[ISC] Q. 14 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution to Question number 14 of the Death of Partner Chapter of TS Grewal Book ISC Board 2023-24 Edition?

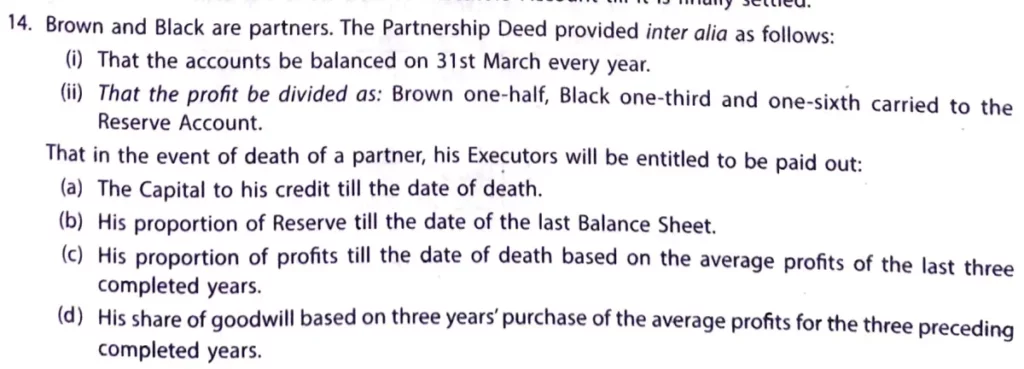

Brown and Black are partners. The partnership Deed provided inter alia as follows:

(i) That tha accounts be balanced on 31st March every year.

(ii) That the profit be divided as: Brown one-half, Black one-third and one-sixed carried to the Reserve Account.

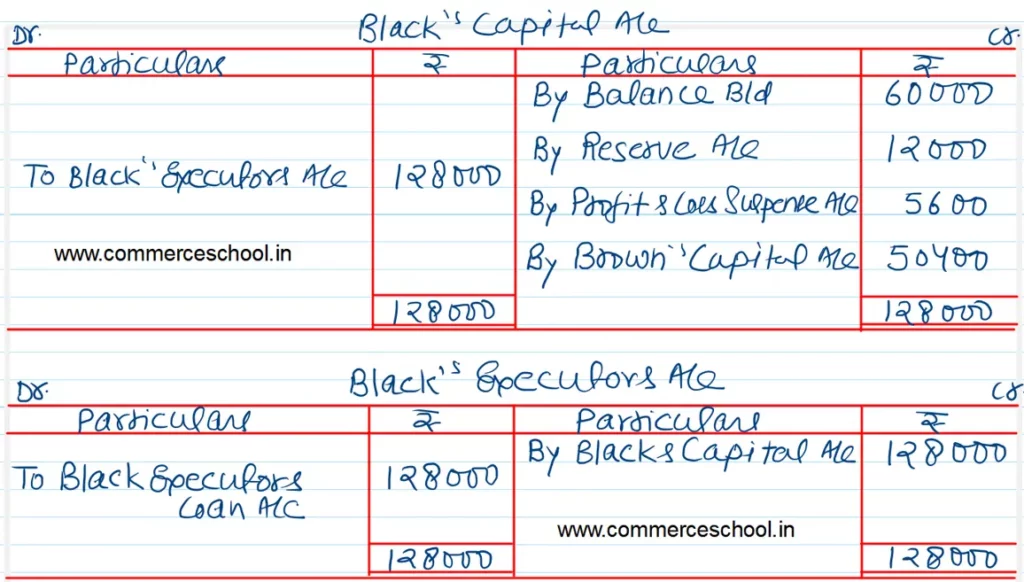

That in the event of death of a partner, his Executors will be entitled to be paid out:

(a) That Capital to his credit till the date of death.

(b) His proportion of Reserve till the date of the last Balance Sheet.

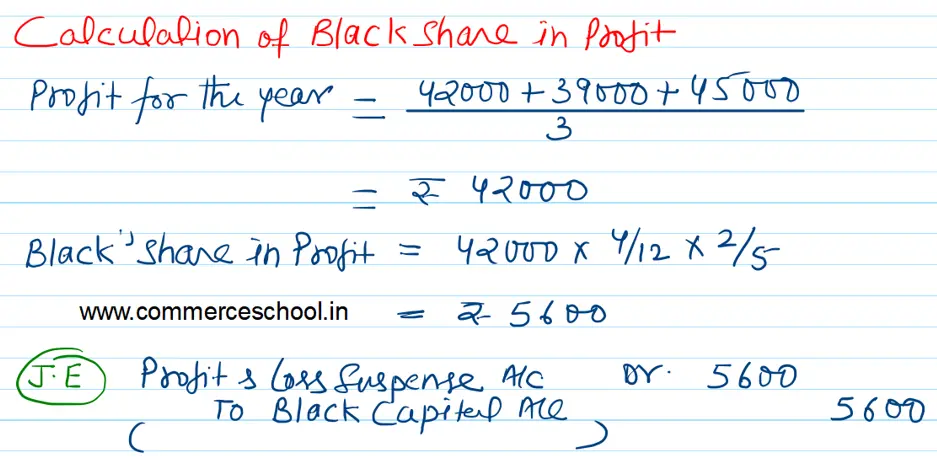

(c) His proportion of profits till the date of death based on the average profits of the last three completed years.

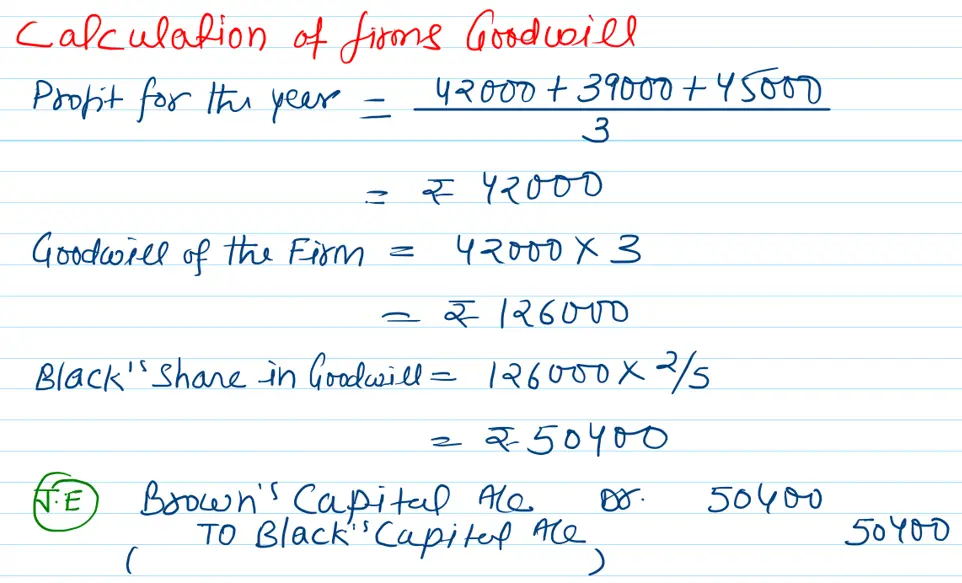

(d) His share of goodwill based on three year’s purchase of the average profits for the three preceding completed years.

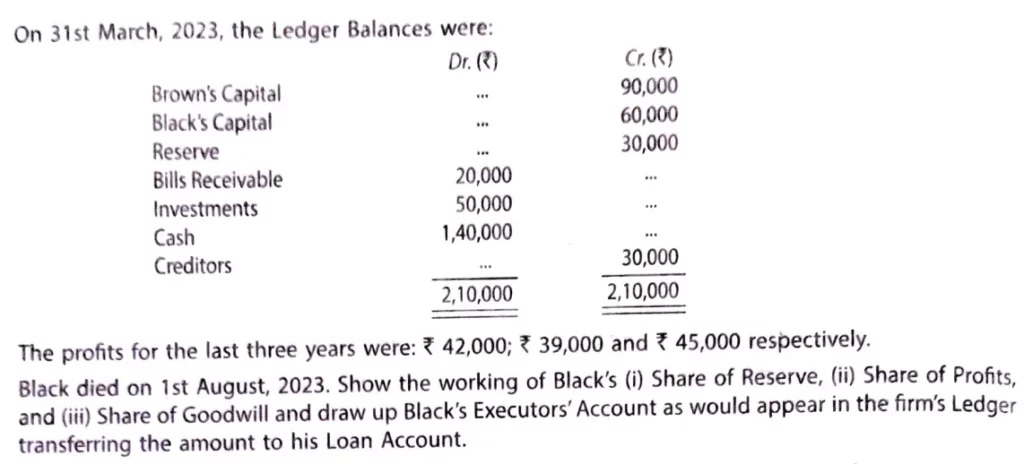

On 31st March, 2023, the Ledger Balances were:

| Dr. (₹) | Cr. (₹) | |

| Brown’s Capital | – | 90,000 |

| Black’s Capital | – | 60,000 |

| Reserve | – | 30,000 |

| Bill Receivable | 20,000 | – |

| Investments | 50,000 | – |

| Cash | 1,40,000 | – |

| Creditors | 30,000 | |

| 2,10,000 | 2,10,000 |

The profits for the last three years were: ₹ 42,000; ₹ 39,000 and ₹ 45,000 respectively.

Black died on 1st August 2023. Show the working of Black’s (i) Share of Reserve, (ii) Share of Profits, and (iii) Share of Goodwill and draw up Black’s Executor’s Account as would appear in the firm’s Ledger transferring the amount to his Loan Account.

Solution:-