[ISC] Q. 20 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution to Question number 20 of the Death of Partner Chapter of TS Grewal Book ISC Board 2023-24 Edition?

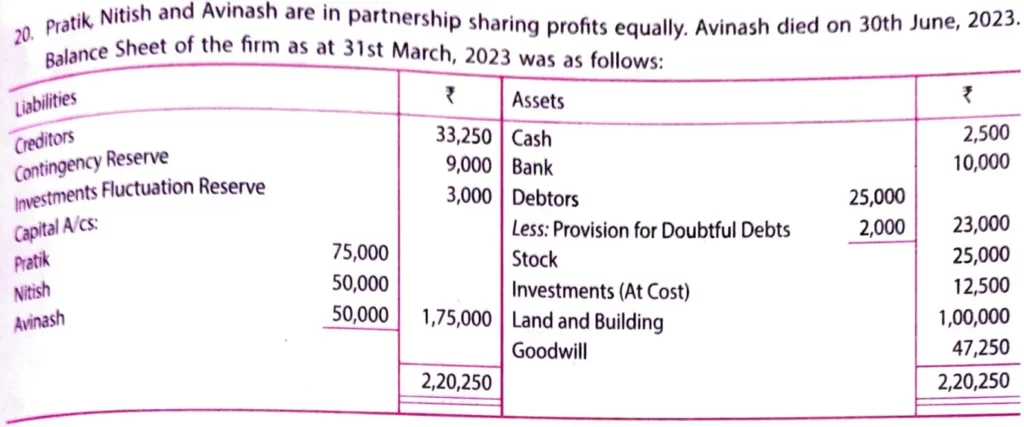

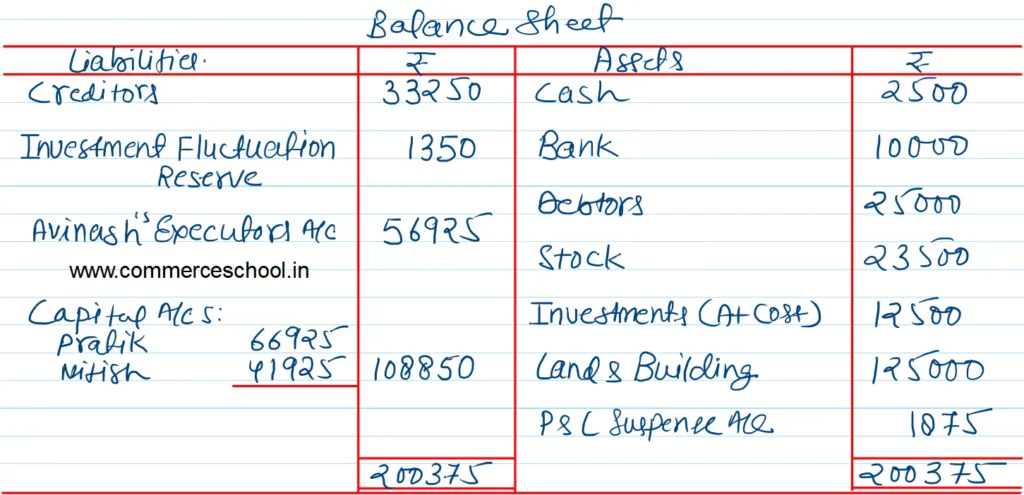

Pratik, Nitish and Avinash are in partnership sharing profits equally. Avinash died on 30th June, 2023. Balance Sheet of the firm as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors Contingency Reserve Investments Fluctuation Reserve Capital A/cs: Pratik Nitish Avinash | 33,250 9,000 3,000 75,000 50,000 50,000 | Cash Bank Debtors Less: PDD Stock Investments (At cost) Land and Building Goodwill | 2,500 10,000 23,000 25,000 12,500 1,00,000 47,250 |

| 2,20,250 | 2,20,250 |

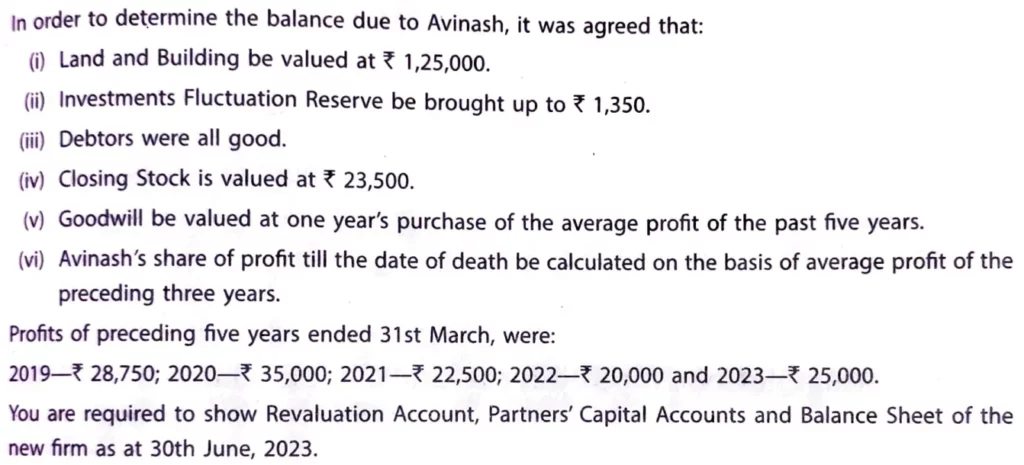

In order to determine the balance due to Avinash, it was agreed that:

(i) Land and Building be valued at ₹ 1,25,000.

(ii) Investments Fluctuation Reserve by brought up to ₹ 1,350.

(iii) Debtors were all good.

(iv) Closing Stock is valued at ₹ 23,500.

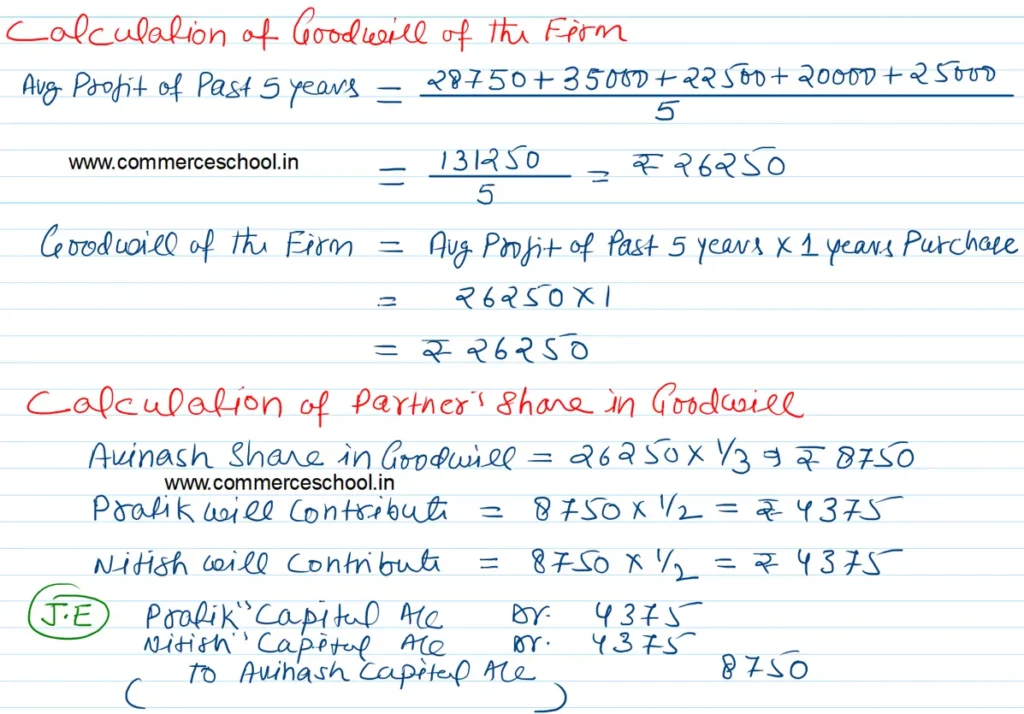

(v) Goodwill be valued at one year’s purchase of the average profit of the past five years.

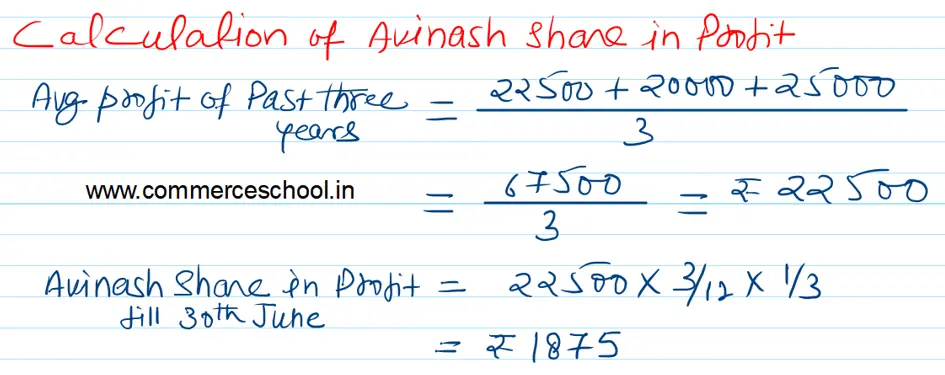

(vi) Avinash’s share of profit till the date of death be calculated on the basis of average profit of the preceding three years.

Profits of preceding five years ended 31st March, were:

2019 – ₹ 28,750; 2020 – ₹ 35,000; 2021 – ₹ 22,500; 2022 – ₹ 20,000 and 2023 – ₹ 25,000.

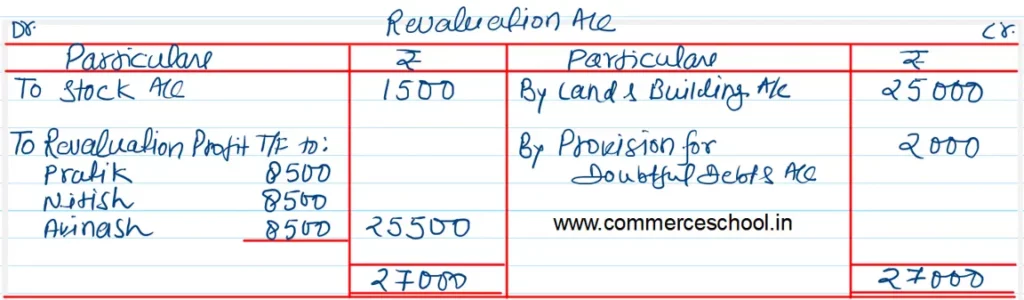

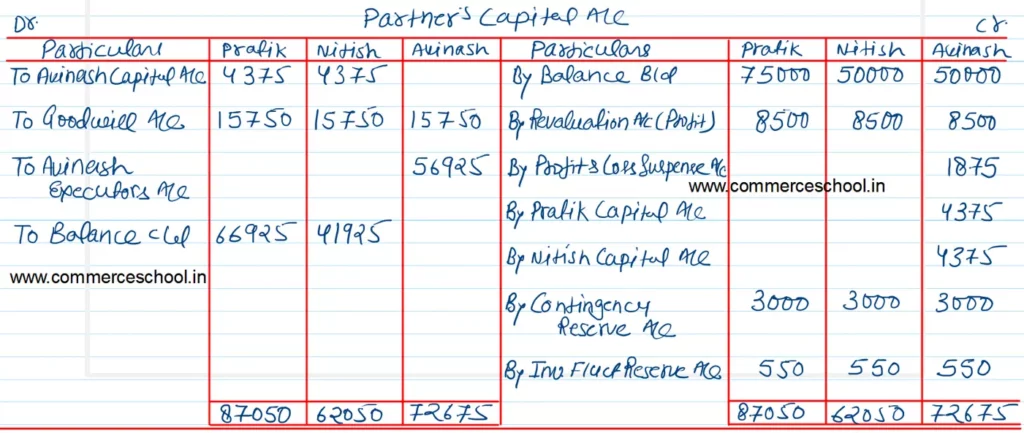

You are required to show Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm as at 30th June, 2023.

Solution:-

the balance sheet only tally’s up when u include profit and loss suspense account. You have not mentioned it in your balance sheet.

corrected, thank for informing