[CBSE] Q. 7 Death of Partner Solution TS Grewal Class 12 (2024-25)

Solution of Question number 7 of the Death of Partner Chapter of TS Grewal Book 2024-25 Edition CBSE Board.

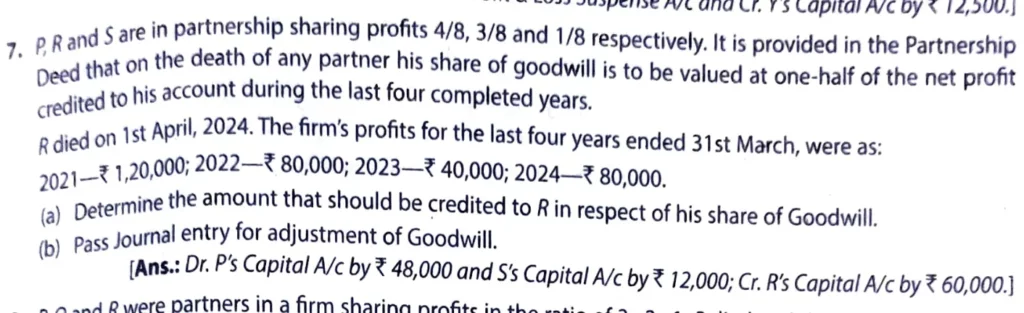

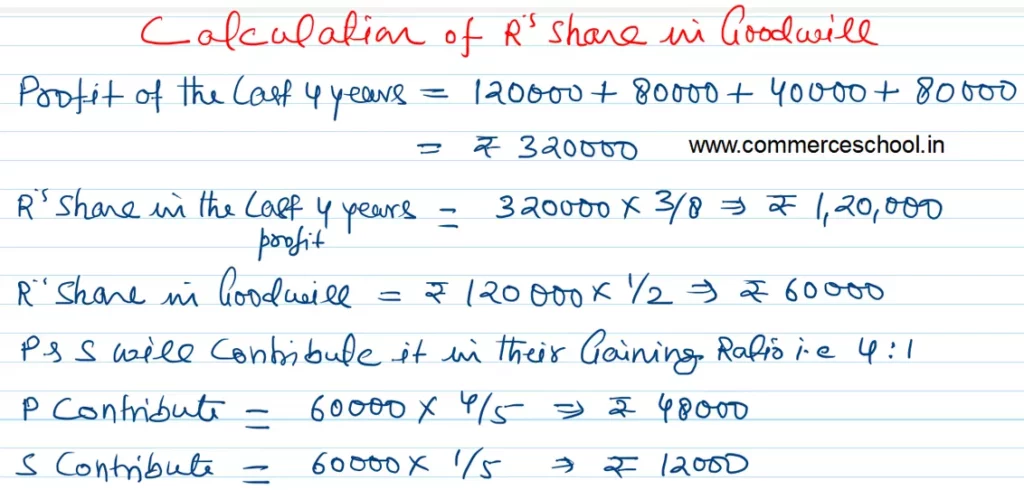

P, R and S are in partnership sharing profits 4/8, 3/8 and 1/8 respectively. It is provided in the partnership deed that on the death of any partner his share of goodwill is to be valued at one half of the net profit credited to his account during the last four completed years.

R died on 1st April, 2023. The firm’s profits for the last four years ended 31st March, were as:

2020 – ₹ 1,20,000; 2021 – ₹ 80,000; 2022 – ₹ 40,000; 2023 – ₹ 80,000.

(a) Determine the amount that should be credited to R in respect of his share of Goodwill.

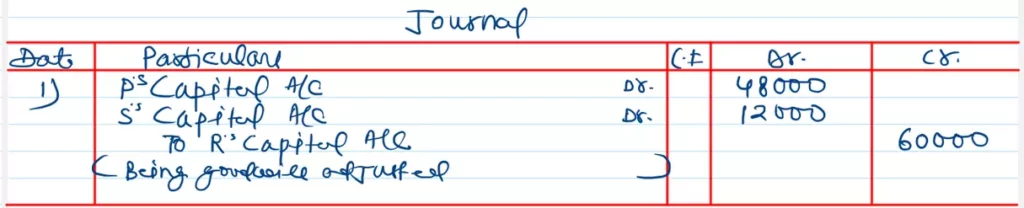

(b) Pass Journal entry for adjustment of Goodwill.

[Ans.: Dr. P’s Capital A/c by ₹ 48,000 and S’s Capital A/c by ₹ 12,000; Cr. R’s Capital A/c by ₹ 60,000.

Solution:-

Solutions of Death of Partner chapter 7 of TS Grewal Book class 12 Accountancy 2024-25 CBSE Board

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |