[ISC] Q. 20 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 20 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

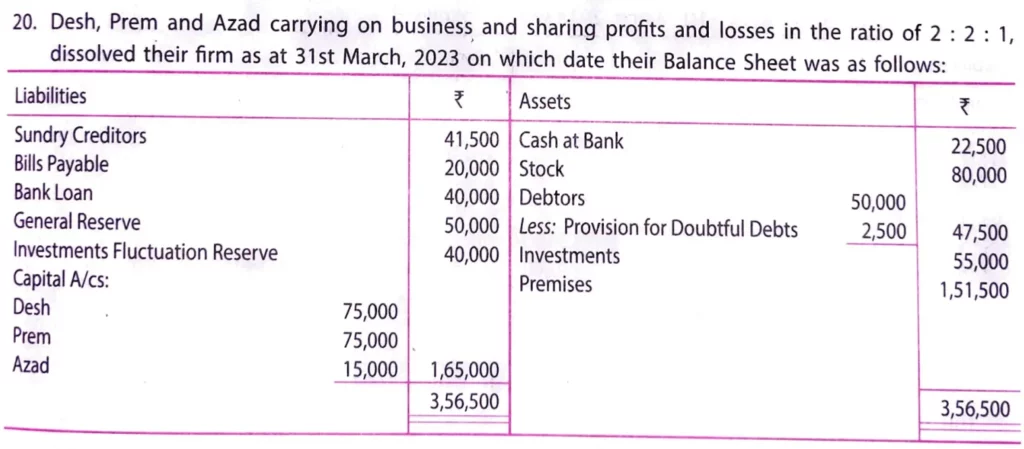

Desh, Prem and Azad carrying on business and sharing profits and losses in the ratio of 2 : 2 : 1, dissolved their firm as at 31st March, 2022 on which date their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors Bills Payable Bank Loan General Reserve Investments Fluctuation Reserve Capital A/cs: Desh Prem Azad | 41,500 20,000 40,000 50,000 40,000 75,000 75,000 15,000 | Cash at Bank Stock Debtors Less: PDD Investments Premises | 50,000 2,500 | 22,500 80,000 47,500 55,000 1,51,500 |

| 3,56,500 | 3,56,500 |

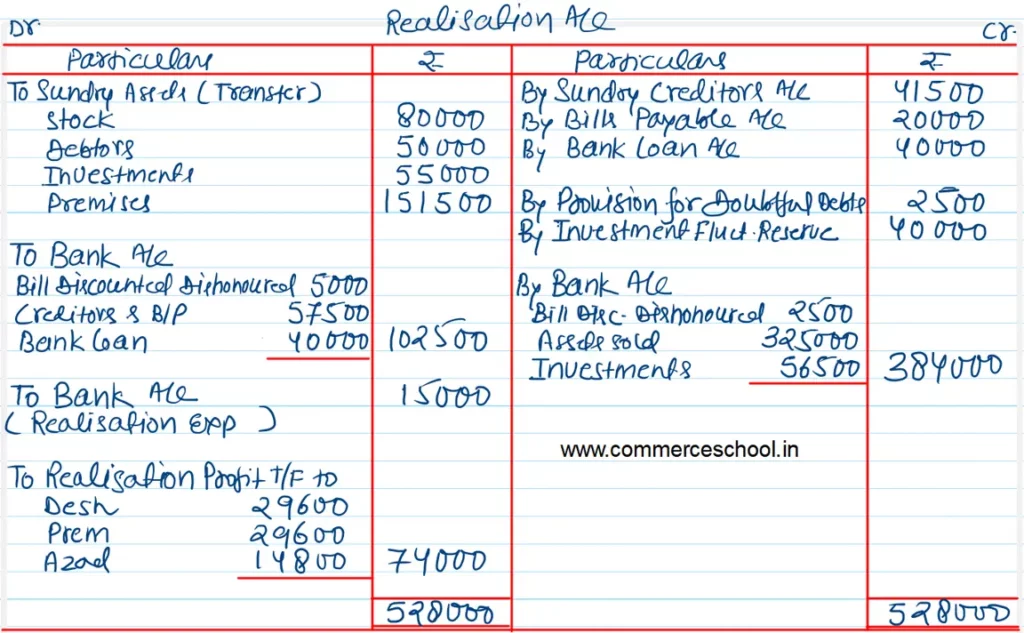

Following transactions took place at the time of dissolution:

(i) A bill for ₹ 5,000 received from Mohan discounted from bank is not met on maturity. Mohan proved insolvent and a dividend of 50% was received from his estate.

(ii) The assets except Cash at Bank and Investments were sold to a company which paid ₹ 3,25,000 in cash. The Investments were sold and ₹ 56,500 were received.

(iii) Sundry Creditors (including Bills Payable) were paid ₹ 57,500 in full settlement.

(iv) Realisation Expneses were ₹ 15,000.

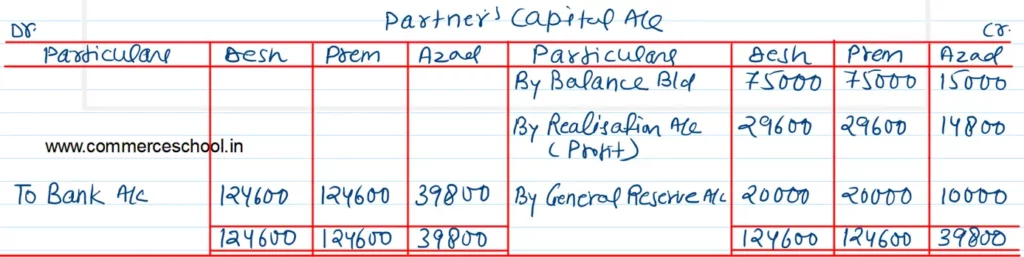

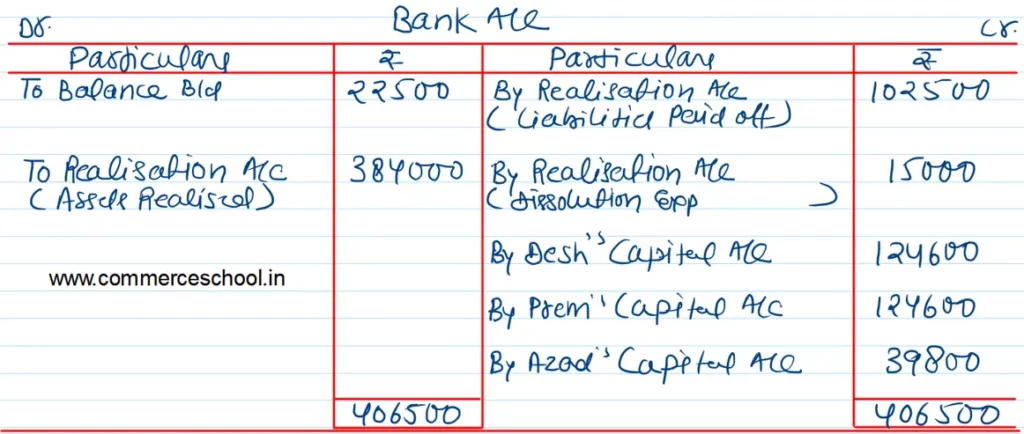

Prepare Realisation Account, Partner’s Capital Accounts and Bank Account.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |