[ISC] Q. 21 Dissolution of Partnership Firm Solution TS Grewal Book Class 12 (2023-24)

Solution to Question number 21 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2023-24 Edition for the ISC Board?

Karam, Burman and Chaman are three partners sharing profits in the ratio of 3 : 1 : 1. On 31st March, 2022, they decided to dissolve their firm. On that date their Balance Sheet was as under:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors Loan General Reserve Capital A/cs: Karam Burman Chaman | 6,000 1,500 10,000 24,500 9,000 6,000 | Cash at Bank Debtors Less: PDD Stock Furniture Sundry Assets Advertisement Suspense A/c | 24,200 1,200 | 3,200 23,000 7,800 1,000 17,000 5,000 |

| 57,000 | 57,000 |

It is agreed that:

(i) Karam is to take over Furniture at ₹ 200 less, and Debtors amounted to ₹ 20,000 at ₹ 17,200; the Creditors of ₹ 6,000 to be paid by his at this amount.

(ii) Burman is to take over all the stock at ₹ 7,000 and some of the Sundry Assets at ₹ 7,200 (being 10% less than book value)

(iii) Chaman is to take the remaining Sundry Assets at 90% of the book value, less ₹ 100 as discount and assume the responsibility for the discharge of the loan together with accrued interest of ₹ 30 which has not been recorded in the books.

(iv) Remaining Debtors were sold to a debt-collecting agency for 50% of the book value.

(v) Karam was to receive ₹ 270 as remuneration for completing the dissolution work and was to bear the realisation expenses. The expenses of realisation ₹ 500 were paid by Karam.

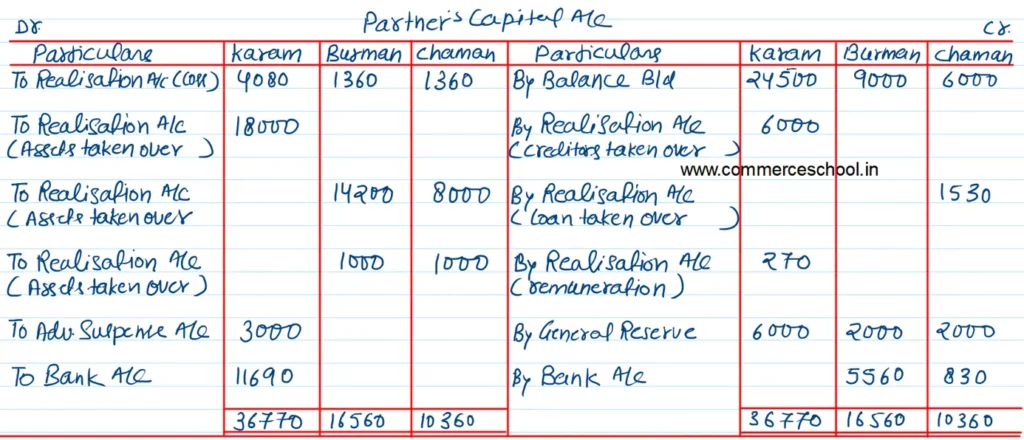

Prepare necessary accounts to close the books of the firm.

Solution:-

Here is the list of solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |