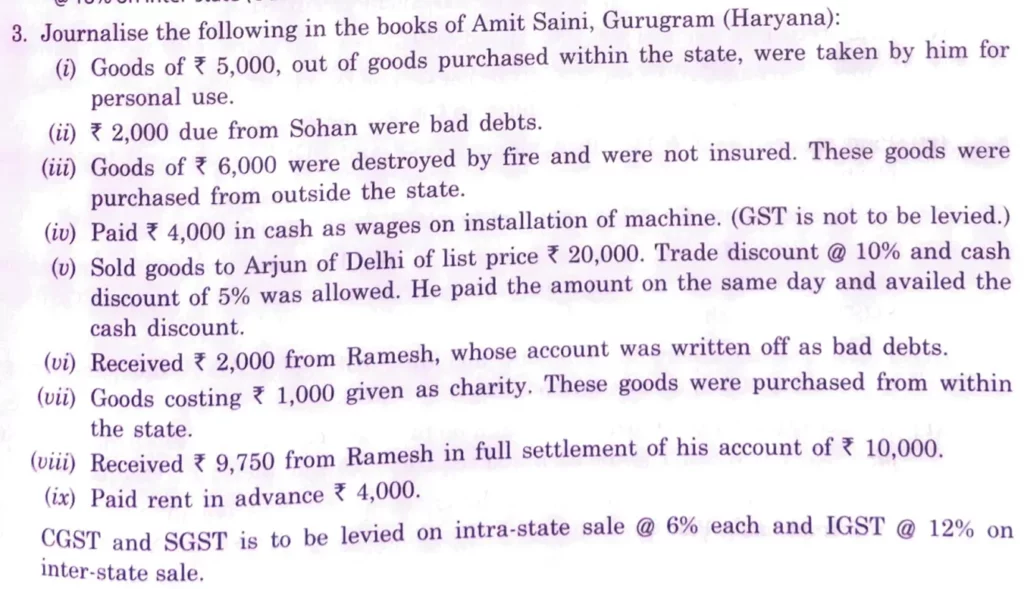

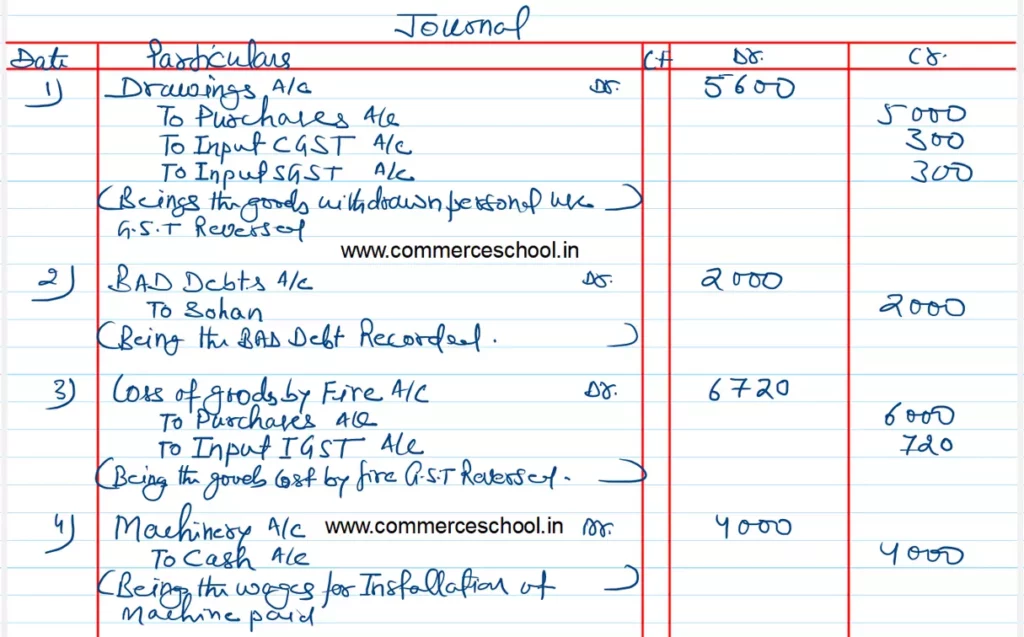

Journalise the following in the books of Amit Saini, Gurugram (Haryana):

(i) Goods of ₹ 5,000, out of goods purchased within the state, were taken by him or personal use.

(ii) ₹ 2,000 due from Sohan were bad debts.

(iii) Goods of ₹ 6,000 were destroyed by fire and were not insured. These good were purchased from outside the state.

(iv) Paid ₹ 4,000 in cash as wages on installation of machine. (GST is not be levied).

(v) Sold goods to Arjun of Delhi of list price ₹ 20,000. Trade discount @ 10% and cash discount of 5% was allowed. He paid the amount on the same day and availed the cash discount.

(vi) Received ₹ 2,000 from Ramesh, whose account was written off as bad debts.

(vii) Goods costing ₹ 1,000 given as charity. These goods were purchased from within the state.

(viii) Received ₹ 9,750 from Ramesh in full settlement of his account of ₹ 10,000.

(ix) Paid rent in advance ₹ 4,000.

CGST and SGST is to be lavied on intra-state sale @ 6% each and IGST @ 12% on inter-state sale.

Solution:-

Below is the list of all solutions of chapter 12 Goods and Services Tax (GST) TS Grewal class 11 CBSE 2023-24