[CBSE] Q. 28 Dissolution of Partnership Firm Solution TS Grewal Class 12 2024-25

Solution to Question number 28 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2024-25 Edition for the CBSE Board.

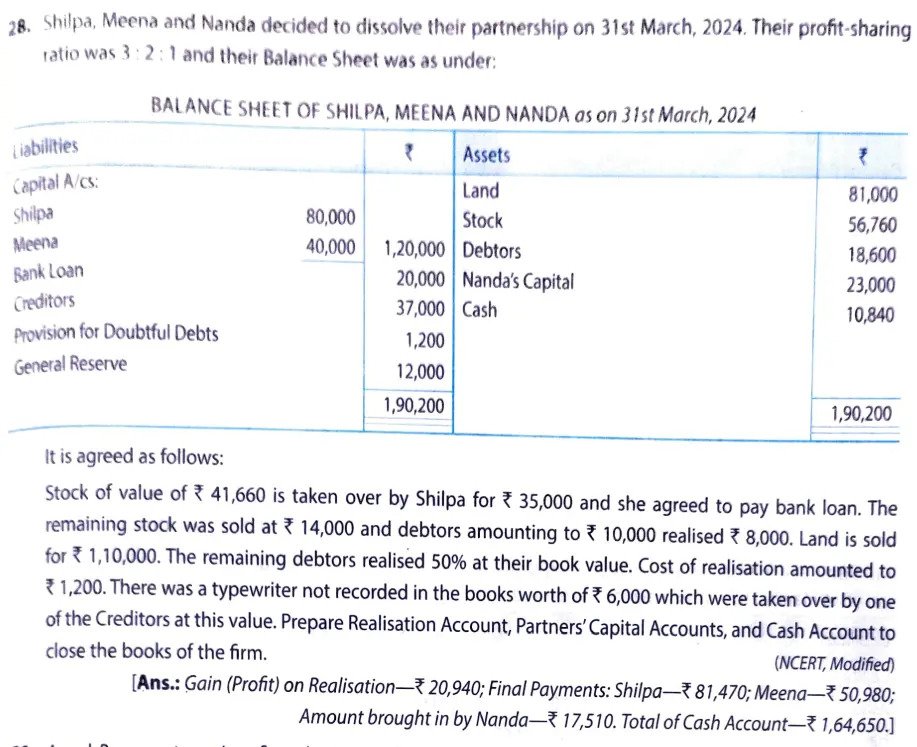

Shilpa, Meena and Nanda decided to dissolve their partnership on 31st March, 2023. Their Profit sharing ratio was 3 : 2 : 1 and their Balance Sheet was as under:

Balance Sheet of Shilpa, Meena and Nanda as on 31st March, 2023

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs: Shilpa Meena Bank Loan Creditors Provision for Doubtful Debts General Reserve | 80,000 40,000 20,000 37,000 1,200 12,000 | Land Stock Debtors Nanda’s Capital Cash | 81,000 56,760 18,600 23,000 10,840 |

| 1,90,200 | 1,90,200 |

It is agreed as follows:

The stock of value of ₹ 41,660 are taken over by Shilpa for ₹ 35,000 and she agreeed to pay bank loan. The remaining stock was sold at ₹ 14,000 and debtors amounting to ₹ 10,000 realised ₹ 8,000. Land is sold for ₹ 1,10,000. The remaining debtors realised 50% at their book value. Cost of realisation amounted to ₹ 1,200. There was a typewriter not recorded in the books worth of ₹ 6,000 which were taken over by one of the Creditors at this value. Prepare Realisation Account, Partner’s Capital Accounts and Cash Account to close the books of the firm.

[Ans.: Gain (Profit) on Realisation – ₹ 20,940; Final Payments: Shilpa – ₹ 81,470; Meena – ₹ 50,980; Amount brought in by Nanda – ₹ 17,510.

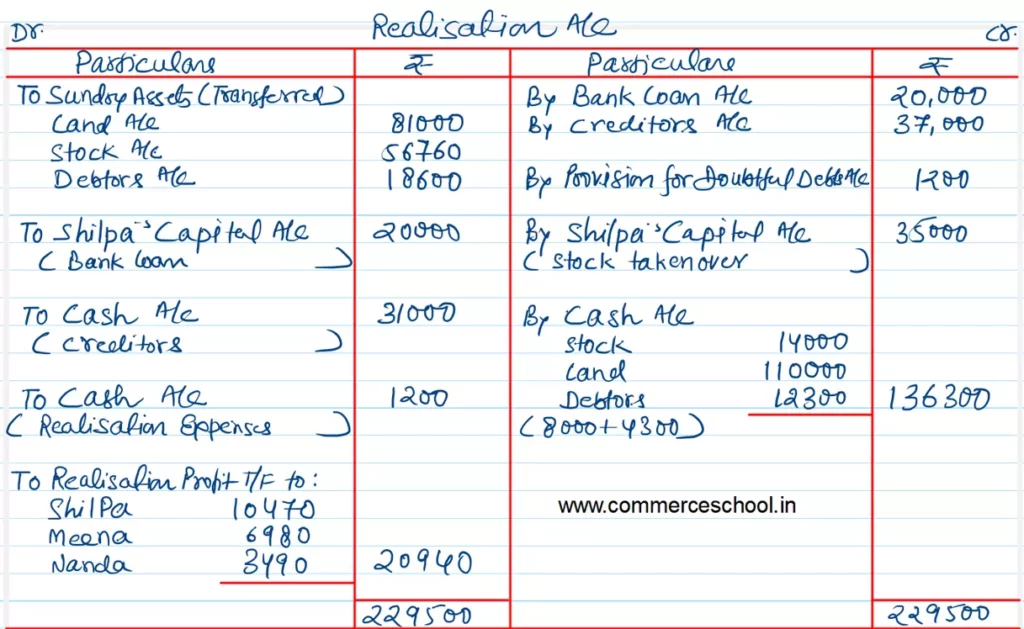

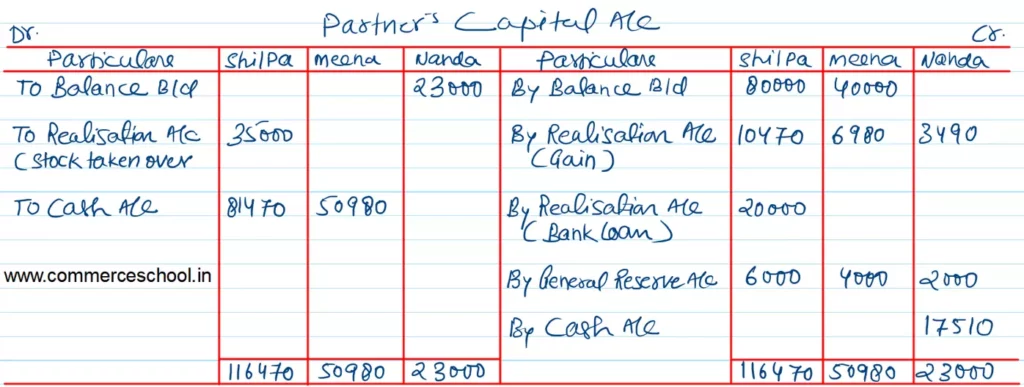

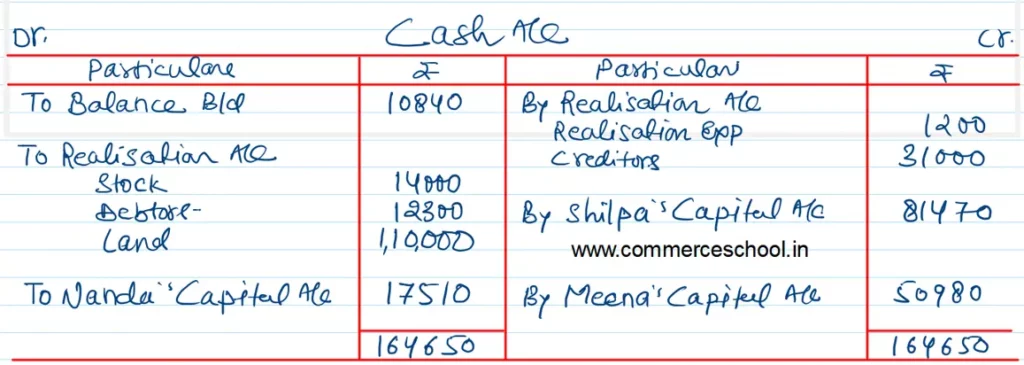

Solution:-

Here is the list of solutions

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |