[ISC] Q 14 Solution Final Accounts with adjustments TS Grewal Class 11 (2023-24)

Solution of Question number 14 solution of Final Accounts with adjustments TS Grewal class 11 Accountancy ISC Board 2023-24.

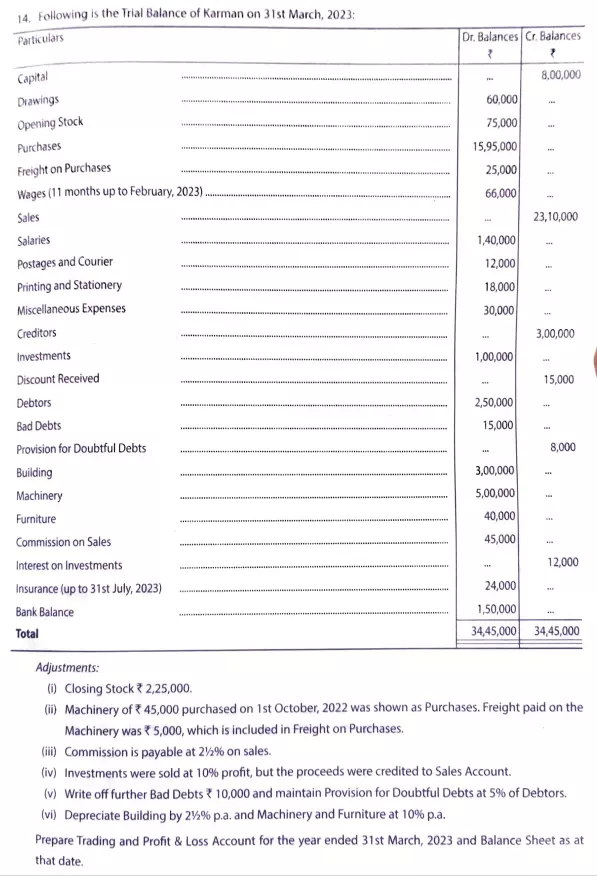

Following is the Trial Balance of Karman on 31st March, 2023:

| Particulars | Dr. | Cr. |

| Capital Drawings Opening Stock Purchases Freight on Purchases Wages (11 months up to February, 2023) Sales Salaries Postage and Courier Printing and Stationery Miscellaneous Expenses Creditors Investments Discount Received Debtors Bad Debts Provision for Doubtful Debts Building Machinery Furniture Commission on Sales Interest on Investments Insurance (up to 31st July, 2023) Bank Balance | – 60,000 75,000 15,95,000 25,000 66,000 – 1,40,000 12,000 18,000 30,000 – 1,00,000 2,50,000 15,000 – 3,00,000 5,00,000 40,000 45,000 – 24,000 1,50,000 | 8,00,000 – – – – – 23,10,000 – – – – 3,00,000 – 15,000 – – 8,000 – – – – 12,000 – – |

| 34,45,000 | 34,45,000 |

Adjustments:

(i) Closing Stock ₹ 2,25,000.

(ii) Machinery of ₹ 45,000 purchased on 1st October, 2022 was shown as Purchases, Freight paid on the Machinery was ₹ 5,000, which is included in Freight on Purchases.

(iii) Commission is payable at 2 and 1/2% p.a. on sales.

(iv) Investments were sold at 10% profit, but the proceeds was credited to Sales Account.

(v) Write off further Bad Debts ₹ 10,000 and maintain Provision for Doubtful Debts at 5% of Debtors.

(vi) Depreciate Building by 2 and 1/2% p.a. and Machinery and Furniture at 10% p.a.

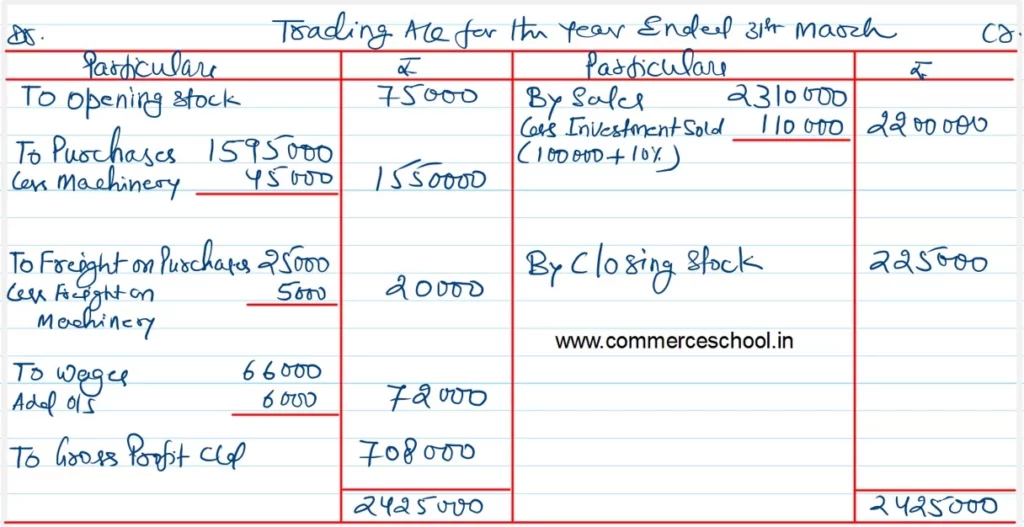

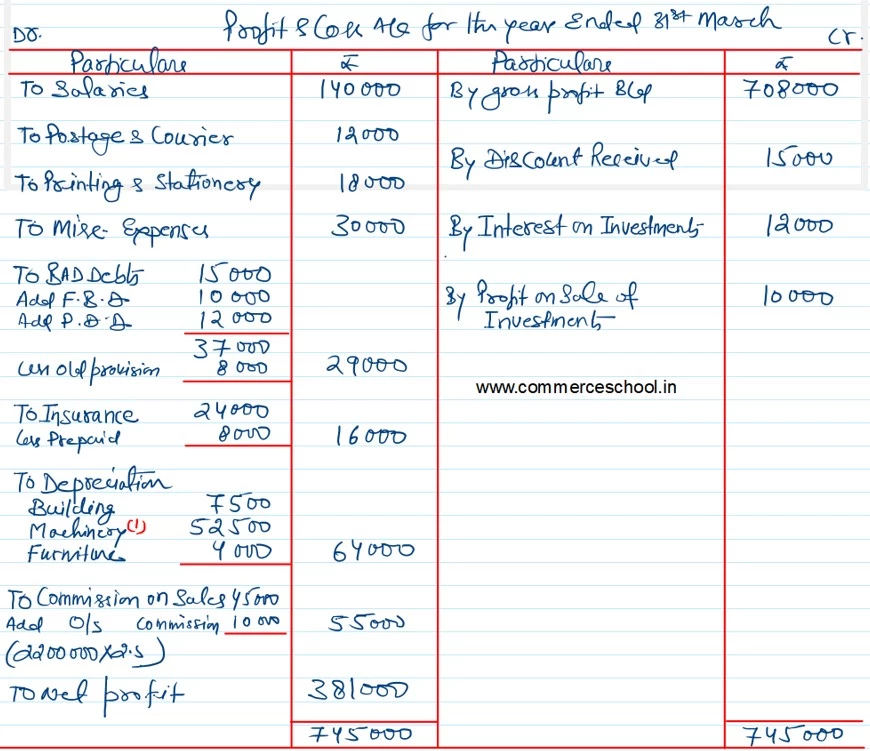

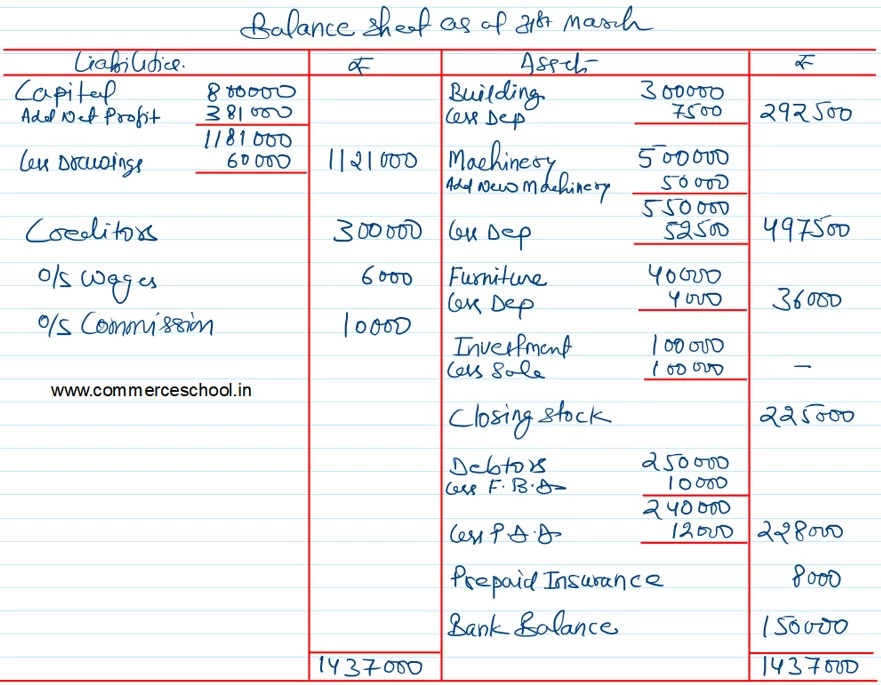

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date.

Solution:-

Here is the list of all solutions of Practical Problems below

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |