[CBSE] Q. 48 Dissolution of Partnership Firm Solution TS Grewal Class 12 2024-25

Solution to Question number 48 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2024-25 Edition for the CBSE Board.

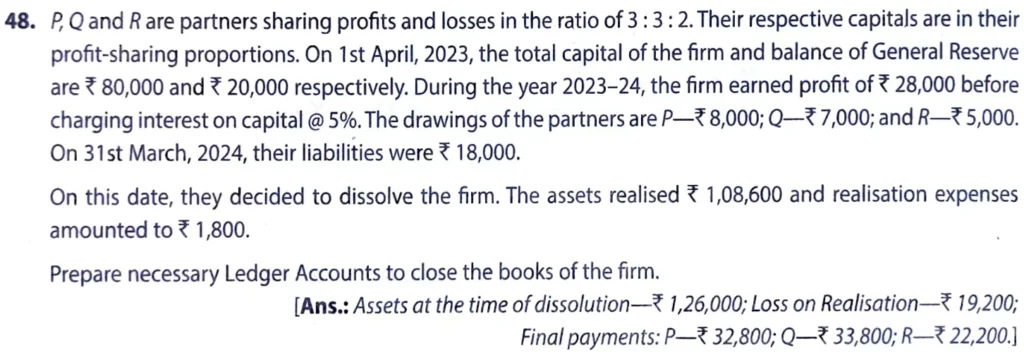

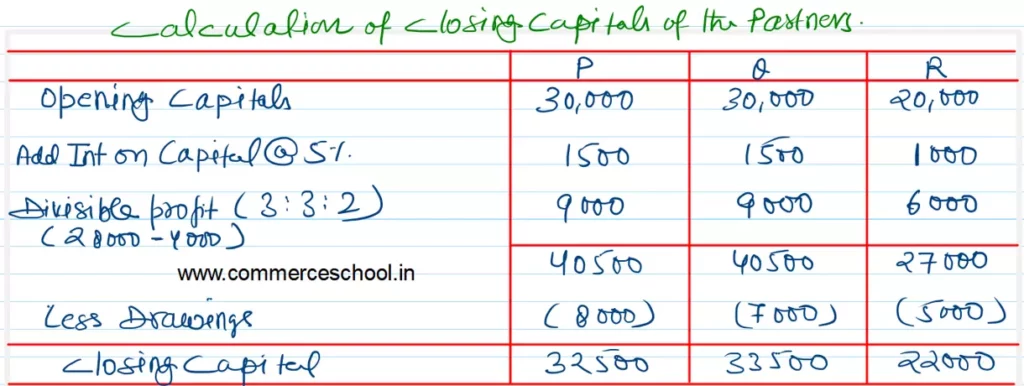

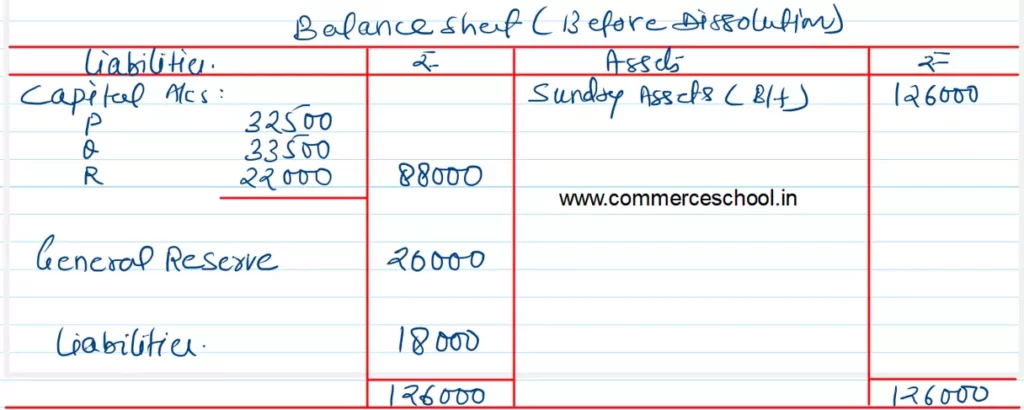

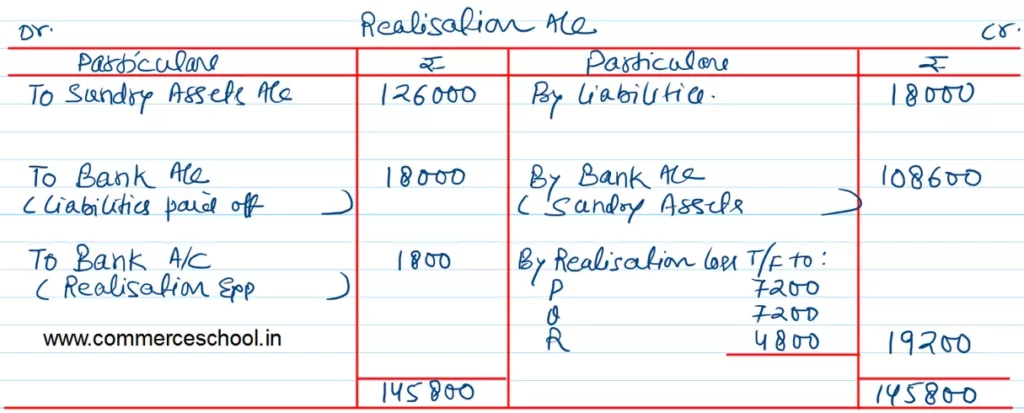

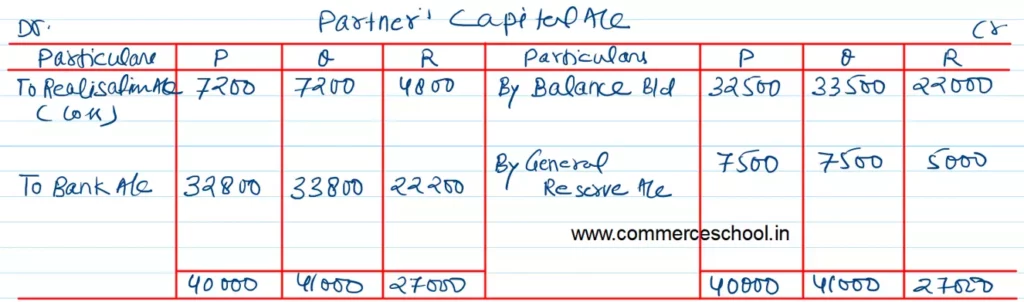

P, Q and R are partners sharing profits and losses in the ratio of 3 : 3 : 2. Their respective capitals are in their profit-sharing proportions. On 1st April, 2022, the total capital of the firm and balance of General Reserve are ₹ 80,00 and ₹ 20,000 respectivel. During the year 2022 – 23, the firm earned profit of ₹ 28,000 before charging interest on capital @ 5%. The drawings of the partners are P – ₹ 8,000; Q – ₹ 7,000; and R – ₹ 5,000. On 31st March, 2023, their liabilities were ₹ 18,000. On this date, they decided to dissolve the firm. The assets realised ₹ 1,08,600 and realisation expenses amounted to ₹ 1,800.

Prepare necessary Ledger Accounts to close the books of the firm.

[Ans.: Assets at the time of dissolution – ₹ 1,26,000; Loss on Realisation – ₹19,200; Final payments: P – ₹ 32,800; Q – ₹ 33,800; R – ₹ 22,200.]

Solution:-

Here is the list of solutions

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |