[ISC] Q. 19 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 19 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

Amal, Amolak and Bhaskar sharing profits in the ratio of 2 : 2 : 1 agreed upon dissolution of their partnership on 31st March, 2022 on which date their Balannce Sheet was as under:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/c – Amal Capital A/c – Amolak Reserves Workmen Compensation Reserve Investments Fluctuation Reserve Creditors Employee’s Provident Fund | 1,20,000 90,000 70,000 35,000 1,500 55,500 6,000 | Fixed Assets Insurance Claim Receivable Debtors Less: PDD Stock Investments Bankj Capital A/c – Bhaskar | 1,50,000 75,000 28,500 24,000 24,000 70,500 6,000 |

| 3,78,000 | 3,78,000 |

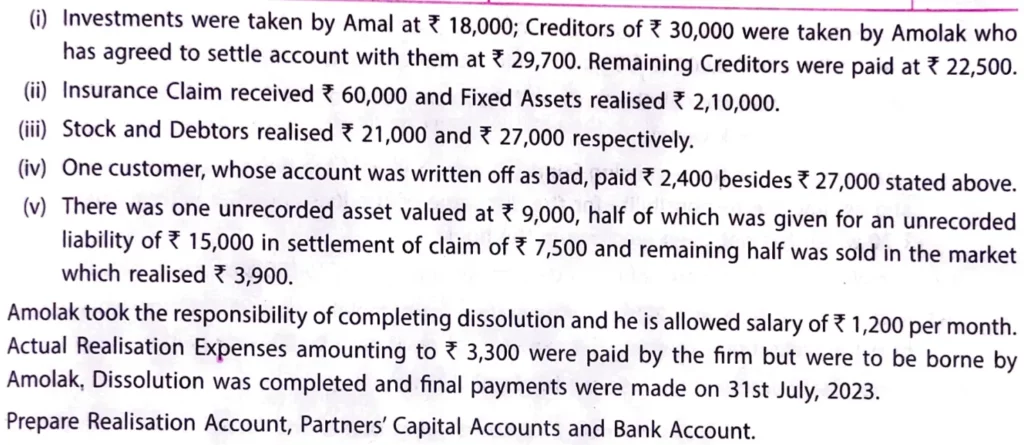

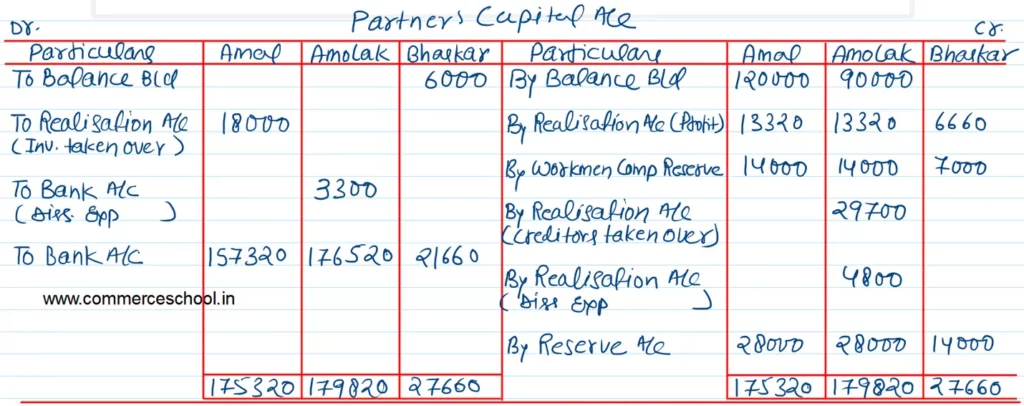

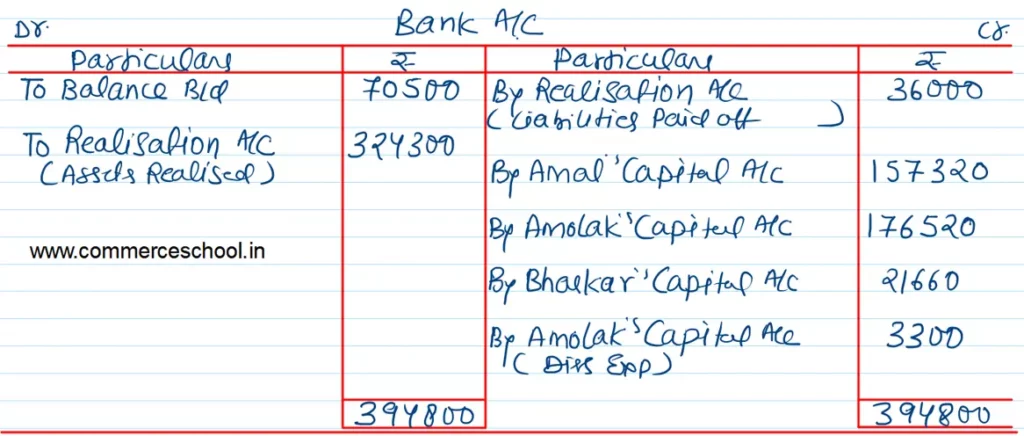

(i) Investments were taken by Amal at ₹ 18,000; Creditors of ₹ 30,000 were taken by Amolak who has agreed to settle account with them at ₹ 29,700. Remaining Creditors were paid at ₹ 22,500.

(ii) Insurance claim received ₹ 60,000 and Fixed Assets realised ₹ 2,10,000.

(iii) Stock and Debtors realised ₹ 21,000 and ₹ 27,000 respectively.

(iv) One customer, whose account was written off as bad, paid ₹ 2,400 besides ₹ 27,000 stated above.

(v) There was one unrecorded asset valued at ₹ 9,000, half of which was given for an unrecorded liability of ₹ 15,000 in settlement of claim of ₹ 7,500 and remaining half was sold in the market which realised ₹ 3,900.

Amolak took the responsibility of completing dissolution and he is allowed salary of ₹ 1,200 per month. Actual Realisation Expenses amounting to ₹ 3,300 were paid by the firm but were to be borne by Amolak. Dissolution was completed and final payments were emade on 31st July, 2022.

Prepare Realisation Account, partner’s Capital Account and Bank Account.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |