[CBSE] Q 23 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 23 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

Q. 23. A, B and C were partners in a firm sharing profits & losses in the ratio of 2 : 2 : 1. The Balance Sheet of the firm at the date of dissolution was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Bank Overdraft | 21,000 | Debtors | 40,000 |

| Creditors | 86,000 | Stock | 60,000 |

| Provident Fund | 18,000 | Investments | 25,000 |

| Capital Accounts: A B | 1,05,000 42,000 | Machinery | 80,000 |

| Prepaid Expenses | 3,200 | ||

| Goodwill | 38,800 | ||

| C’s Capital Account | 25,000 | ||

| 2,72,000 | 2,72,000 |

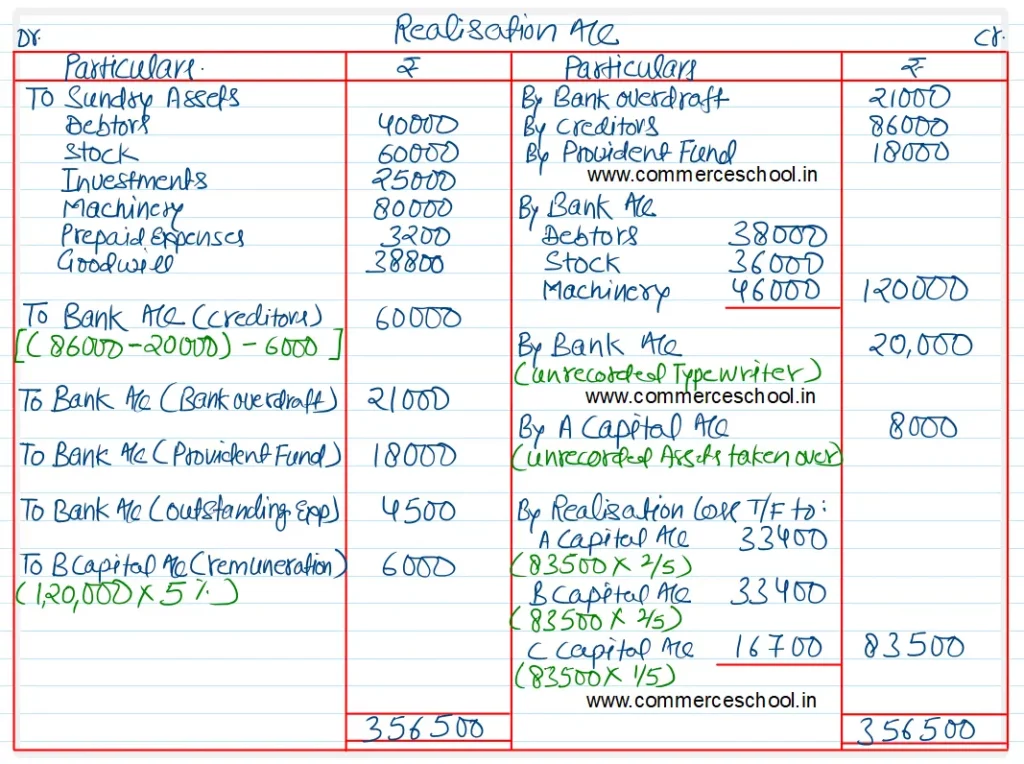

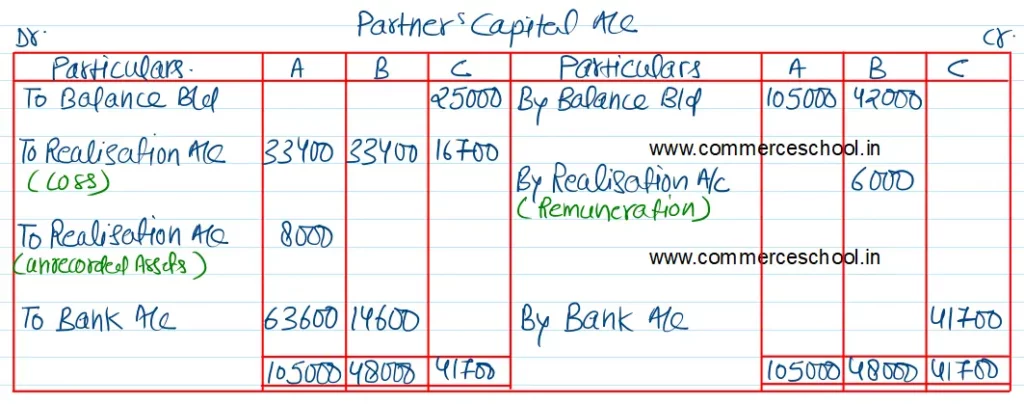

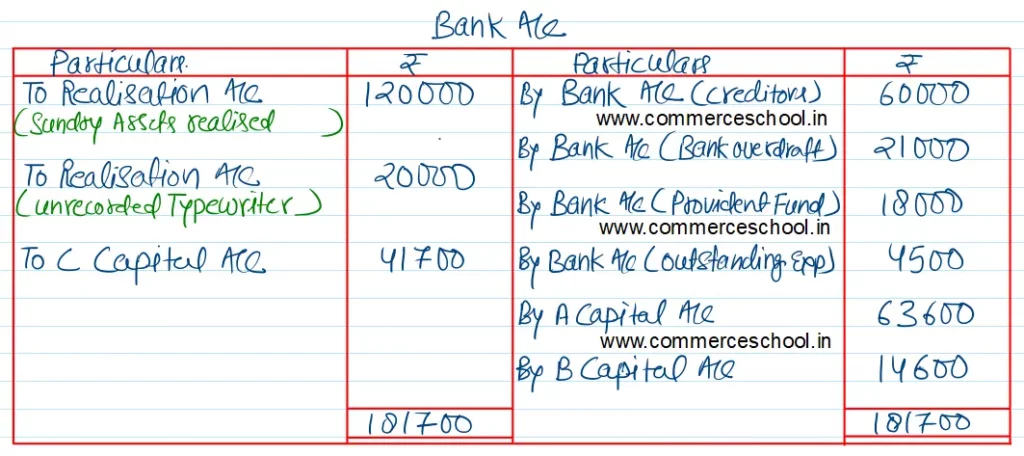

You are informed that:

(i) They appointed B to realise the assets. He is to receive 5% of the amounts realised from Debtors, Stock and Machinery, and is to bear all expenses of realisation.

(2) Bad Debts amounted to ₹ 2,000; Stock realised ₹ 36,000 and Machinery realised ₹ 46,000. There was an unrecorded asset of ₹ 10,000 which was taken over by A at ₹ 8,000.

(3) Market value of Investments was ascertained to be ₹ 20,000, and one of the creditors agreed to accept the Investments at this value, Remaining creditors were paid at a discount of ₹ 6,000.

(4) An office typewriter, not shown in the books of accounts, realised ₹ 20,000.

(5) There were outstanding expenses amounting to ₹ 6,000. These were settled for ₹ 4,500. Expenses of realisation met by B amounted to ₹ 2,000.

Prepare necessary accounts.

[Ans. Loss on Realisation ₹ 83,500; C brings in ₹ 41,700; Final Payment to A ₹ 63,600; and B ₹ 14,600. Total of Bank A/c ₹ 181,700.]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |