[CBSE] Q. 27 Solution of Retirement of Partner TS Grewal Class 12 (2024-25)

Solution to Question number 27 of the Retirement of Partner chapter 5 of TS Grewal Book 2024-25 Edition CBSE Board.

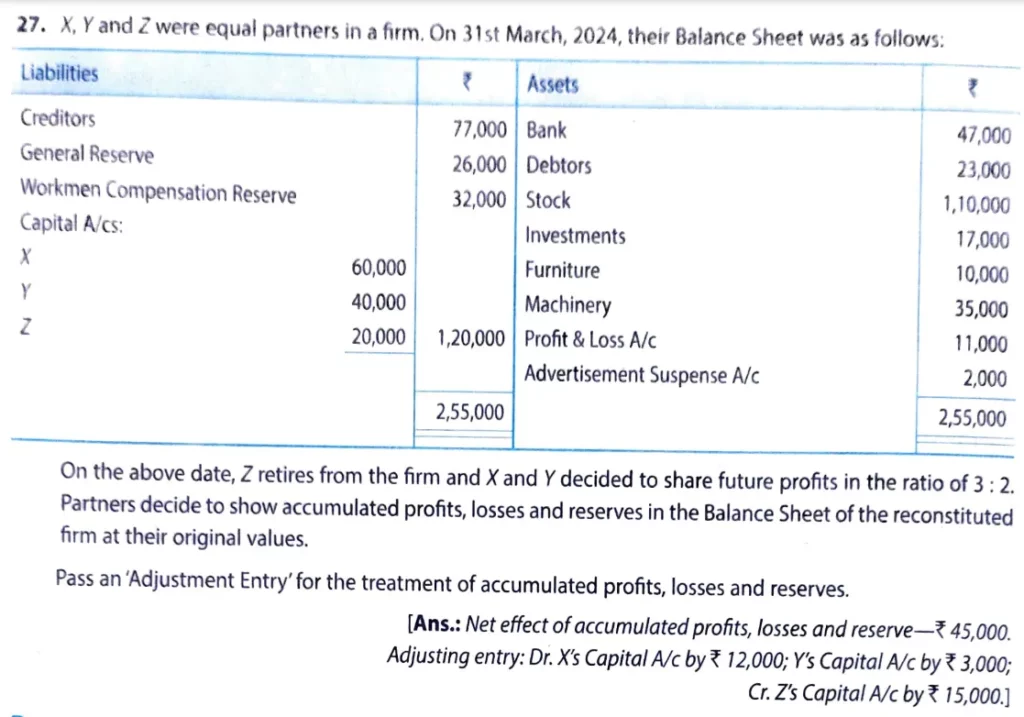

X, Y and Z were equal partners in a firm. On 31st March, 2023, their Balances Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors General Reserve Workmen Compensation Reserve Capital A/cs: X Y Z | 77,000 26,000 32,000 60,000 40,000 20,000 | Bank Debtors Stock Investments Furniture Machinery Profit & Loss A/c Advertisement Suspense A/c | 47,000 23,000 1,10,000 17,000 10,000 35,000 11,000 2,000 |

| 2,55,000 | 2,55,000 |

On the above date, Z retires from the firm and X and Y decided to share future profits in the ratio of 3 : 2. partners decide to show accumulated profits, losses and reserves in the Balance Sheet of the reconstituted firm at their original values.

Pass an ‘Adjustment Entry’ for the treatment of accumulated profits, losses and reserves.

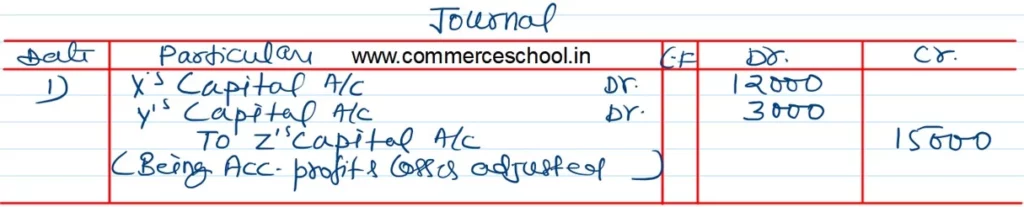

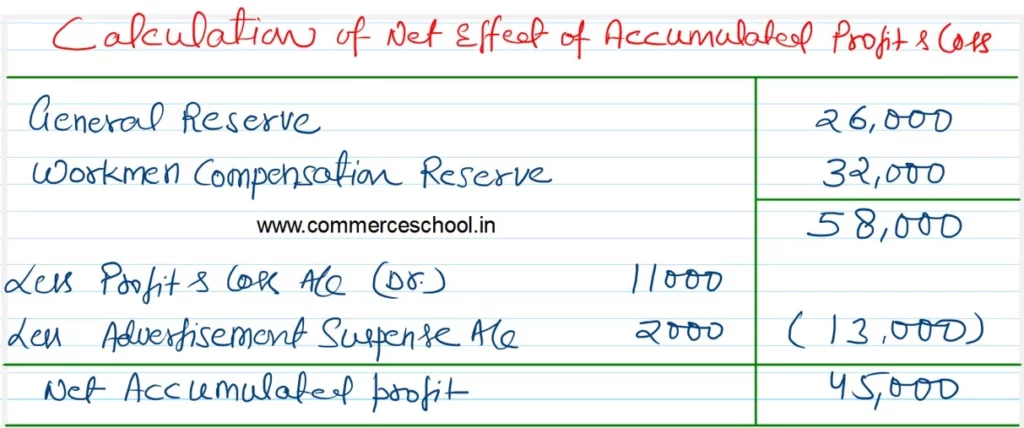

[Ans.: Net effect of accumulated profits, losses and reserve – ₹ 45,000. Adjusting entry: Dr. X’s Capital A/c by ₹ 12,000; Y’s Capital A/c by ₹ 3,000; Cr. Z’s Capital A/c by ₹ 15,000.]

Solution:-

Here is the list of all Solutions of Retirement of Partners of TS Grewal class 12 CBSE 2024-25.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |