[ISC] Q. 23 Cash Flow Statement Solution TS Grewal Class 12 (2023-24)

Solution of Question number 23 of the Cash Flow Statement of TS Grewal Book 2023-24 session ISC Board?

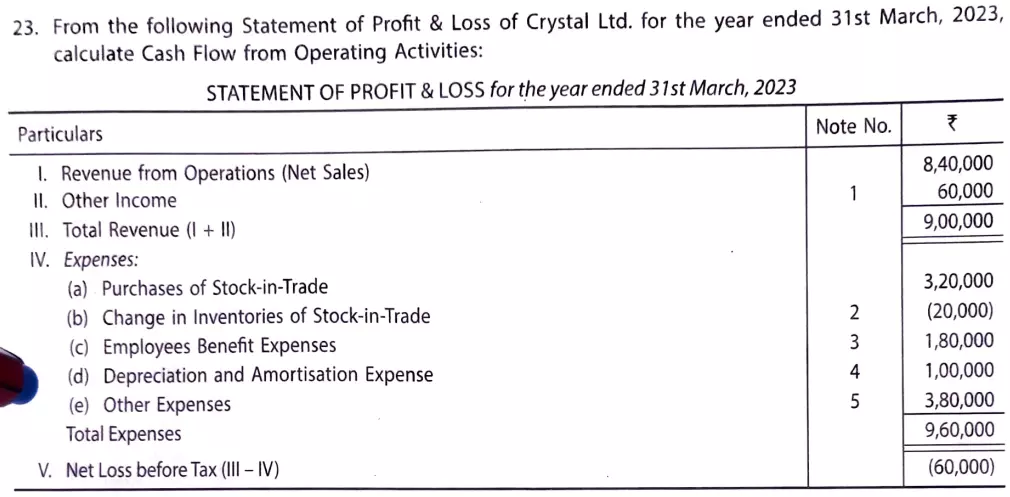

From the following Statement of Profit & Loss of Crystal Ltd. for the year ended 31st March, 2023, Calculate Cash Flow from Operating Activities:

Statement of Profit & Loss for the year ended 31st March, 2023

| Particulars | ₹ |

| I. Revenue from Operations (Net Sales) II. Other Income | 8,40,000 60,000 |

| III. Total Revenue (I + II) | 9,00,000 |

| IV. Expenses: (a) Purchase of Stock in Trade (b) Change in Inventories of Stock-in-Trade (c) Employee Benefit Expenses (d) Depreciation and Amortisation Expense (e) Other Expenses | 3,20,000 (20,000) 1,80,000 1,00,000 3,80,000 |

| Total Expenses | 9,60,000 |

| V. Net Loss before Tax (III – IV) | (60,000) |

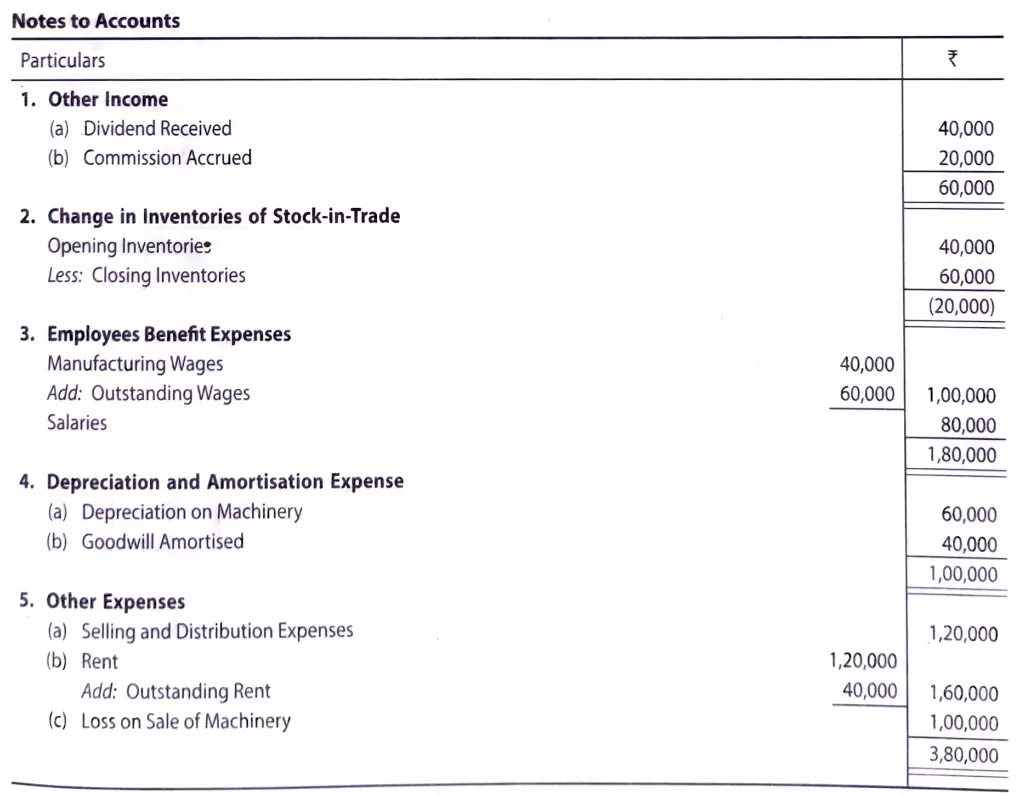

Notes to Accounts

| Particulars | ₹ | |

| 1. Other Income (a) Dividend Received (b) Commission Accrued | 40,000 20,000 | |

| 60,000 | ||

| 2. Change in Inventories of Stock in Trade Opening Inventories Less: Closing Inventories | 40,000 60,000 | |

| (20,000) | ||

| 3. Employees Benefit Expenses Manufacturing Wages Add: Outstanding Wages Salaries | 40,000 60,000 | 1,00,000 80,000 |

| 1,80,000 | ||

| 4. Depreciation and Amortisation Expenses (a) Depreciation on Machinery (b) Goodwill Amortised | 60,000 40,000 | |

| 1,00,000 | ||

| 5. Other Expenses (a) Selling and Distribution Expenses (b) Rent Add: outstanding Rent (c) Loss on sale of Machinery | 1,20,000 40,000 | 1,20,000 1,60,000 1,00,000 |

| 3,80,000 |

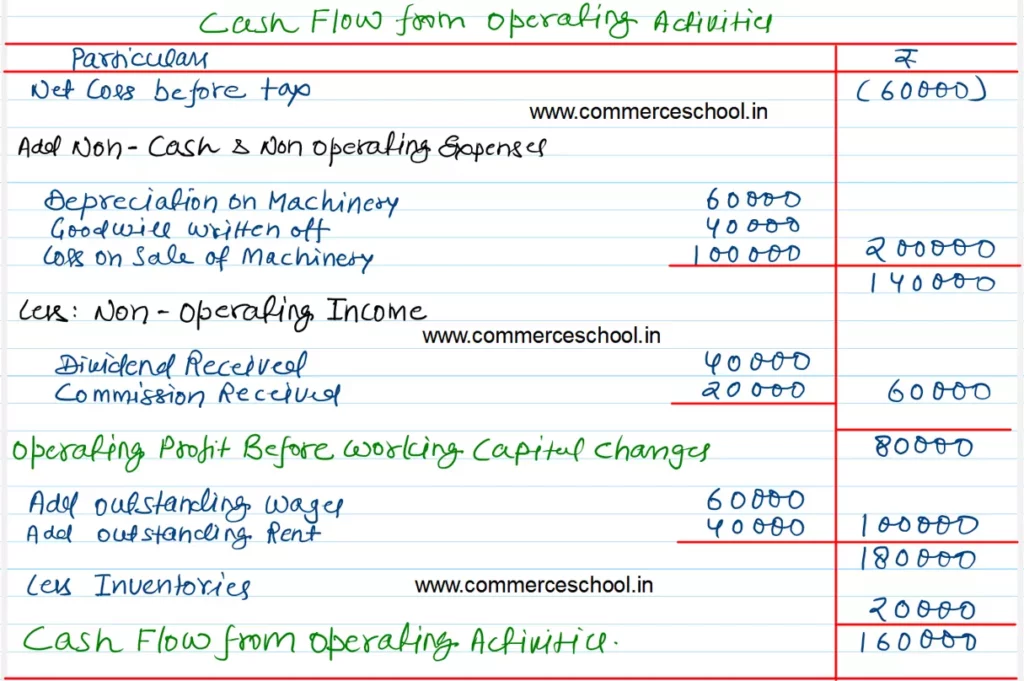

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |