[ISC] Q. 14 Goodwill Solution TS Grewal Class 12 (2024-25)

Solution to Question number 14 of the Goodwill chapter 2 TS Grewal Book ISC Board 2024-25 Edition.

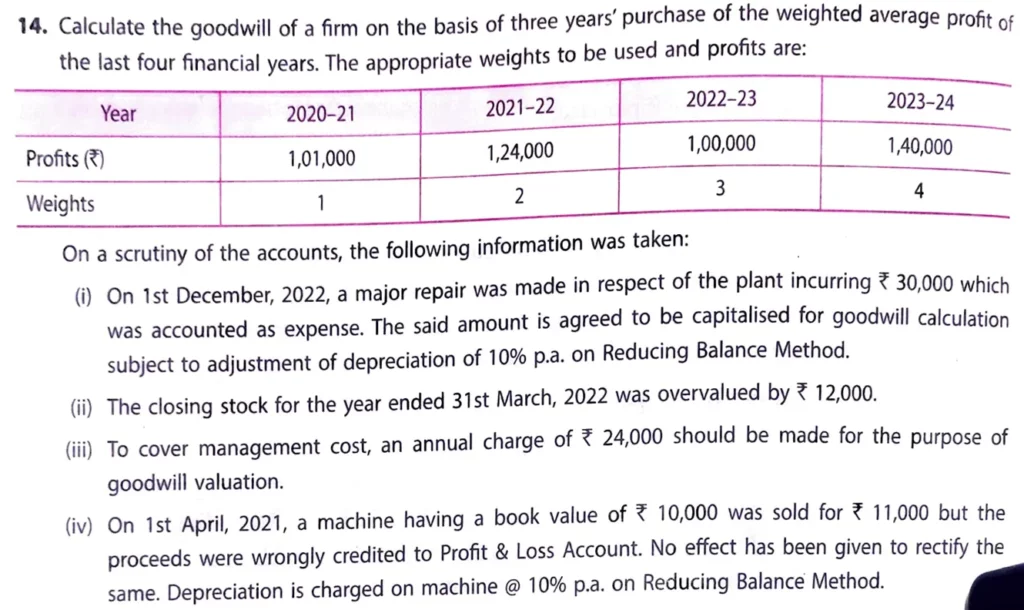

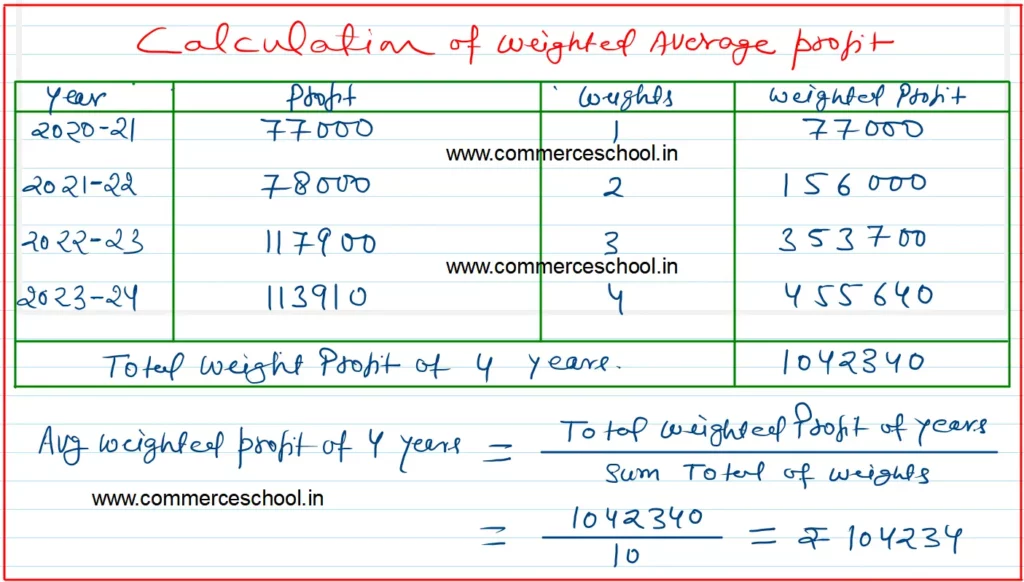

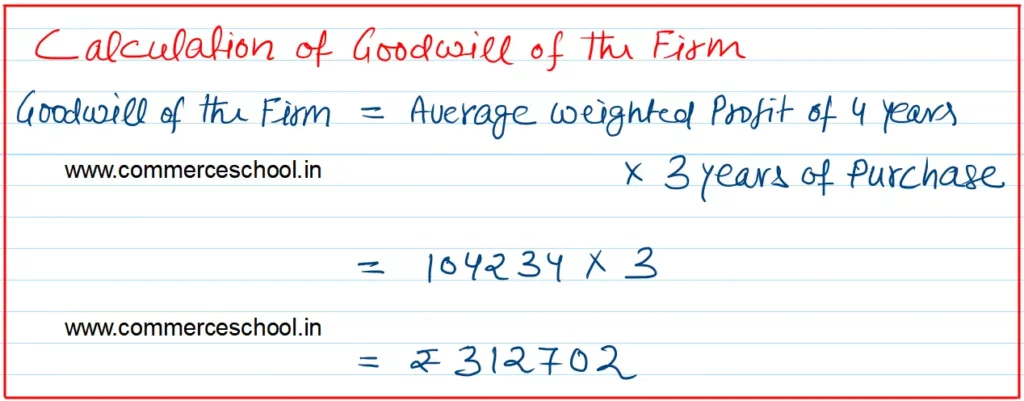

Calculate the goodwill of a firm on the basis of three year’s purchase of the weighted average profit of the last four financial years. The appropriate weights to be used and profits are:

| Year | Profits (₹) |

| 2020 – 21 | 1,01,000 |

| 2021 – 22 | 1,24,000 |

| 2022 – 23 | 1,00,000 |

| 2023 – 24 | 1,40,000 |

On a scrutiny of the accounts, the following information was taken:

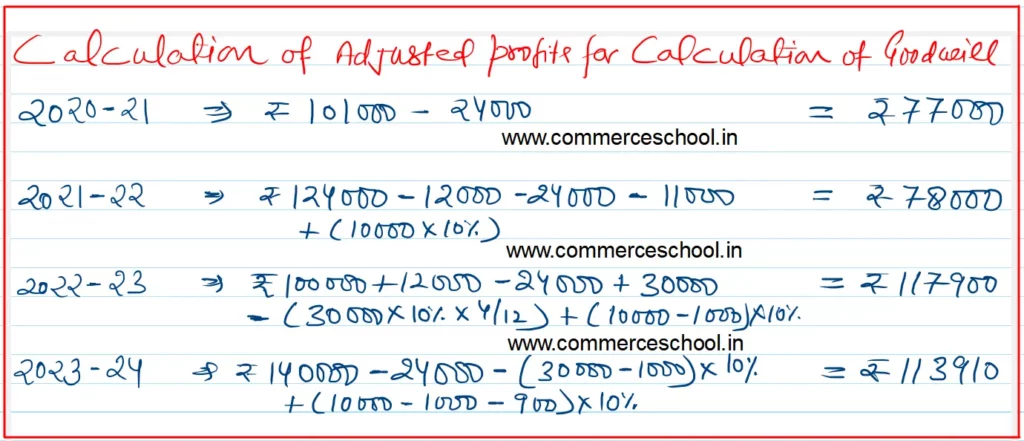

i) On 1st December, 2022, a major repair was made in respect of the plant incurring ₹ 30,000 which was charged to revenue. The said sum is agreed to be capitalised for goodwill calculation subject to adjustment of depreciation of 10% p.a. on Reducing Balance Method.

ii) The closing stock for the year ended 31st March, 2022 was overvalued by ₹ 12,000.

iii) To cover management cost, an annual charge of ₹ 24,000 should be made for the purpose of goodwill valuation.

iv) On 1st April 2021, a machine having a book value of ₹ 10,000 was sold for ₹ 11,000 but the proceeds were wrongly credited to Profit & Loss Account. No effect has been given to rectify the same. Depreciation is charged on machine @ 10% p.a. on Reducing balance Method.

Solution:-

List of all solutions of Goodwill chapter TS Grewal ISC Board class 12 (2024-25)

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |