[ISC] Q. 24 Retirement of Partner TS Grewal Solution Class 12 (2023-24)

Solution to Question number 24 of the Retirement of Partner Chapter of TS Grewal Book ISC Board 2023 – 24 session?

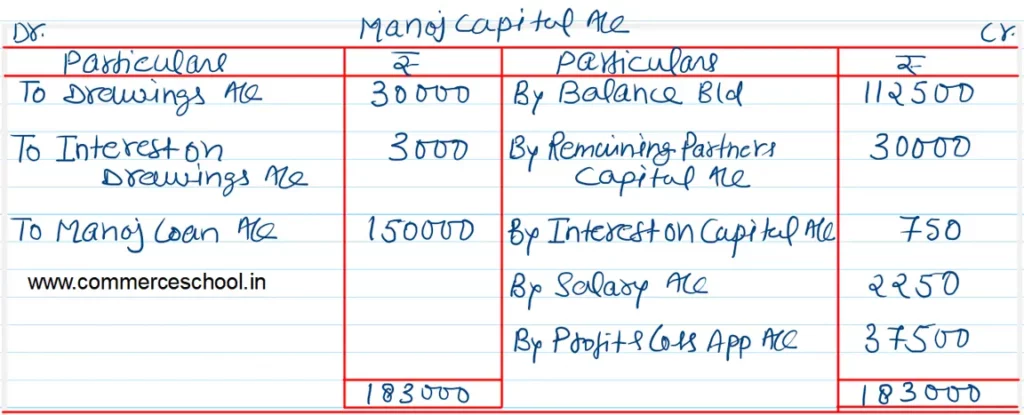

On 1st April, 2021, Manoj retired from partnership and his share was determined on the date of retirement from the following:

| Goodwill Interest on Capital Salary Drawings Interest on Drawings Share of Profit Capital | 30,000 750 2,250 30,000 3,000 37,500 1,12,500 |

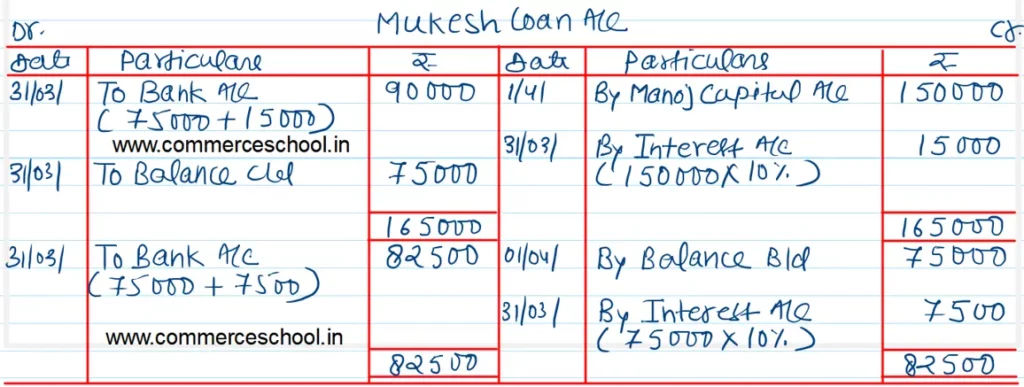

The amount due to Manoj was to be kept with the firm as a loan bearing interest @ 10% p.a. and was to be paid to Manoj by annual instalments of ₹ 75,000 each, interest being calculated @ 10% p.a. on the unpaid balances. The firm instalment was paid on 31st March, 2022.

You are required to prepare Manoj’s Capital Account and also Manoj’s Loan Account until the payment of the whole amount due to him is made.

Solution:-

Here is the list of all solutions of Retirement of Partners TS grewal ISC class 12 (2023 – 24)

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |