[ISC] Q. 31 Retirement of Partner TS Grewal Solution Class 12 (2023-24)

Solution to Question number 31 of the Retirement of Partner Chapter of TS Grewal Book ISC Board 2023 – 24 session?

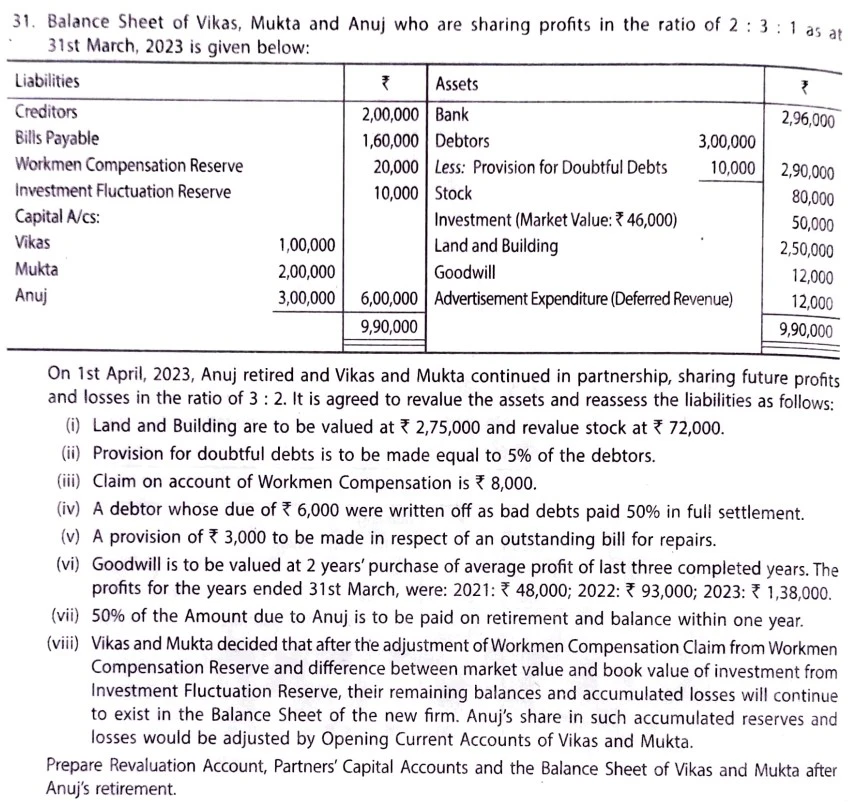

Balance Sheet of Vikas, Mukta and Anuj who are sharing profits in the ratio of 2 : 3 : 1 as at 31st March, 2023 is given below:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors Bills Payable Workmen Compensation Reserve Investment Fluctuation Reserve Capital A/cs: Vikas Mukta Anuj | 2,00,000 1,60,000 20,000 10,000 1,00,000 2,00,000 3,00,000 | Bank Debtors Less: PDD Stock Investment (Market Value: ₹ 46,000) Land and Building Goodwill Advertisement Expenditure (Deferred Revenue) | 3,00,000 10,000 | 2,96,000 2,90,000 80,000 50,000 2,50,000 12,000 12,000 |

| 9,90,000 | 9,90,000 |

On 1st April, 2023, Anuj retired and Vikas and Mukta continued in partnership, sharing future profits and losses in the ratio of 3 : 2. It is agreed to revalue the assets and reassess the liabilities as follows:

(i) Land and Building are to be valued at ₹ 2,75,000 and revalue stock at ₹ 72,000.

(ii) Provision for doubtful debts is to be made equal to 5% of the debtors.

(iii) Claim on account of Workmen Compensation is ₹ 8,000.

(iv) A debtor whose due of ₹ 6,000 were written off as bad debts paid 50% in full settlement.

(v) A provision of ₹ 3,000 to be made in respect of an outstanding bill for repairs.

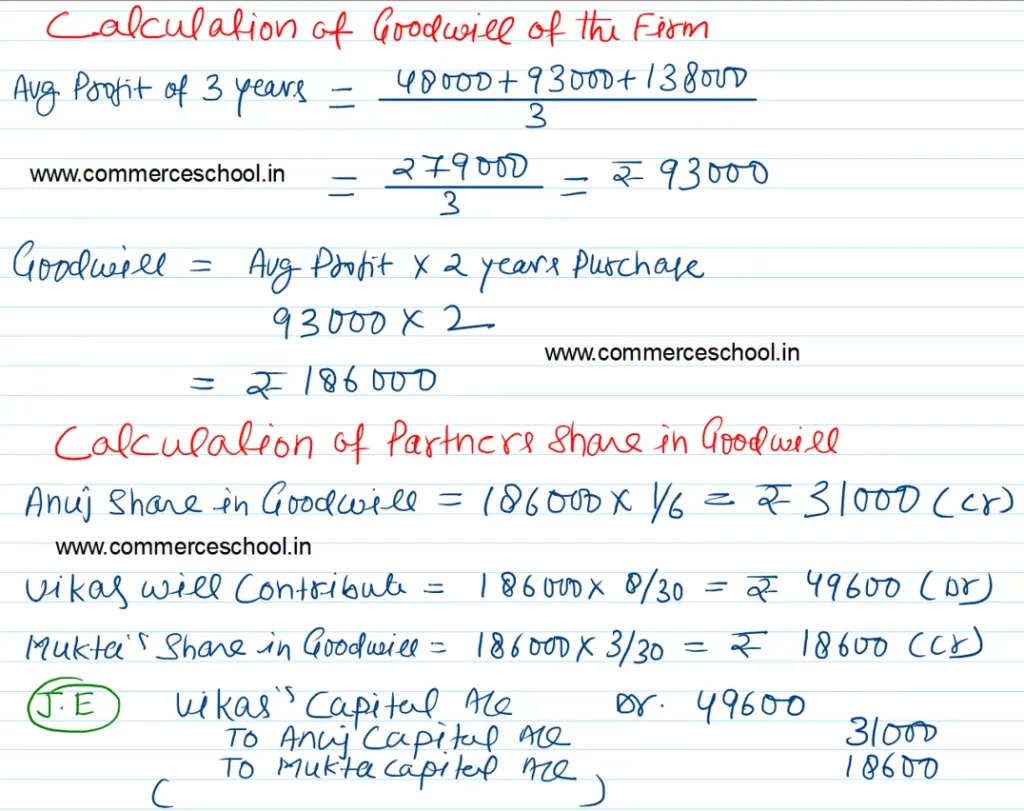

(vi) Goodwill is to be valued at 2 year’s purchase of average profit of last three completed years. The profits for the years ended 31st March, were: 2021: ₹ 48,000; 2022: ₹ 93,000; 2023: ₹ 1,38,000.

(vii) 50% of the Amount due to Anuj is to be paid on retirement and balance within one year.

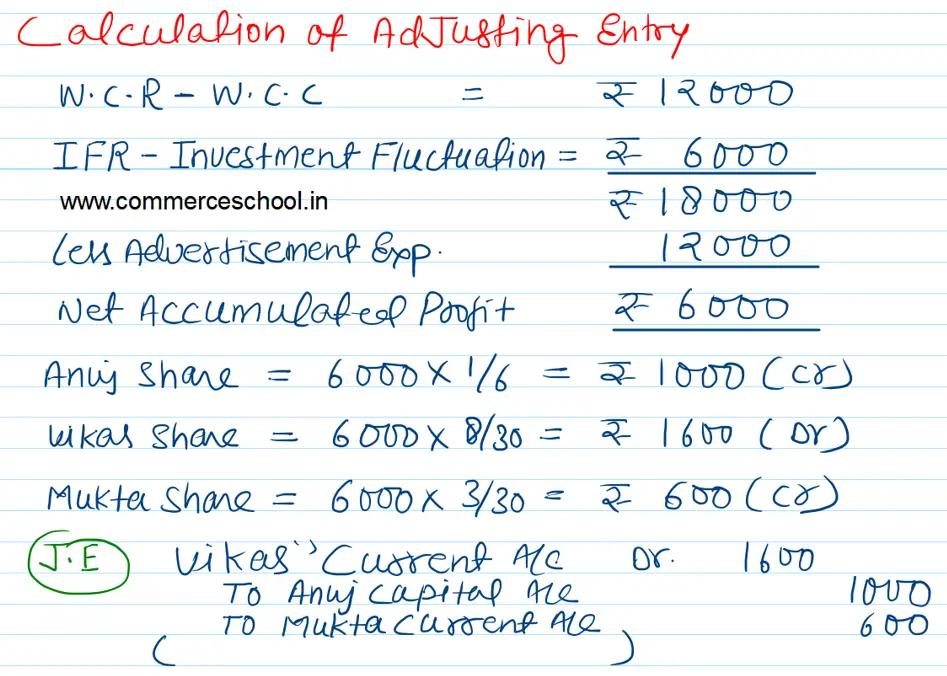

(viii) Vikas and Mukta decided that after the adjustment of Workmen Compensation Claim from Workmen Compensation Reserve and difference between market value and book value of investment from investment Fluctuation Reserve, their remaining balances and accumulated losses will continue to exist in the Balance Sheet of the new firm. Anuj’s share in such accumulated reserves and losses would be adjusted by Opening Current Accounts and Vikas and Mukta

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of Vikas and Mukta after Anuj’s retirement.

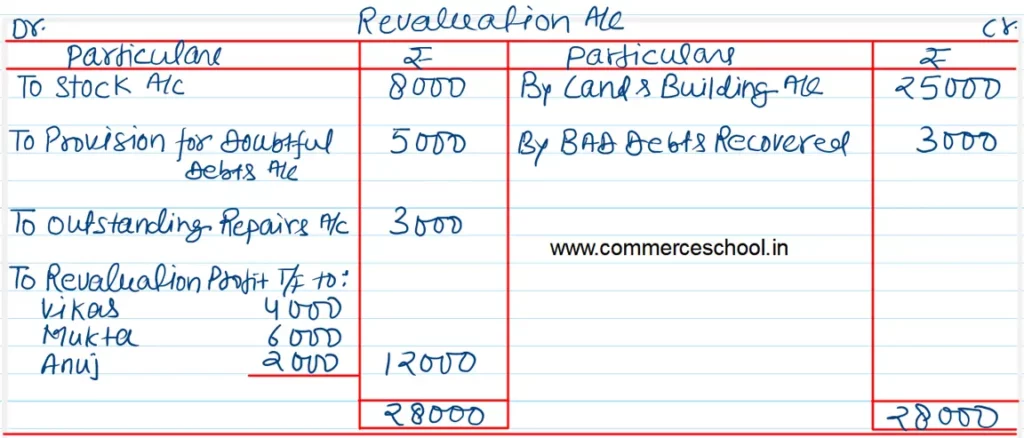

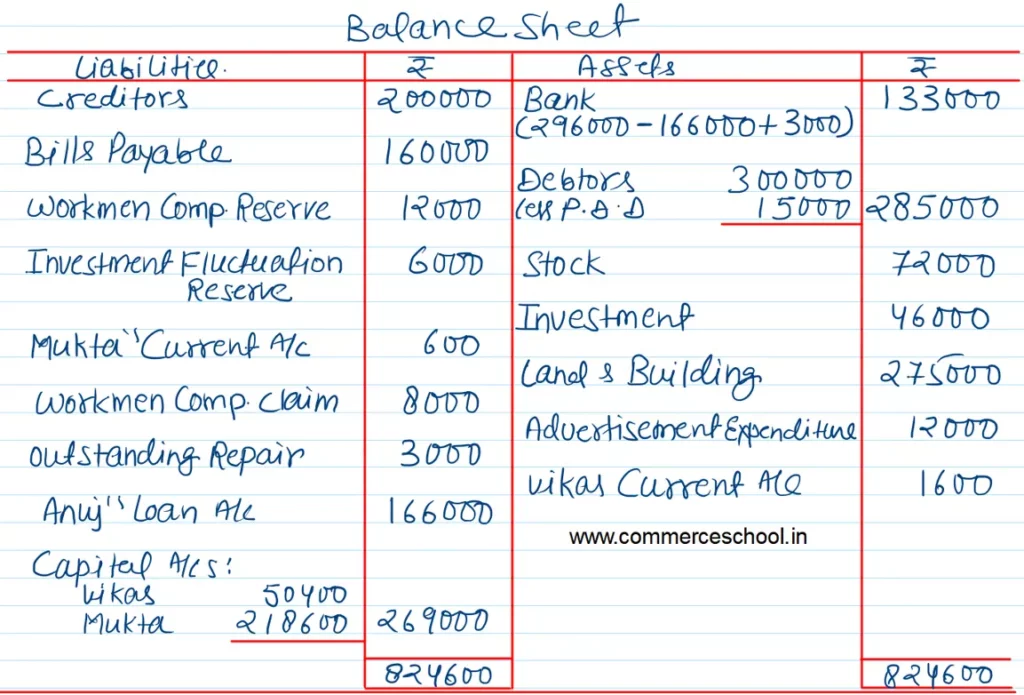

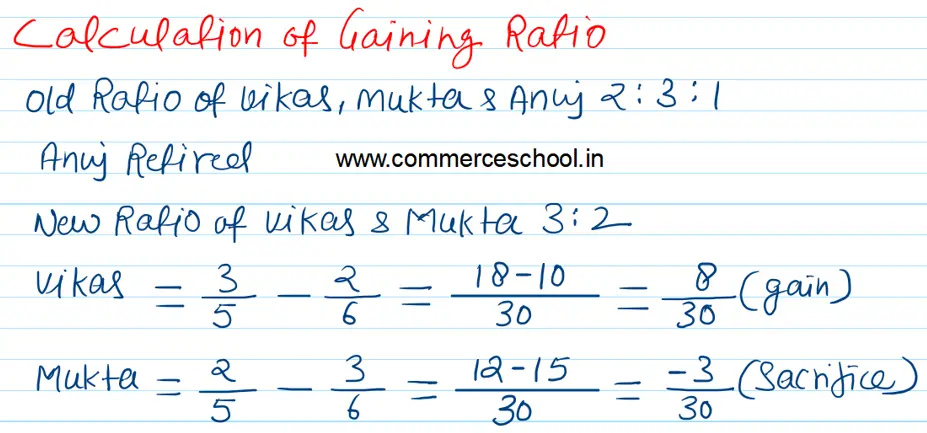

Solution:-

Here is the list of all solutions of Retirement of Partners TS grewal ISC class 12 (2023 – 24)

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |