[CBSE] Q 11 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 11 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

The following is the Balance Sheet of A and B as at 31st March, 2024:

| Liabilities | ₹ | Assets | ₹ |

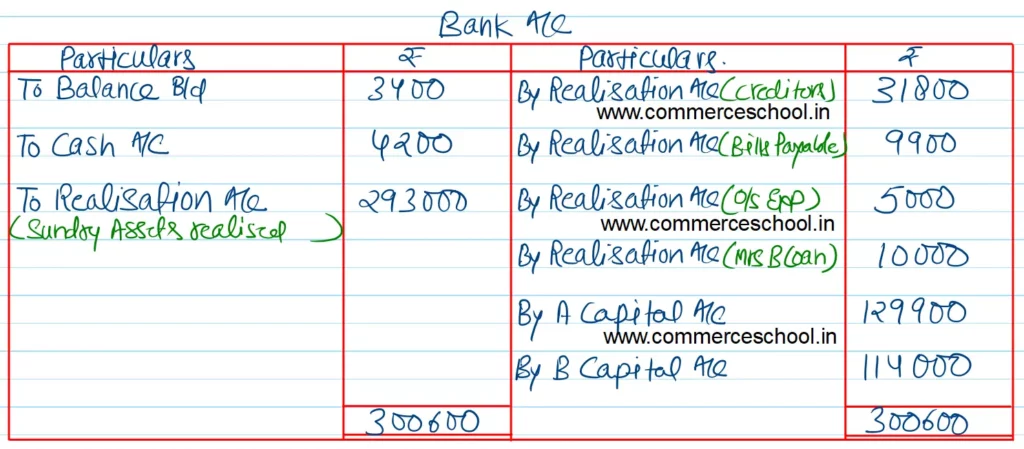

| Mrs. A’s Loan | 15,000 | Cash | 4,200 |

| Mrs. B’s Loan | 10,000 | Bank | 3,400 |

| Trade Creditors | 30,000 | Debtors 30,000 Less: Provision 2,000 | 28,000 |

| Bills Payable | 10,000 | Investments | 10,000 |

| Outstanding Expenses | 5,000 | Stock | 40,000 |

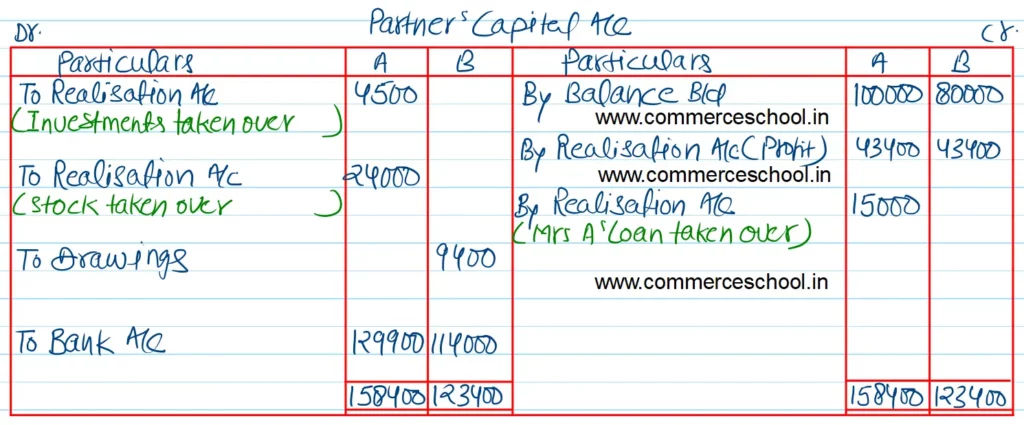

| A: Capital B: Capital | 1,00,000 80,000 | Truck | 75,000 |

| Plant and Machinery | 80,000 | ||

| B: Drawings | 9,400 | ||

| 2,50,000 | 2,50,000 |

Firm was dissolved on this date.

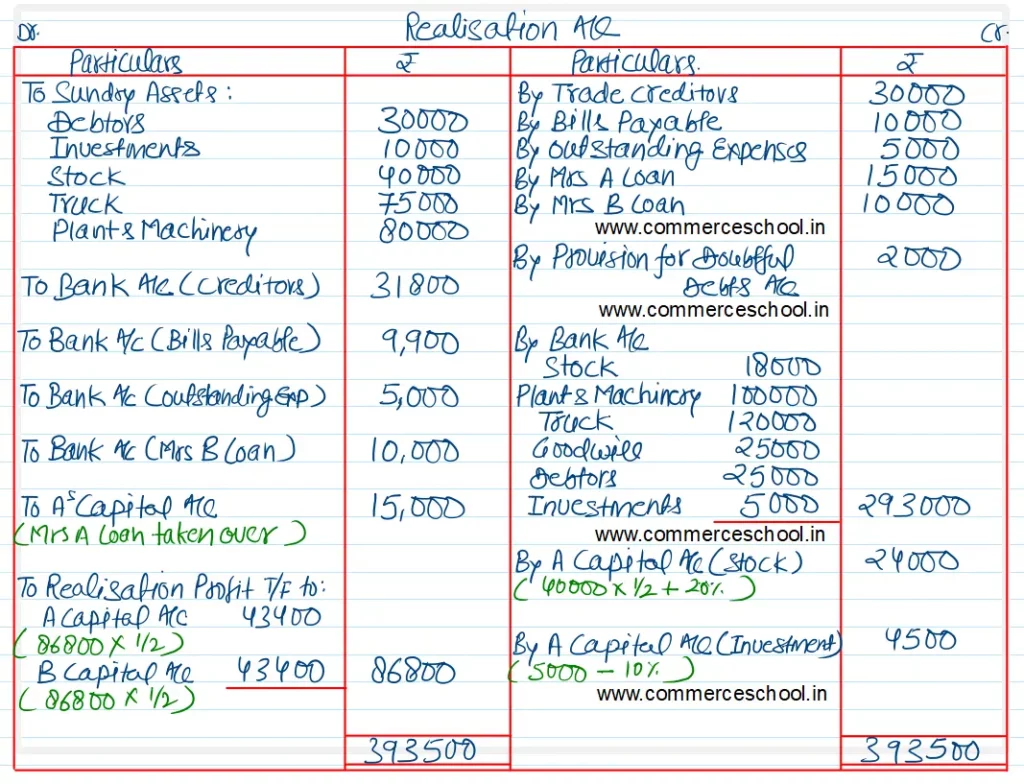

(i) Half the stock was sold at 10% less than the book value and the remaining half was taken over by A at 20% more than the book value.

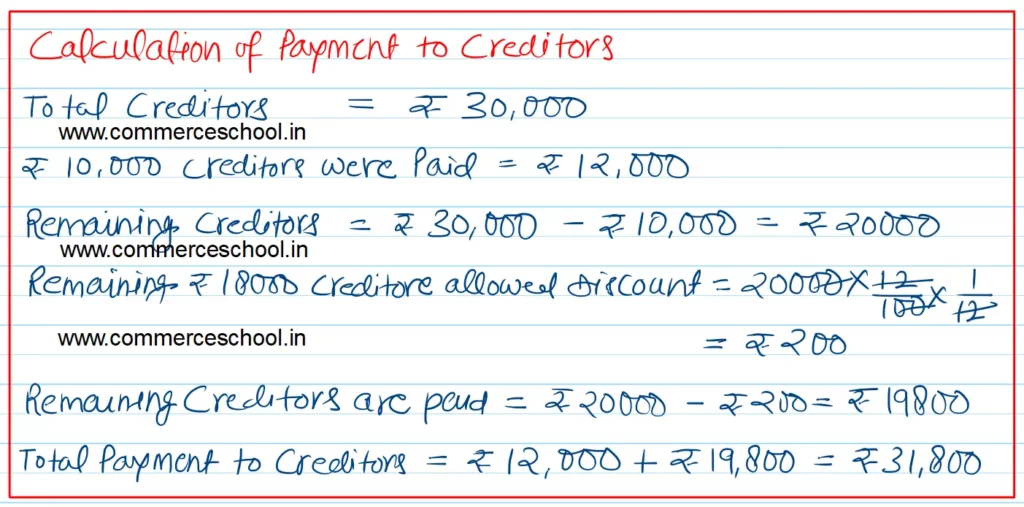

(ii) During the course of dissolution, a liability under action for damages was settled at ₹ 12,000 against ₹ 10,000 included in the creditors.

(iii) Assets realised as follows:

Plant & Machinery – ₹ 1,00,000; Truck – ₹ 1,20,000; Goodwill was sold for ₹ 25,000; Bad Debts amounted to ₹ 5,000. Half the investments were sold at book value.

(iv) A promised to pay off Mrs. A’s Loan and took away half the investments at 10% discount.

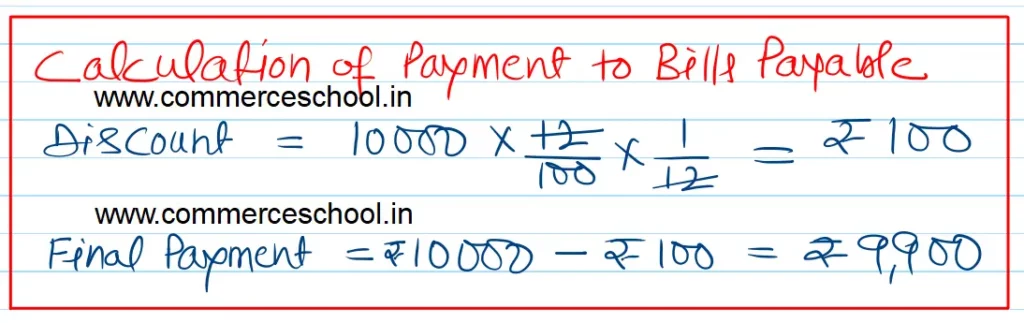

(v) Trade Creditors and Bills Payable were due on average basis of one month after 31st March, but were paid immediately on 31st March, at 12% discount per annum.

Prepare necessary accounts.

[Ans. Gain on Realisation ₹ 86,800; Final Payment to A ₹ 1,29,900 and B ₹ 1,14,000; Total of Bank A/c ₹ 3,00,600]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |