[CBSE] Q. 14 Dissolution of Partnership Firm Solution TS Grewal Class 12 2024-25

Solution to Question number 14 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2024-25 Edition for the CBSE Board.

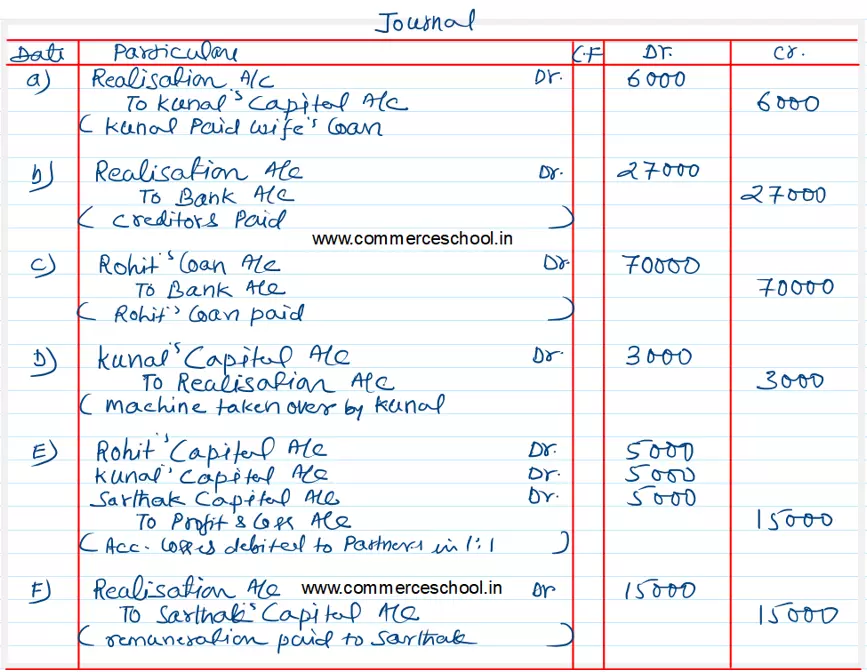

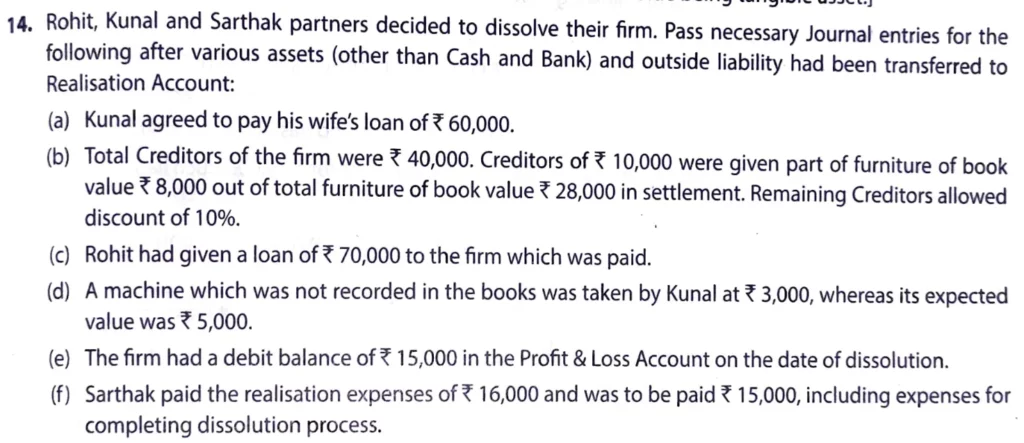

Rohit, Kunal and Sarthak are partners in a firm. They decided to dissolve their firm. Pass necessary Journal entries for the following after various assets (other than Cash and Bank) and the third-party liability have been transferred to Realisation Account:

(a) kanal agreed to pay his wife’s loan of ₹ 6,000.

(b) Total Creditors of the firm were ₹ 40,000. Creditors of ₹ 10,000 were given a piece of furniture of book value ₹ 8,000 out of total furniture of book value ₹ 28,000 in settlement. Remaining Creditors allowed a discount of 1%.

(c) Rohit had given a loan of ₹ 70,000 to the firm which was duly paid.

(d) A machine which was not recorded in the books was taken by Kunal at ₹ 3,000, whereas its expected value was ₹ 5,000.

(e) The firm had a debit balance of ₹ 15,000 in the Profit & Loss Account on the date of dissolution.

(f) Sarthak paid the realisation expenses of ₹ 16,000 out of his private funds, who was to get a remuneration of ₹ 15,000 for completing dissolution process and was responsible to bear all the realisation

Solution:-