[ISC] Q. 47 Retirement of Partner TS Grewal Solution Class 12 (2024-25)

Solution to Question number 47 of the Retirement of Partner Chapter of TS Grewal Book ISC Board 2024-25 session.

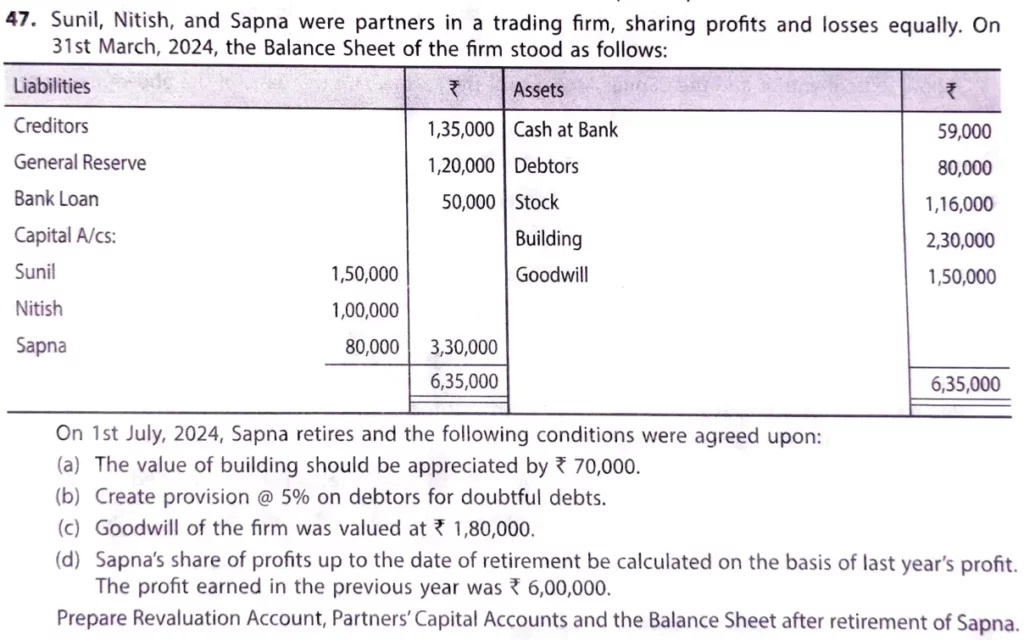

Sunil, Nitish and Sapna were partners in a trading firm, sharing profits and losses equally. On 31st March, 2023, the Balance Sheet of the firm stood as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors General Reserve Bank Loan Capital A/cs: Sunil Nitish Sapna | 1,35,000 1,20,000 50,000 1,50,000 1,00,000 80,000 | Cash at Bank Debtors Stock Building Goodwill | 59,000 80,000 1,16,000 2,30,000 1,50,000 |

| 6,35,000 | 6,35,000 |

On 1st July, 2023, Sapna retires and the following conditions were agreed upon:

(a) The value of Building should be appreciated by ₹ 70,000.

(b) Create Provision @ 5% on debtors for doubtful debts.

(c) Goodwill of the firm was valued at ₹ 1,80,000.

(d) Sapna’s share of profits up to the date of retirement be calculated on the basis of last year’s profit. The profit earned in the previous year was ₹ 6,00,000.

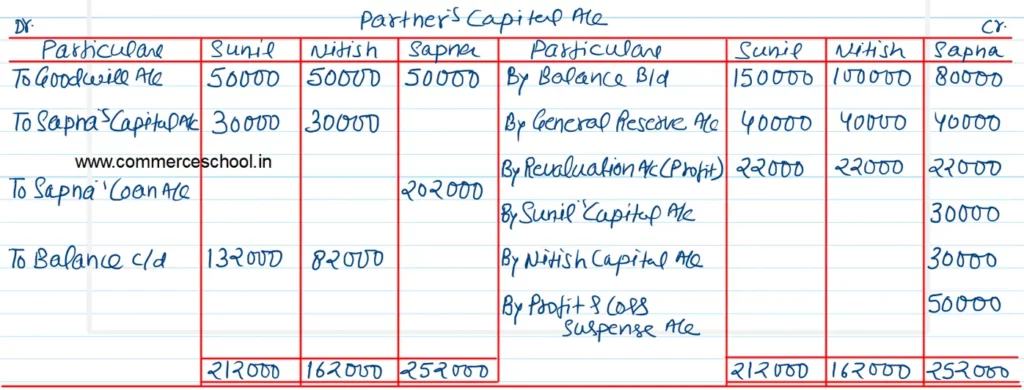

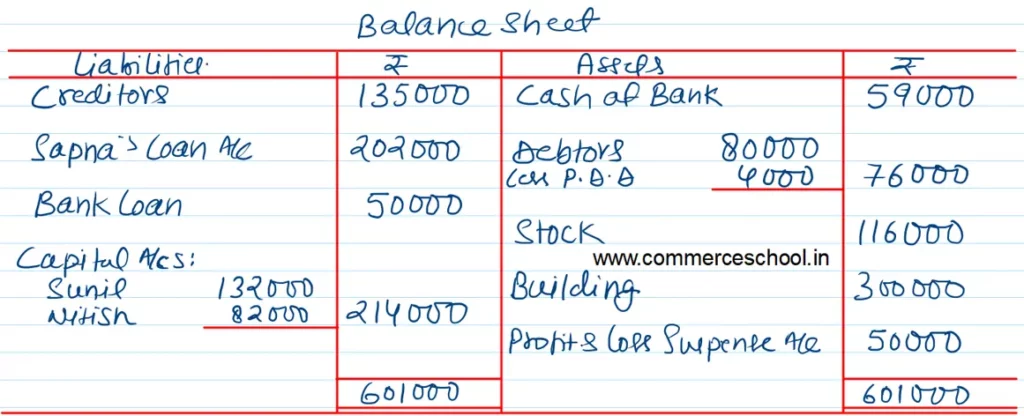

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet after retirement of Sapna.

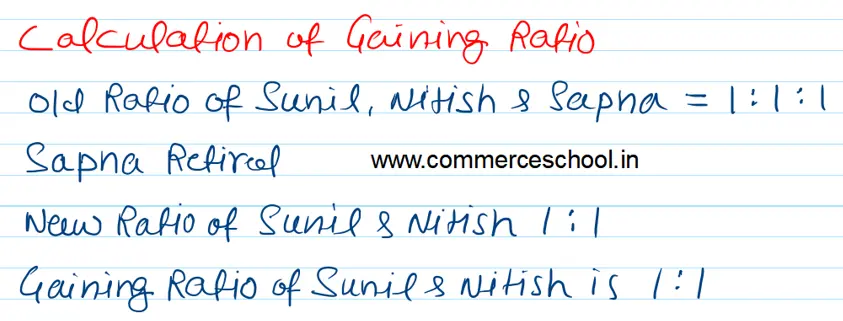

Solution:-

Here is the list of all solutions of Retirement of Partners TS grewal ISC class 12 (2024-25)

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |