[ISC] Q 50 Non-Trading Organisation Solution TS Grewal Class 11 (2023-24)

Solution of Question number 50 Non Trading Organisation (NPO) Chapter TS Grewal class 11 ISC Board for 2023-24 Session?

The Accountant of Diana Club furnishes you the following Balance Sheet as at 1st April, 2022 and Receipts & Payments Account for the year ended 31st March, 2023:

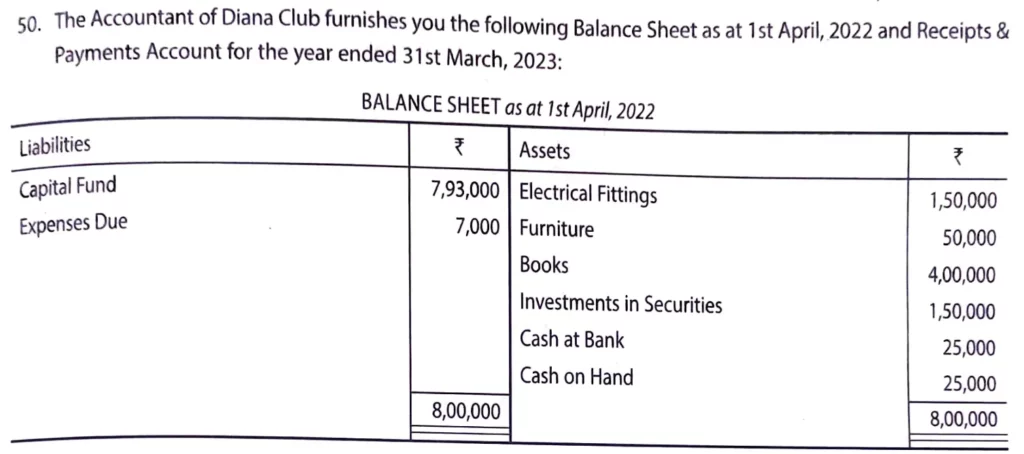

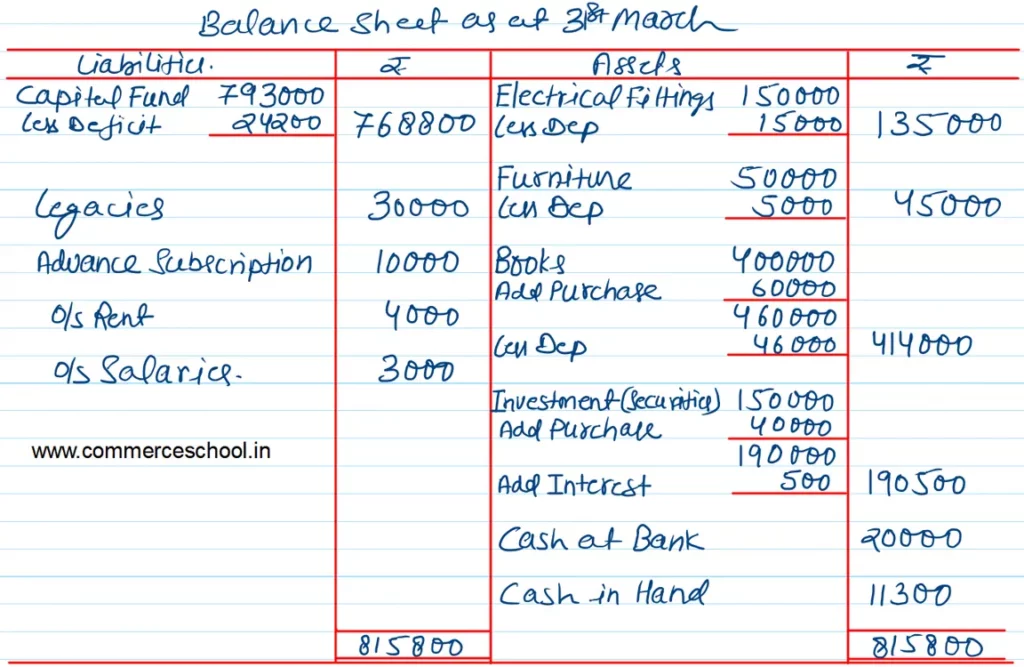

Balance Sheet as at 1st April, 2022

| Liabilities | ₹ | Assets | ₹ |

| Capital Fund Expenses Due | 7,93,000 7,000 | Electrical Fittings Furniture Books Investments in Securities Cash at Bank Cash on Hand | 1,50,000 50,000 4,00,000 1,50,000 25,000 25,000 |

| 8,00,000 | 8,00,000 |

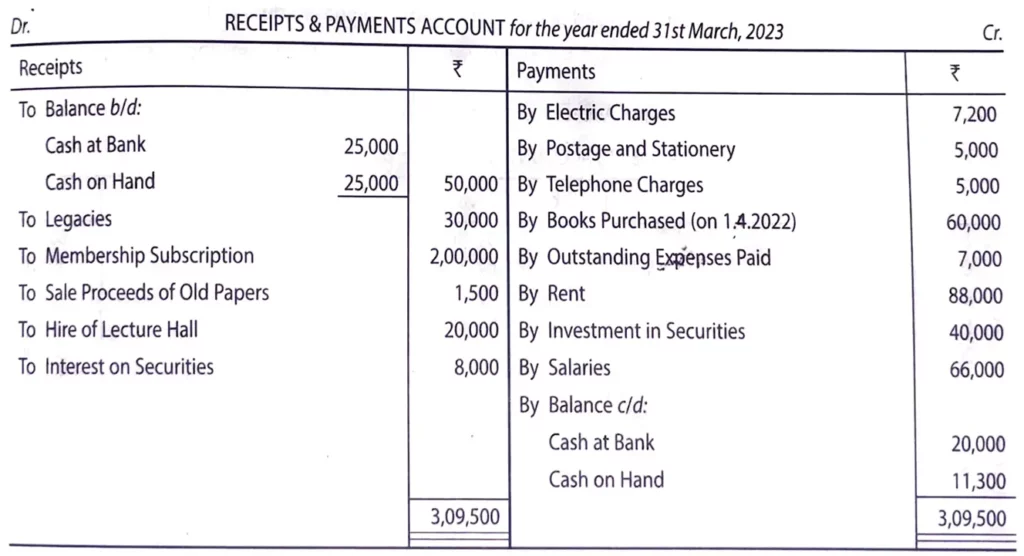

Receipts & Payments Account for the year ended 31st March, 2023

| Receipts | ₹ | Payemnts | ₹ | |

| To Balance b/d: Cash at Bank Cash in Hand To Legacies To Membership Subscription To Sale Proceeds of Old Papers To Hire of Lecture Hall To Interest on Securities | 25,000 25,000 | 50,000 30,000 2,00,000 1,500 20,000 8,000 | By Electric Charges By Postage and Stationery By Telephone Charges By Books Purchaed (On 1.4.2022) By Outstanding Expenses Paid By Rent By Investment in Securities By Salaries By Balance c/d: Cash at Bank Cash on Hand | 7,200 5,000 5,000 60,000 7,000 88,000 40,000 66,000 20,000 11,300 |

| 3,09,500 | 3,09,500 |

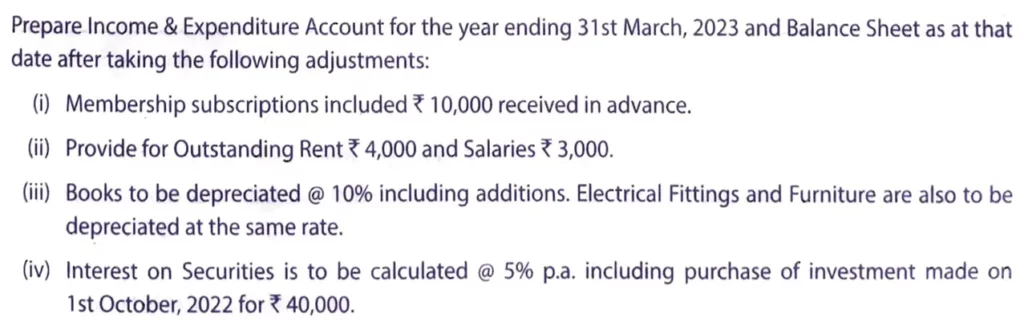

Prepare Income & Expenditure Account for the year ending 31st March, 2023 and Balance Sheet as at that date after taking the following adjustments:

(i) Membership subscriptions included ₹ 10,000 received in advance.

(ii) Provide for outstanding Rent ₹ 4,000 and Salaries ₹ 3,000.

(iii) Books to be depreciated @ 10% including additions. Electrical Fittings and Furniture are also to be depreciated at the same rate.

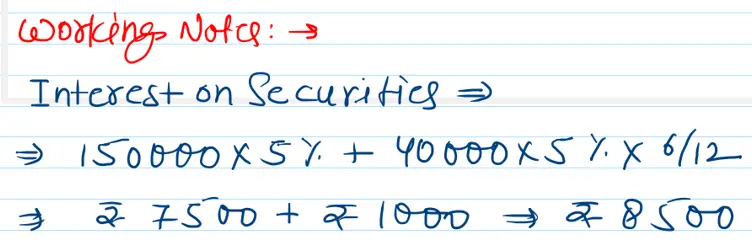

(iv) Interest on Securities is to be calculated @ 5% p.a. including purchase of investment made on 1st October 2022 for ₹ 40,000.

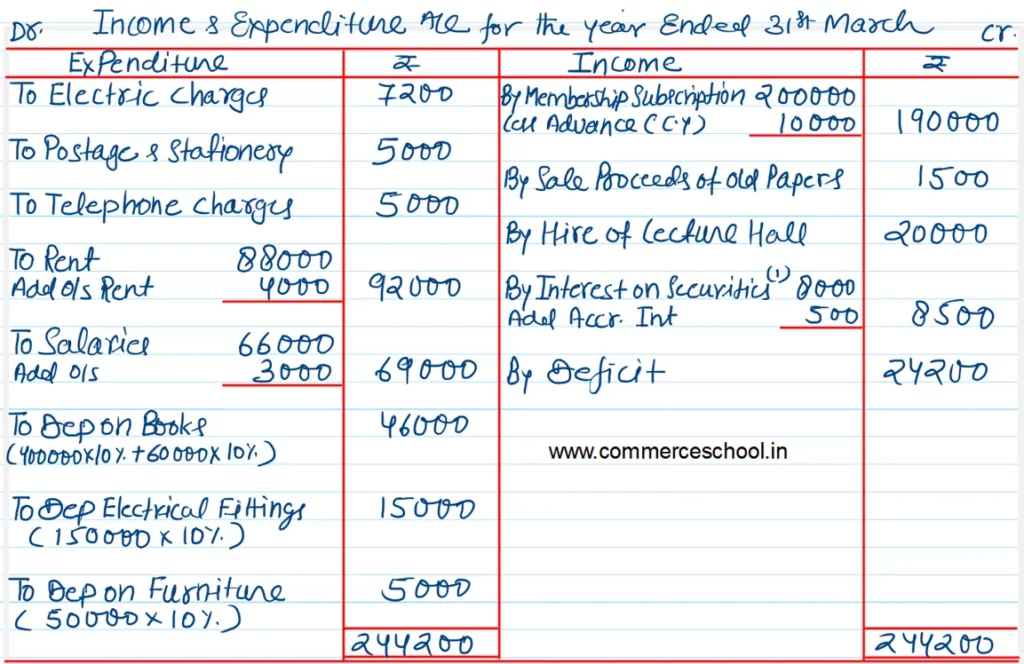

Solution:-

Below is the list of all the Practical problems

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |