[ISC] Q. 9 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution to Question number 9 of the Death of Partner Chapter of TS Grewal Book ISC Board 2023-24 Edition?

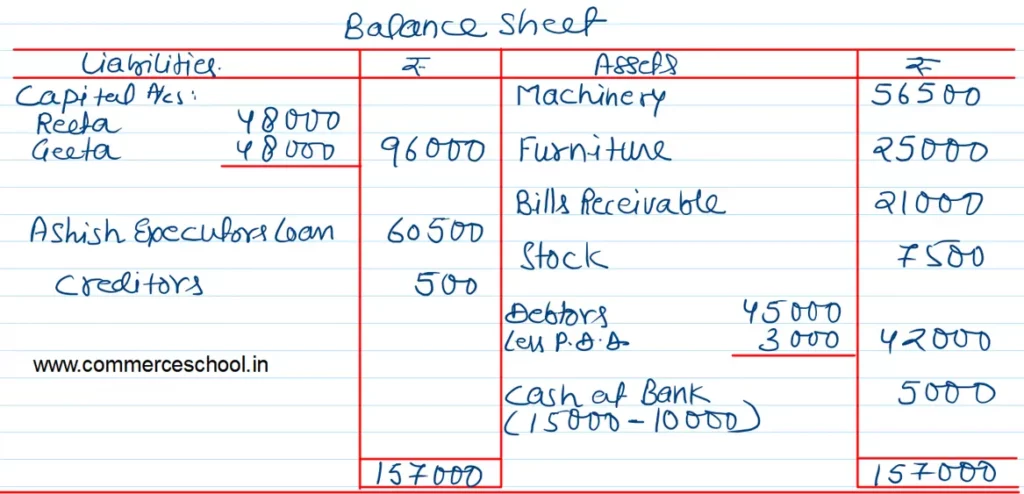

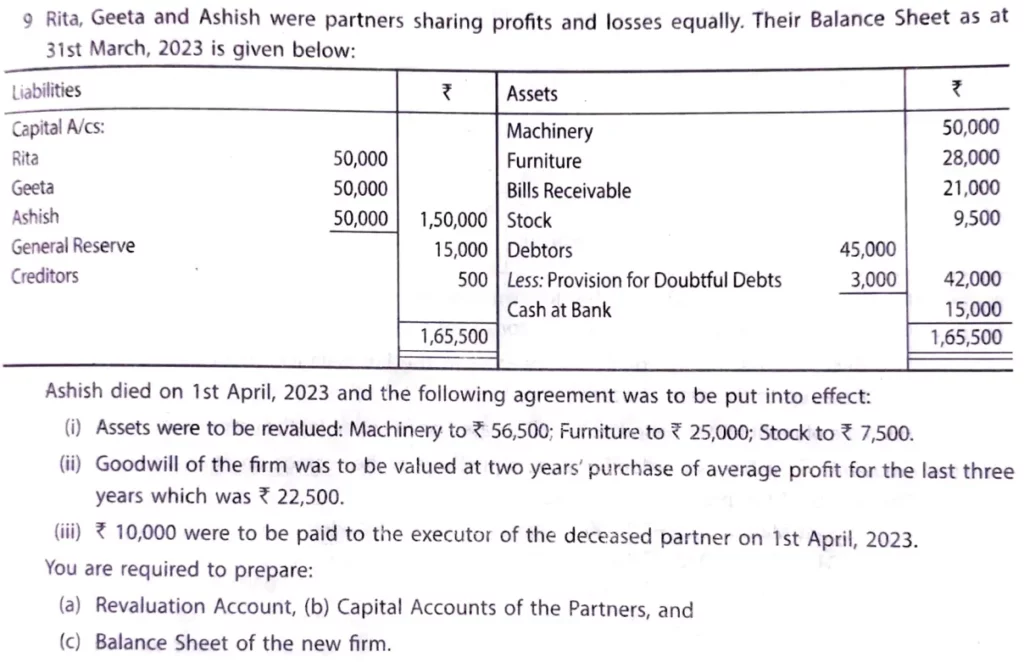

Rita Geeta and Ashish were partners sharing profits and losses equally. Their Balance Sheet as at 31st March, 2023 is given below:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs: Rita Geeta Ashish General Reserve Creditors | 50,000 50,000 50,000 15,000 500 | Machinery Furniture Bills Receivable Stock Debtors Less: PDD Cash at Bank | 45,000 3,000 | 50,000 28,000 21,000 9,500 42,000 15,000 |

| 1,65,500 | 1,65,500 |

Ashish died on 1st April, 2023 and the following agreement was to be put into effect:

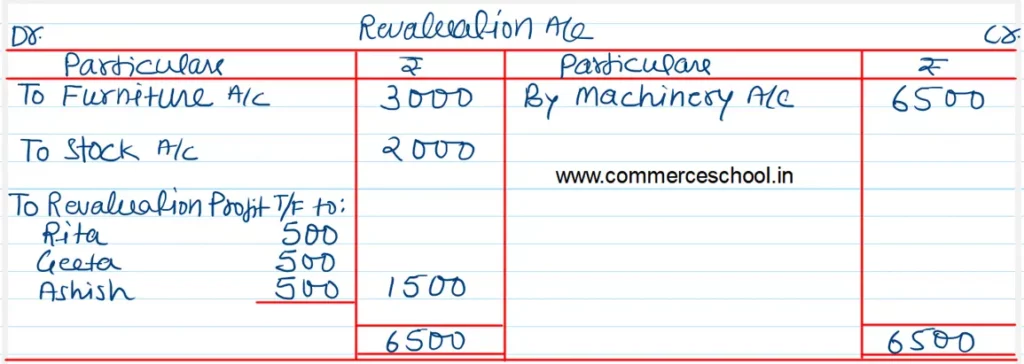

(i) Assets were to be revalued: Machinery to ₹ 56,500; Furniture to ₹ 25,000; Stock to ₹ 7,500.

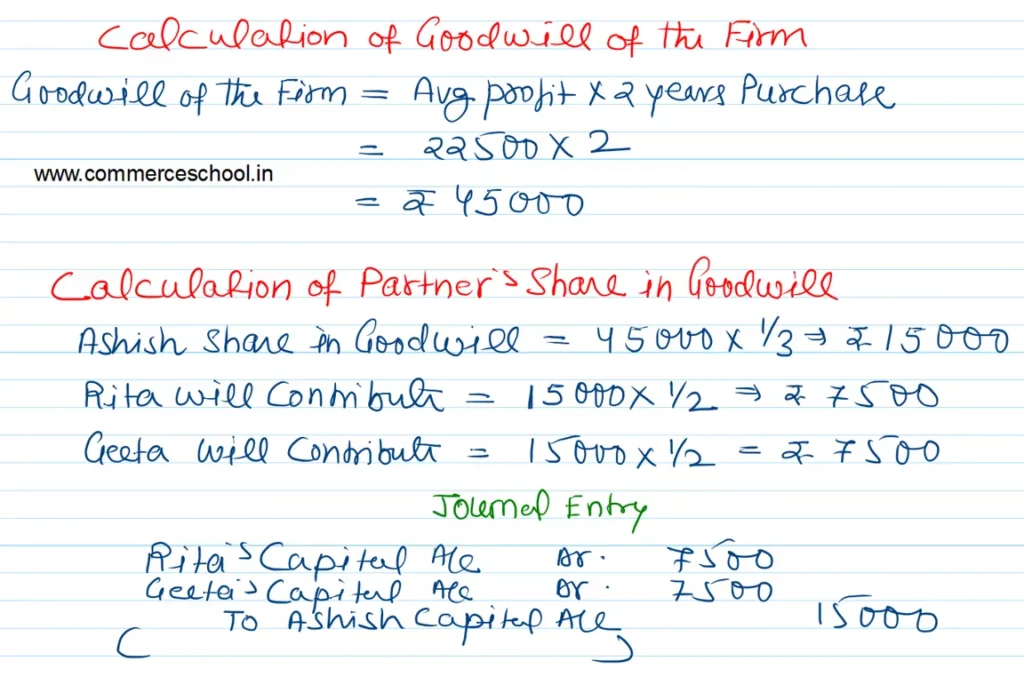

(ii) Goodwill of the firm was to be valued at two year’s purchase of average profit for the last three years which was ₹ 22,500.

(iii) ₹ 10,000 were to be paid to the executor of the deceased partner on 1st April, 2022.

You are required to prepare:

(a) Revaluation Account, (b) Capital Accounts of the partners, and (c) Balance Sheet of the new firm.

Solution:-