[ISC] Q. 21 Death of Partner Solution TS Grewal Class 12 (2023-24)

Solution to Question number 21 of the Death of Partner Chapter of TS Grewal Book ISC Board 2023-24 Edition?

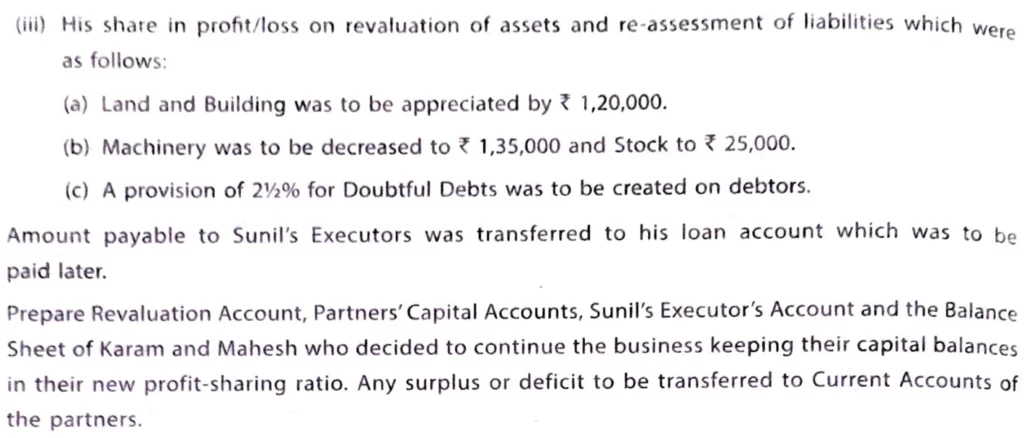

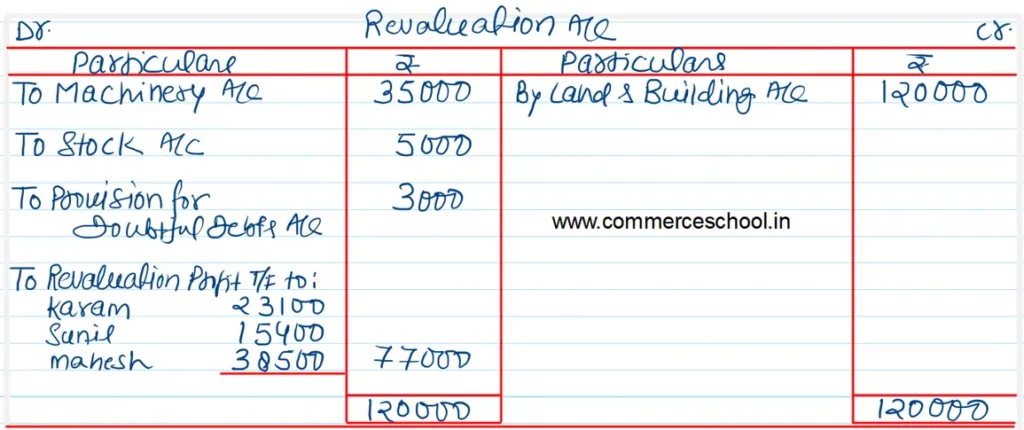

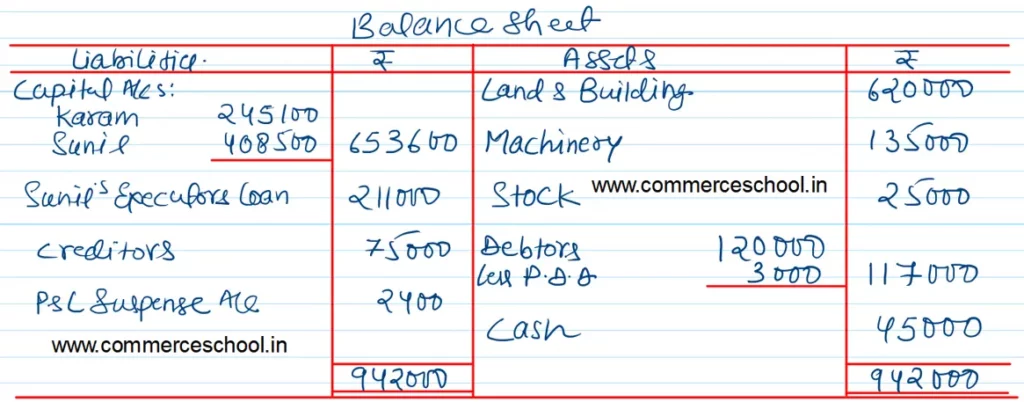

Karam, Sunil and Mahesh were partners in a firm sharing profits in the ratio of 3 : 2 : 5. On 31st March, 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs: Karam Sunil Mahesh General Reserve Loan from Sunil Creditors | 3,00,000 2,00,000 5,00,000 | 10,00,000 1,00,000 50,000 75,000 | Goodwill Land and Building Machinery Stock Debtors Cash Profit & Loss Account | 3,00,000 5,00,000 1,70,000 30,000 1,20,000 45,000 60,000 |

| 12,25,000 | 12,25,000 |

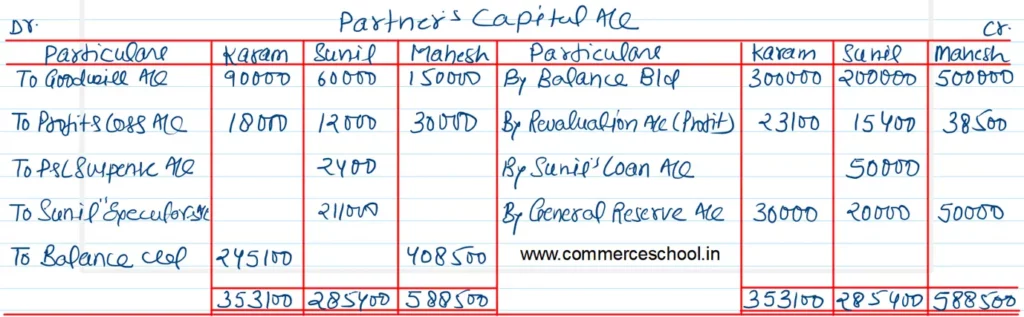

On 12th June, 2023 Sunil died. The Partnership Deed provided that on the death of a partner the executor of the deceased partner is entitled to:

(i) Balance in Capital Account:

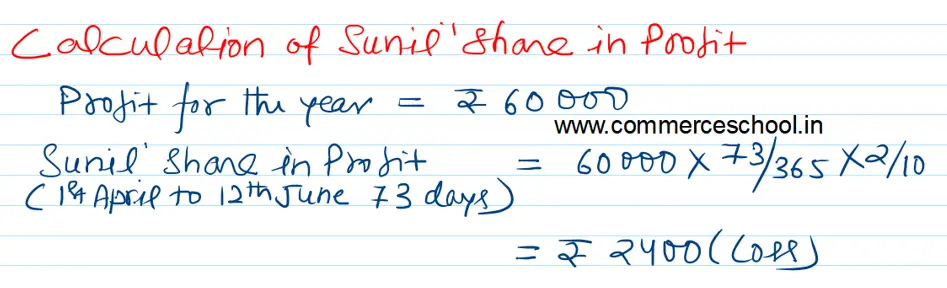

(ii) Share in profits up to the date of death on the basis of last year’s profit:

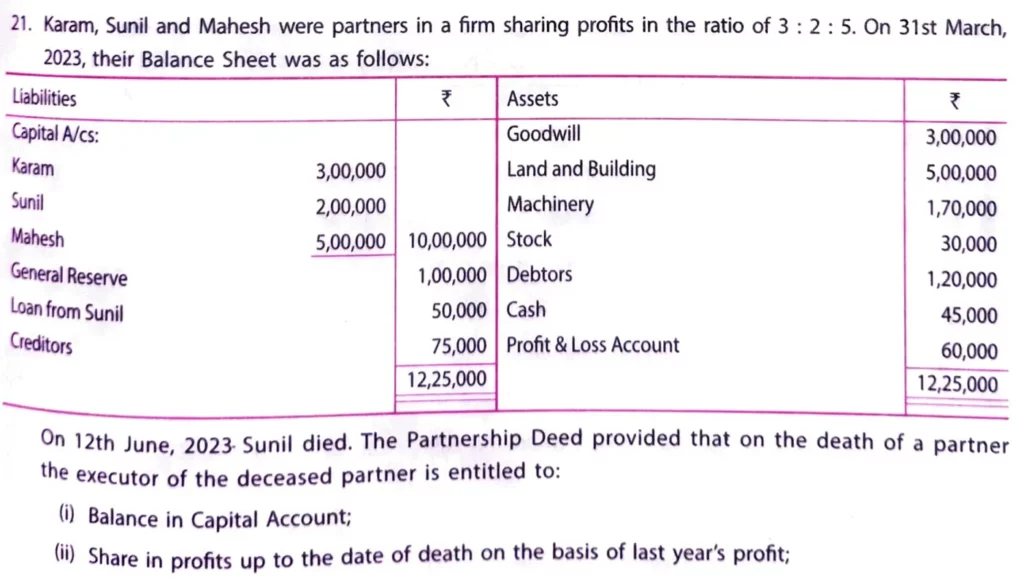

(iii) His share in profit/loss on revaluation of assets and re-assessment of liabilities which were as follows:

(a) Land and Buildings was to be appreciated by ₹ 1,20,000.

(b) Machinery was to be decreased to ₹ 1,35,000 and Stock to ₹ 25,000.

(c) A provision of 2 and 1/2% for Doubtful Debts was to be created on debtors.

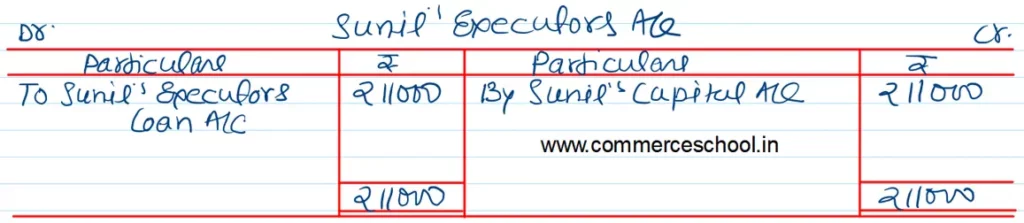

Amount payable to Sunil’s Executors was transferred to his loan account which was to be paid later.

Prepare Revaluation Account, Partner’s Capital Account, Sunil’s Executor’s Account, and the Balance Sheet of Karam and Mahesh who decided to continue the business keeping their capital balances in their new profit sharing ratio. Any surplus or deficit to be transferred to Current Accounts of the partners.

Solution:-

After all adjustments, the capital account balances of Karam and Mahesh are already in a new profit-sharing ratio (i.e., 3 : 5). Thus, Current Accounts and cash adjustments are not required.