[CBSE] DK Goel Q. 8 Change in Profit Sharing Ratio Solutions Class 12 (2024-25)

Solution of Question 8 of Change in Profit sharing ratio DK Goel Class 12 CBSE (2024-25)

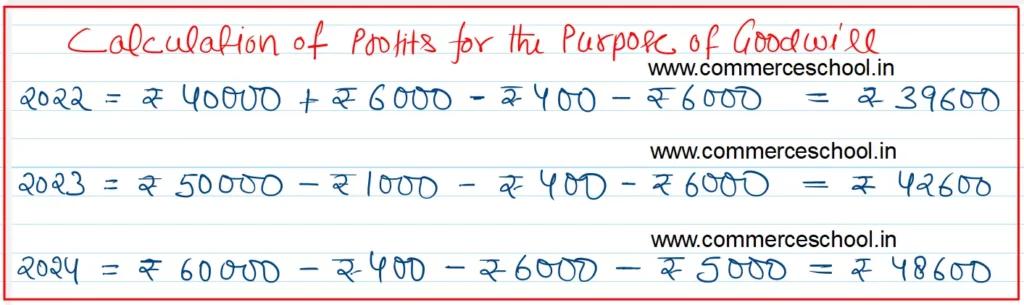

Following information is available about the business of a firm:

(i) Profits : In 2022, ₹ 40,000; In 2023, ₹ 50,000; In 2024, ₹ 60,000, (ii) Non-recurring income of ₹ 1,000 is included in the profits of 2023, (iii) Profits of 2022 have been reduced by ₹ 6,000 because goods were destroyed by fire, (iv) Goods have not been insured but it is throught to insure them in future. The insurance premium is estimated at ₹ 400 per year, (v) Reasonable remuneration of the proprietor of business is ₹ 6,000 per year, but it has not been taken into account for calculation of above mentioned profits, (vi) Profits of 2024 include ₹ 5,000 income on investment.

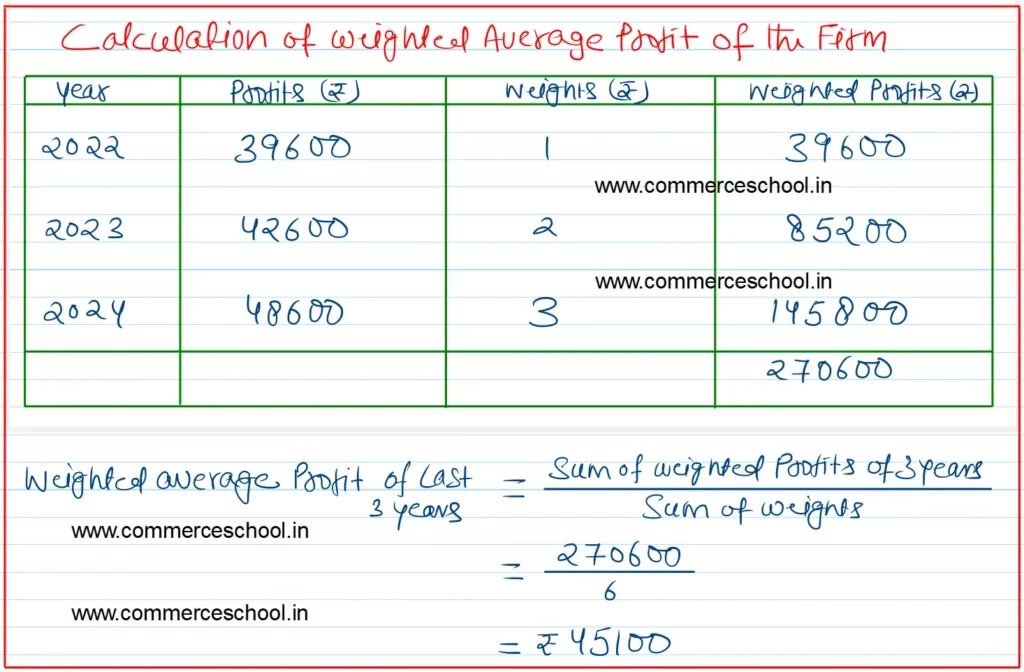

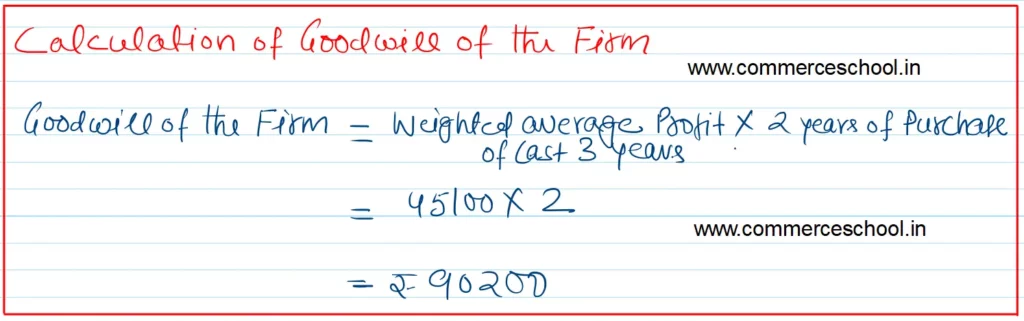

Goodwill is agreed to be valued at two year’s purchase of the weighted average profits of the past three years. The appropriate weights to be used are :-

2022 :- 1: 2023 :- 2; 2024 :- 3.

[Ans. Value of Goodwill ₹ 90,200.]

Solution:-

Note:-

(i) Non recurring income is a non-operating income. it is deducted out of profit.

(ii) Goods destroyed by fire is an extraordinary loss and it is not the part of operating expenses. thus it would be added to back to the profit.

(iii) Future operating expenses is deducted out of profits. as goodwill is the future expectation of the profit to incur.

(iv) Regular operating expenses are deducted out of profit for the purpose of valuation of goowill.

Here are the solutions of Change in Profit Sharing ratio chapter of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |