[CBSE] Q 1 Solutions Financial Statements of Sole Proprietorship TS Grewal Class 11 (2023-24)

Solution of Question number 1 of the Financial Statements of Sole Proprietorship of TS Grewal Book class 11, 2023-24?

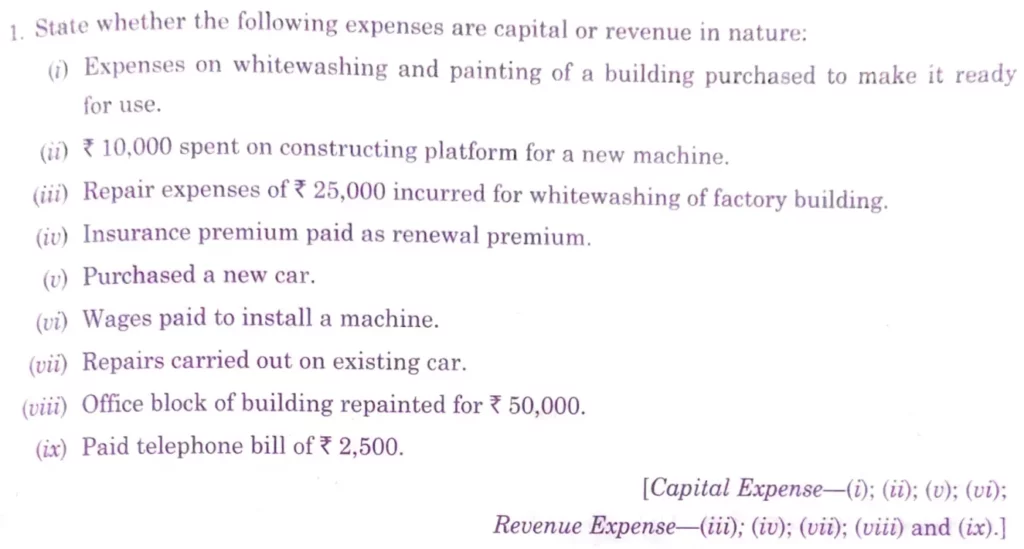

State whether the following expenses are capital or revenue in nature:

(i) Expenses on whitewhashing and painting of a building purchased to make it ready for use.

(ii) ₹ 10,000 spent on constructing platform for a new machine.

(iii) Repair expenses of ₹ 25,000 incurred for whitewashing of factory building.

(iv) Insurance premium paid as renewal premium.

(v) Purchased a new car.

(vi) GST paid on purchase of new machine.

(vii) Wages paid to install a machine.

(viii) Repairs carried out on existing car.

(ix) Office block of building repainted for ₹ 50,000.

(x) Paid telephone bill of ₹ 2,500.

[Capital Expense – (i), (ii), (v), (vi), (vii); Revenue Expense – (iii), (iv), (viii), (ix) and (x).]

Solution:-

I) Capital Expenses

Reason:- Expenses incurred on after purchasing an assets are included in the purchasing cost of the assets.

ii) Capital Expenses

Reason:- Expneses incurred on a new machine to make it usable is included in the purchasing cost of the assets.

iii) Revenue Expenses

Reason:- Expenses incurred in the maintenance of the old assets of the business are the Revenue Expenses.

iv) Revenue Expenses

Reason:- Insurance premium is the day to day expenses of the business.

v) Capital Expenses

Reason:- Expenditure incurred on purchasing a new assets are Capital expenses.

vi) Capital Expenses:-

Reason:- Expenditure incurred on purchasing a new assets are Capital expenses.

vii) Capital Expenses:-

Reason:- Expenditure incurred on a new machine to make it usable in business are included in the purchasing cost of the machine. thus installation charges of a new machine are Capital expenditures.

viii) Revenue Expenses:-

Reason:- Expenses incurred on maintenance of the existing assets are considered as day to day expenses of the business. Thus Repairs of existing car are Revenue Expenses.

ix) Revenue Expenses

Reason:- Expenses incurred on maintenance of the existing assets are considered as day-to-day expenses of the business. Thus expenses of repainted of office blocks are Revenue Expenses.

x) Telephone Bill:-

Reason:- Expenses on Telephone bill are day to day expenses of the business. Thus are Revenue Expenses.

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |