[CBSE] DK Goel Q. 4 Change in Profit Sharing Ratio Solutions Class 12 (2024-25)

Solution of Question 4 of Change in Profit sharing ratio DK Goel Class 12 CBSE (2024-25)

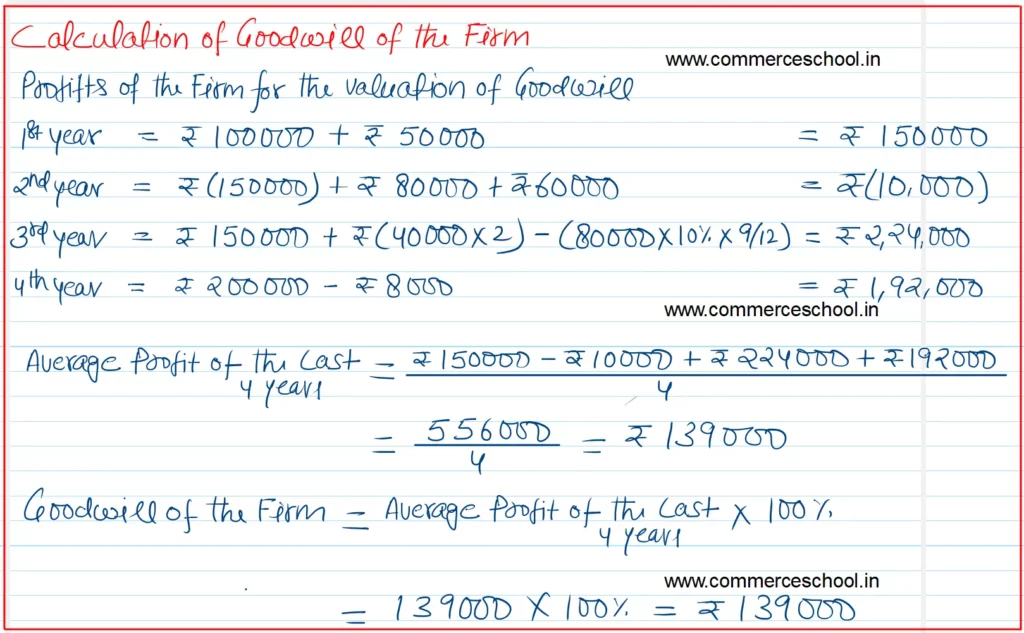

X purchased the business of Y from 1st April, 2023. For this purpose goodwill is to be valued at 100% of the average annual profits of the last four years. The profits shown on Y’s business for the last four years were:

| Year Ended | Profits | |

| 31st March 2020 | 1,00,000 | (after debiting loss of stock by fire ₹ 50,000) |

| 31st March 2021 | (1,50,000) | (includes voluntary retirement compensation paid ₹ 80,000) |

| 31st March 2022 | 1,50,000 | |

| 31st March 2023 | 2,00,000 |

Verification of books of accounts revealed the following:

(i) During the year ended 31st March, 2021, a machine got destroyed in accident and ₹ 60,000 was written off as loss in Profit & Loss Account.

(ii) On 1st July 2021, Two Computers costing ₹ 40,000 each were purchased and were debited to Travelling Expenses Account on which depreciation is to be charged @ 10% p.a. on Straight Line Method.

Calculate the value of goodwill.

[Ans. Goodwill ₹ 1,39,000.]

Hint: Profit for the year ended 31st March 2022 ₹ 2,24,000 and for 2023 ₹ 1,92,000.

Solution:-

Here are the solutions of Change in Profit Sharing ratio chapter of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |