[CBSE] Q 16 Accounts for Incomplete Records Solutions (2023-24)

Solution of Question number 16 Accounts for Incomplete Records (Single Entry System) CBSE Board (2023-24)

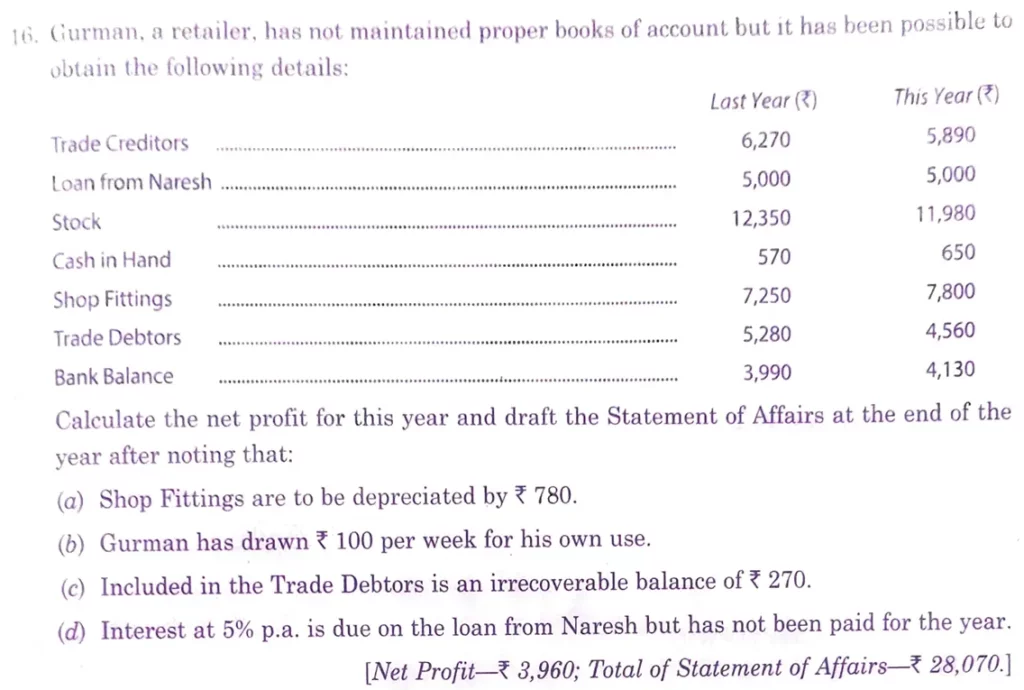

Gurman, a retailer, has not maintained proper books of account but it has been possible to obtain the following details:

| Last Year (₹) | This Year (₹) | |

| Trade Creditors | 6,270 | 5,890 |

| Loan from Naresh | 5,000 | 5,000 |

| Stock | 12,350 | 11,980 |

| Cash in Hand | 570 | 650 |

| Shop Fittings | 7,250 | 7,800 |

| Trade Debtors | 5,280 | 4,560 |

| Bank Balance | 3,990 | 4,130 |

Calculate the net profit for this year and draft the Statement of Affairs at the end of the year after noting that:

(a) Shop Fittings are to be depreciated by ₹ 780.

(b) Gurman has drawn ₹ 100 per week for his own use.

(c) Included in the Trade Debtors is an irrecoverable balance of ₹ 270.

(d) Interest at 5% p.a. is due on the loan from Naresh but has not been paid for the year.

[Net Profit – ₹ 3,960; Total of Statement of Affairs – ₹ 28,070.]

Solution:-

Following is the list

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |