[ISC] Q. 18 Dissolution of Partnership Firm Solution TS Grewal Class 12 (2024-25)

Solution to Question number 18 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2024-25 Edition for the ISC Board.

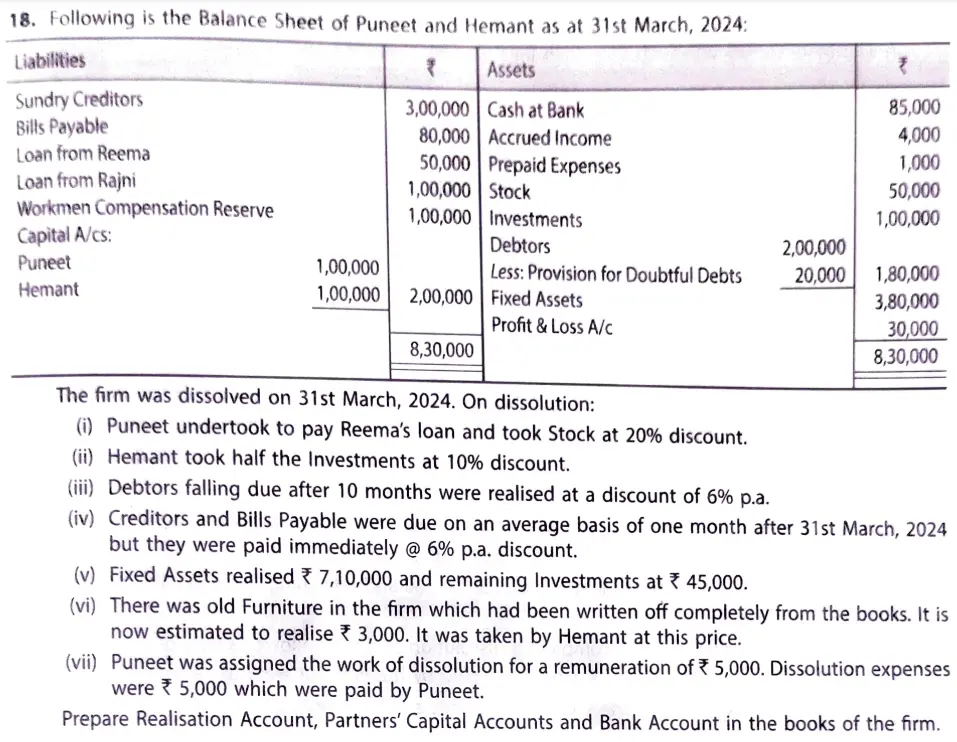

Following is the Balance Sheet of Puneet and Hemant as at 31st March, 2024:

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors Bills Payable Loan from Reema Loan from Rajni Workmen Compensation Reserve Capital A/cs: Puneet Hemant | 3,00,000 80,000 50,000 1,00,000 1,00,000 1,00,000 1,00,000 | Cash at Bank Accrued Income Prepaid Expenses Stock Investments Debtors Less: Provision for Doubtful Debts Fixed Assets Profit & Loss A/c | 2,00,000 20,000 | 85,000 4,000 1,000 50,000 1,00,000 1,80,000 3,80,000 30,000 |

| 8,30,000 | 8,30,000 |

The firm was dissolved on 31st March, 2024. On dissolution:

(i) Puneet undertook to pay Reema’s loan and took stock at 20% discount.

(ii) Hemant tool half the Investments at 10% discount.

(iii) Debtors falling due after 10 months were realised at a discount of 6% p.a.

(iv) Creditors and Bills Payable were due on an average basis of one month after 31st March, 2024 but they were paid immediately @ 6% p.a. discount.

(v) Fixed Assets realised ₹ 7,10,000 and remaining Investments at ₹ 45,000.

(vi) There was old Furniture in the firm which had been written off completely from the books. It is now estimated to realise ₹ 3,000. It was taken by Hemant at this price.

(vii) Puneet was assigned the work of dissolution for a remuneration of ₹ 5,000. Dissolution expenses were ₹ 5,000 which were paid by Punnet.

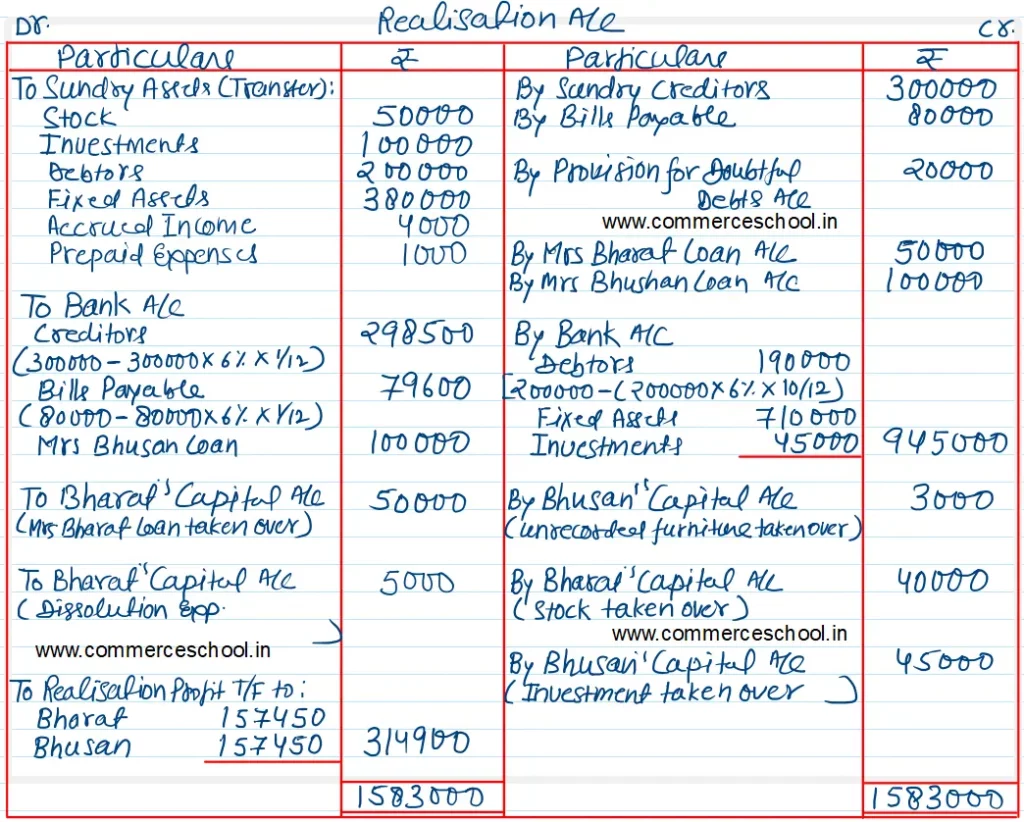

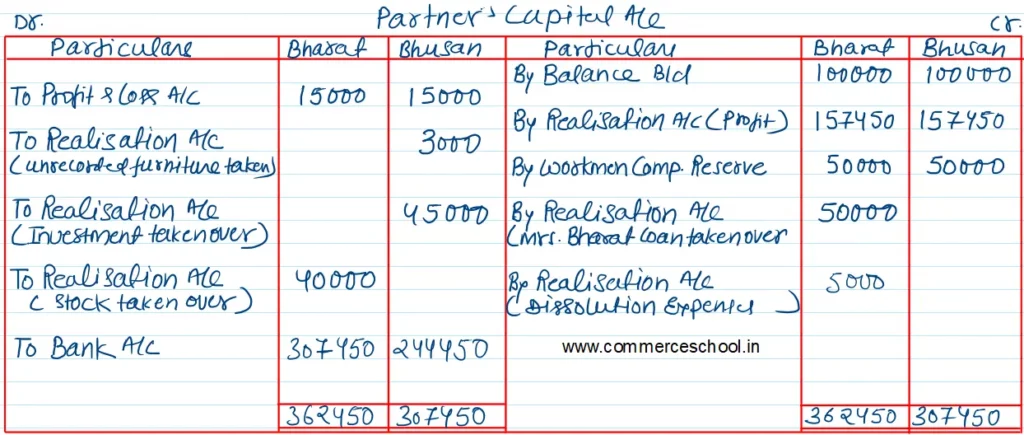

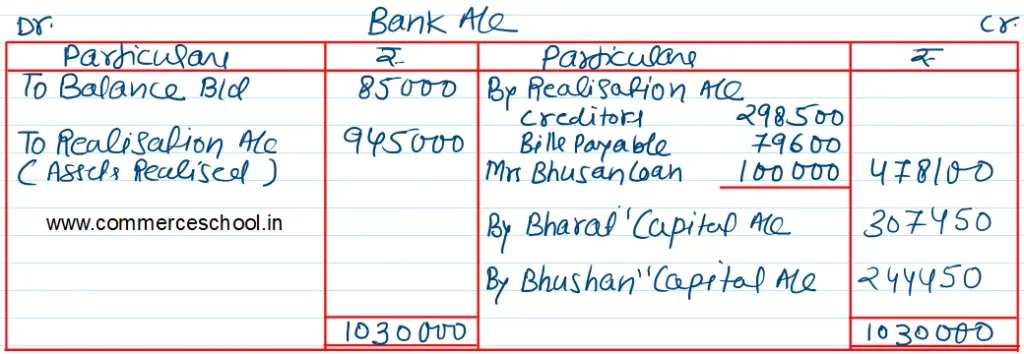

Prepare Realisation Account, Partner’s Capital Accounts and bank Account in the books of the firm.

Solution:-