[CBSE] DK Goel Q. 52 Change in Profit Sharing Ratio Solutions Class 12 (2024-25)

Solution of Question 52 of Change in Profit sharing ratio DK Goel Class 12 CBSE (2024-25)

The following information relates to a partnership firm:

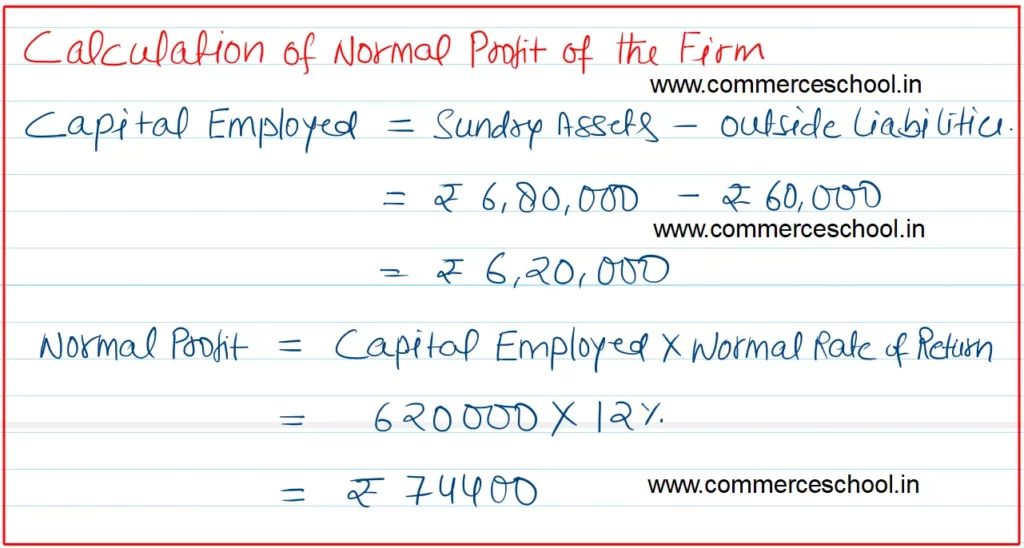

(a) Sundry Assets of the firm ₹ 6,80,000. Outside Liabilities ₹ 60,000.

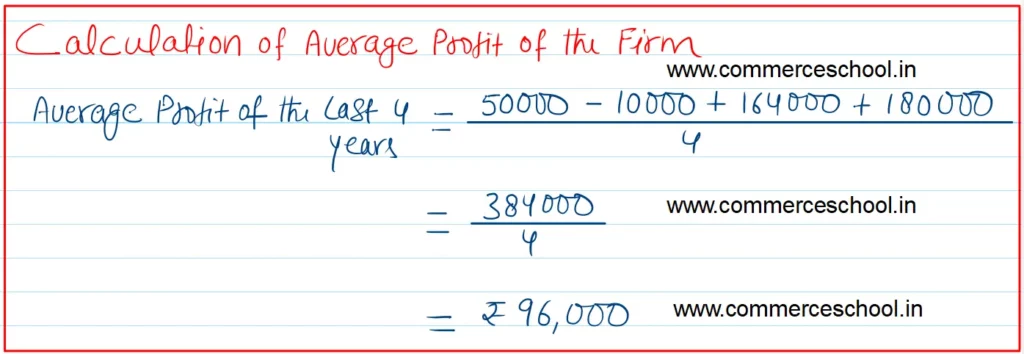

(b) Profits and losses for the past years : Profit 2021 ₹ 50,000; Loss 2022 ₹ 10,000; Profit 2023 ₹ 1,64,000 and Profit 2024 ₹ 1,80,000.

(c) The normal rate of return in a similar type of business is 12%.

Calculate the value of goodwill on the basis of:

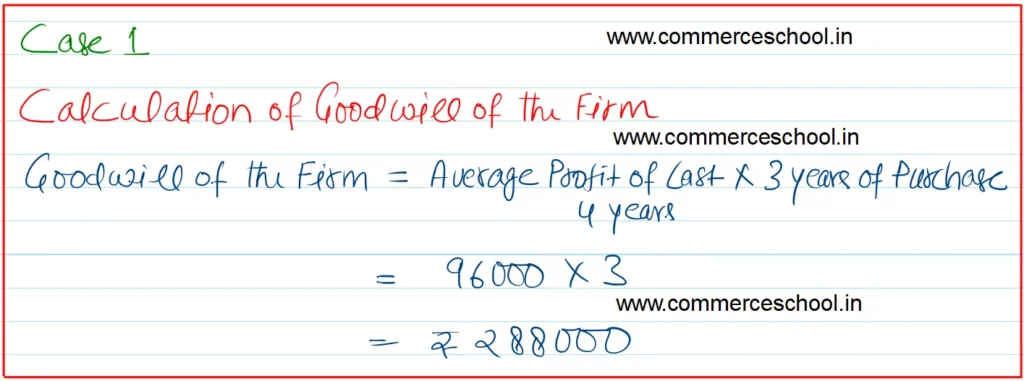

(i) Three year’s purchase of average profits.

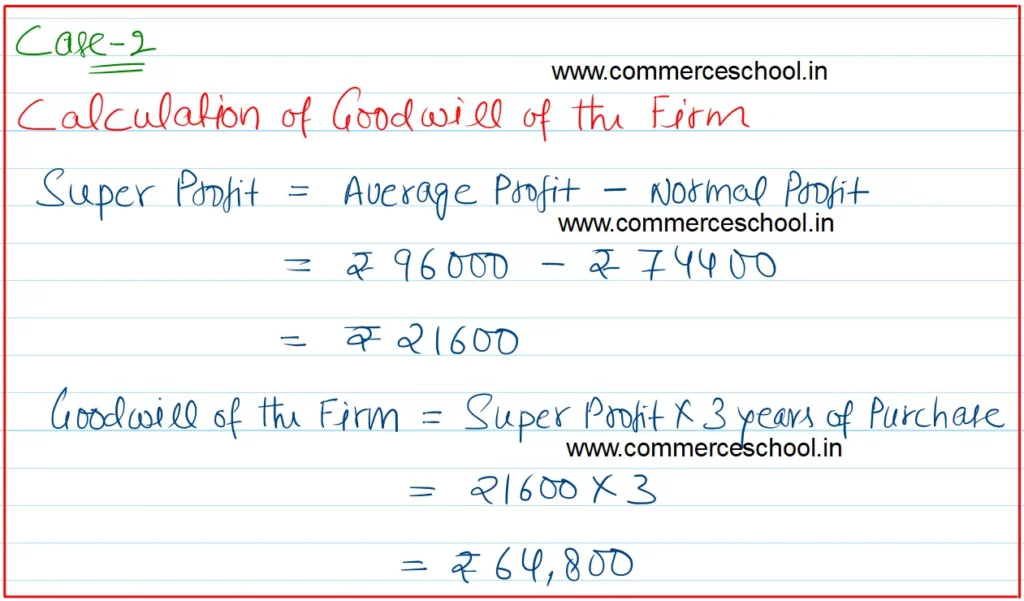

(ii) Three year’s purchase of super profits.

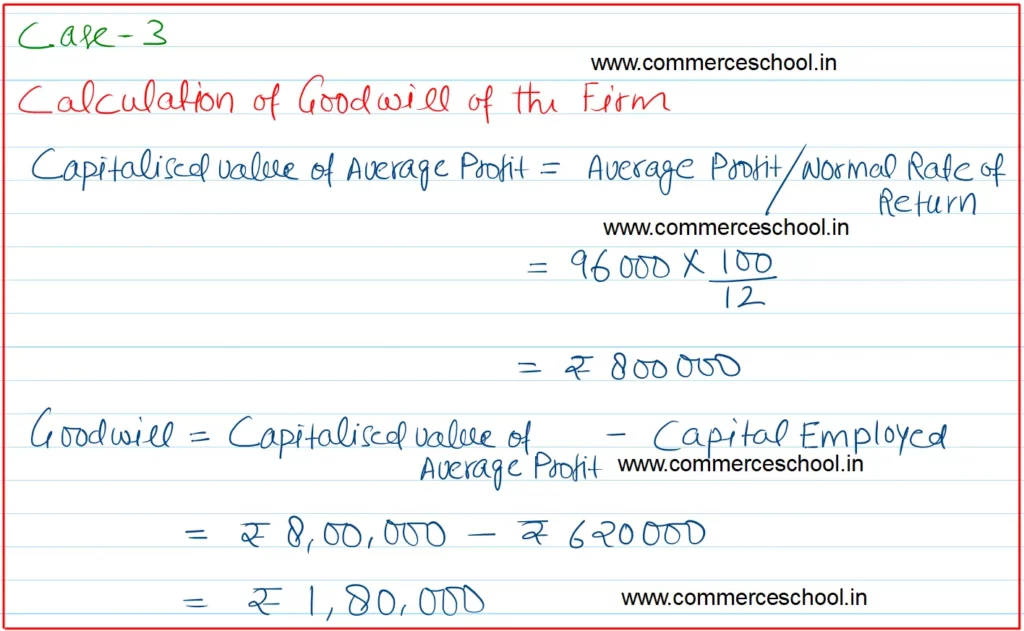

(iii) Capitalisation of average profits, and

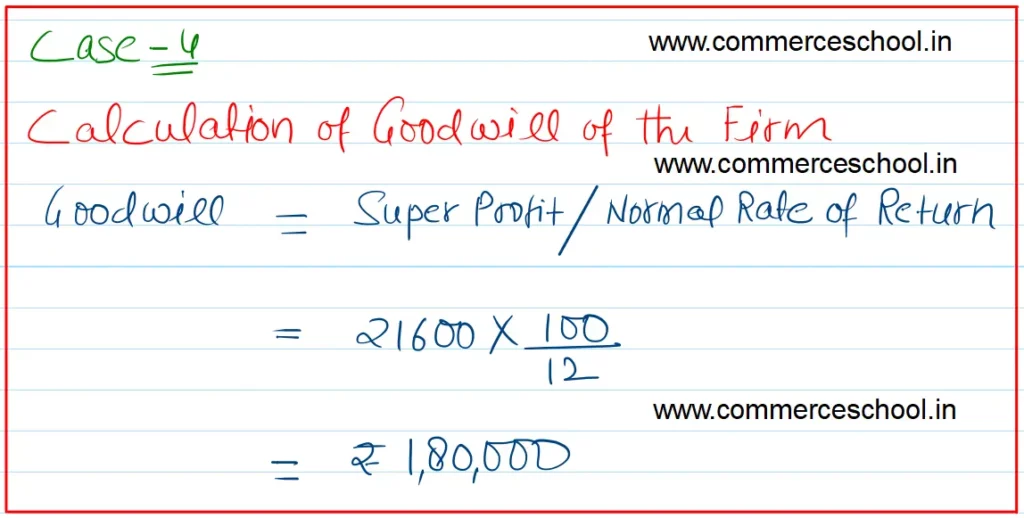

(iv) Capitalisation of super profits.

[Ans. (i) ₹ 2,88,000; (ii) ₹ 64,800; (iii) ₹ 1,80,000 and (iv) ₹ 1,80,000.]

Solution:-

Here are the solutions of Change in Profit Sharing ratio chapter of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |