[ISC] Q. 10 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution to Question number 10 of the Death of Partner Chapter of TS Grewal Book ISC Board 2023-24 Edition?

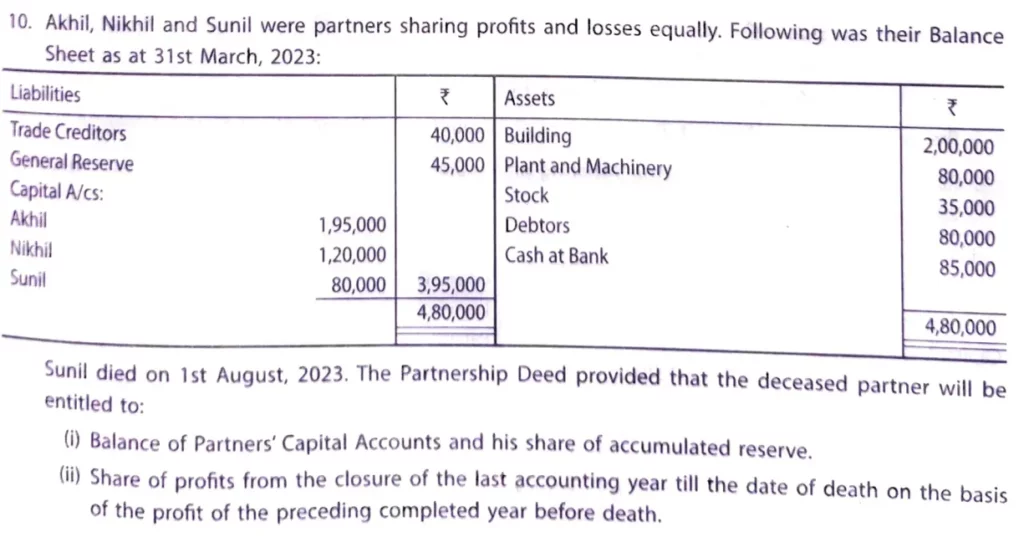

Akhil, Nikhil and Sunil were partners sharing profits and losses equally. Following was their Balance Sheet as at 31st March, 2023:

| Liabilities | ₹ | Assets | ₹ |

| Trade Creditors General Reserve Captal A/cs: Akhil Nikhil Sunil | 40,000 45,000 1,95,000 1,20,000 80,000 | Building Plant and Machinery Stock Debtors Cash at Bank | 2,00,000 80,000 35,000 80,000 85,000 |

| 4,80,000 | 4,80,000 |

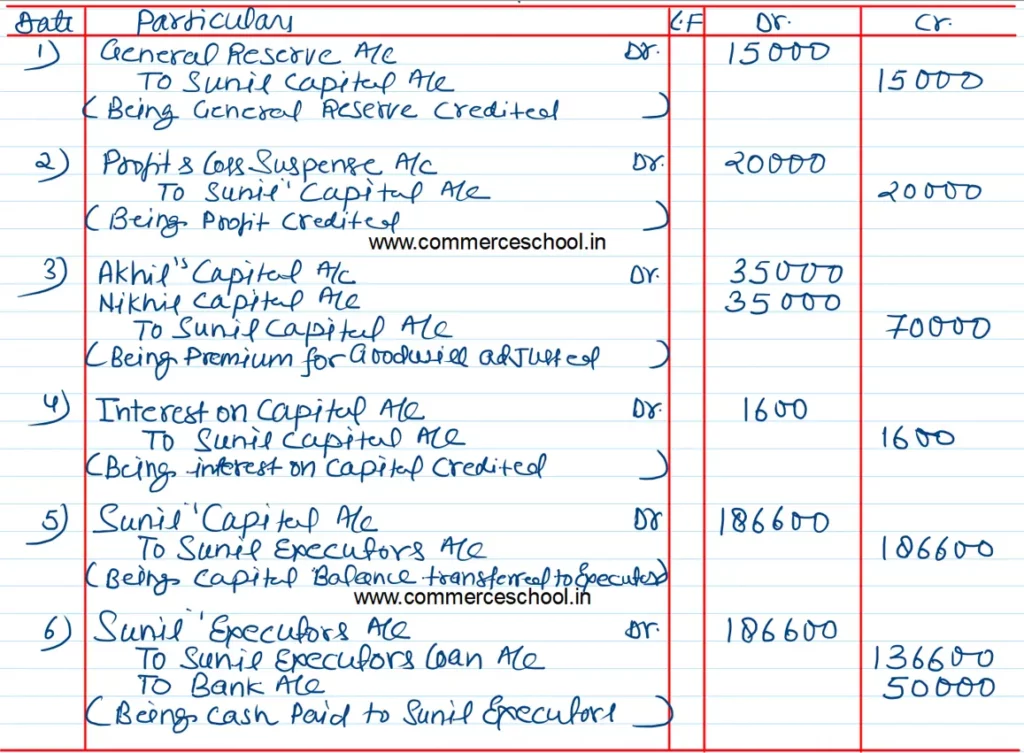

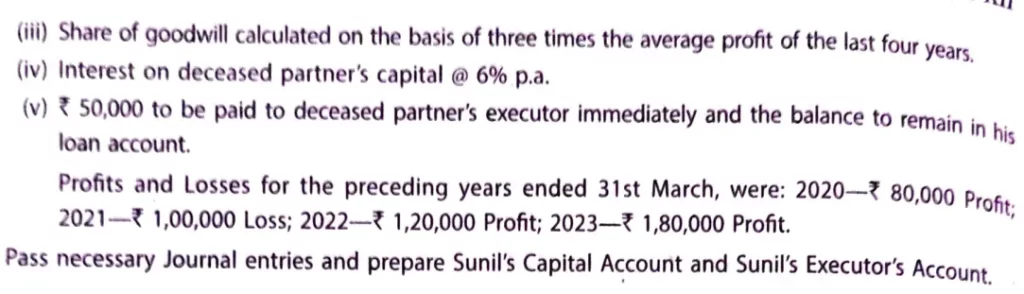

Sunil ded on 1st August, 2023. The Partnership Deed provided that the deceased partner will be entitled to:

(i) Balance of Partner’s Capital Accounts and his share of accumulated reserve.

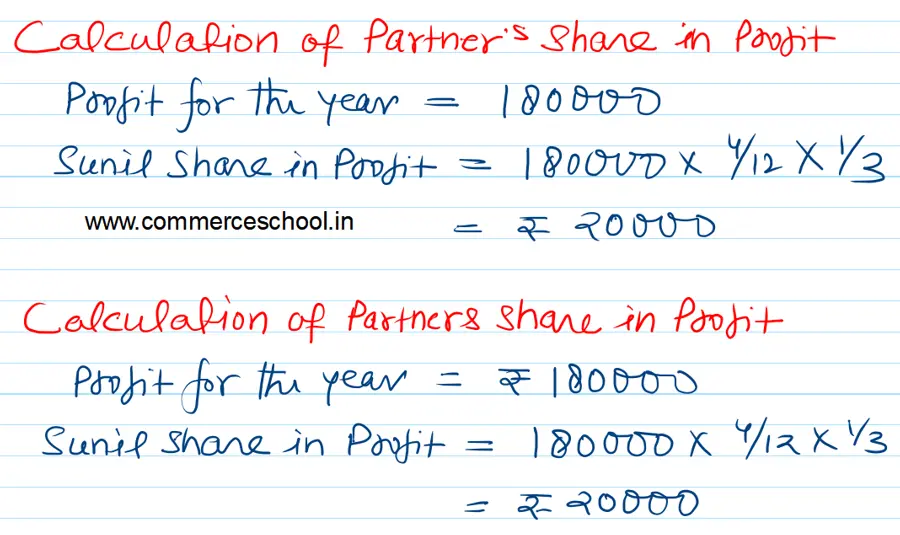

(ii) Share of profits from the closure of the last accounting year till the date of death on the basis of the profit of the preceding completed year before death.

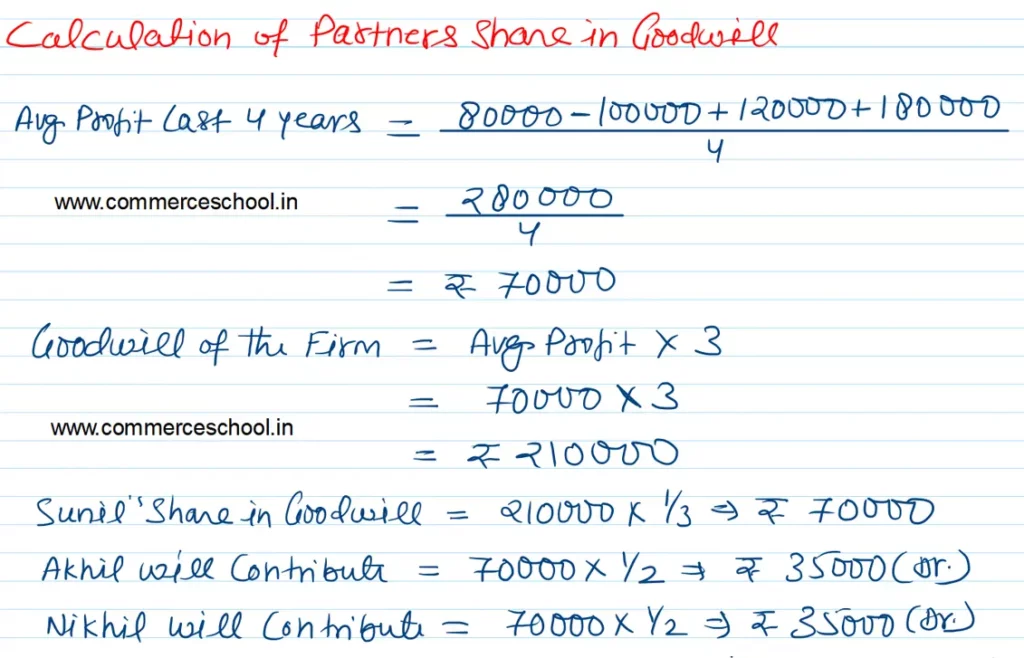

(iii) Share of goodwill calculated on the basis of three times the average profit of the last four years.

(iv) Interest on deceased partner’s Capital @ 6% p.a.

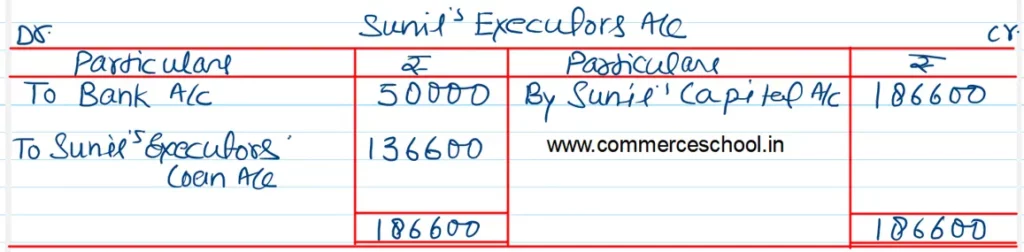

(v) ₹ 50,000 to be paid to deceased partner’s executor immediately and the balance to remain in his loan account.

Profits and Losses for the preceding years ended 31st March, were: 2020 – ₹ 80,000 profit; 2021 – ₹ 1,00,000 Loss; 2022 – ₹ 1,20,000 Profit; 2023 – ₹ 1,80,000 Profit.

Pass necessary Journal entries and prepare Sunil’s Capital Account and Sunil’s Executor’s Account.

Solution:-