[CBSE] Q 24 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 24 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

Q. 24. A, B and C are partners sharing profits and losses in the ratio of 4 : 2 : 1. On 31st March, 2024, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 35,400 | Goodwill | |

| Mrs. B’s Loan | 15,000 | Leasehold Premises | |

| Capital Accounts: A B C | 1,30,000 1,02,700 5,000 | Plant and Machinery | |

| Stock | |||

| Sundry Debtors 30,000 Less: Provision 700 | 29,300 | ||

| Cash at Bank | 17,700 | ||

| Profit & Loss A/c | 8,400 | ||

| 2,88,100 |

It was decided to dissolve the firm, A agreeing to take over the business (except Cash at Bank) at the following valuations:

Leasehold Premises at ₹ 60,000.

Plant and Machinery at ₹ 12,000 less than the book value.

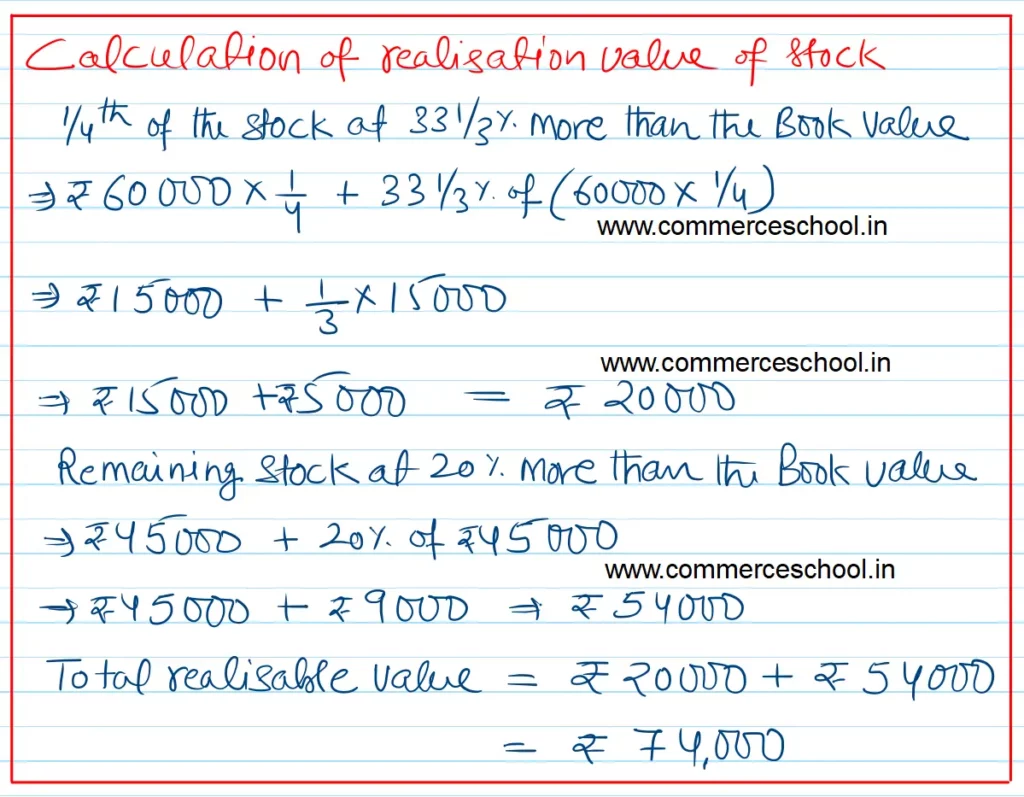

1/4th stock at 33 and 1/3% more than its book value.

Remaining stock at 20% more than the book value.

Sundry Debtors subject to a provision of 5%.

Mrs. B’s Loan was paid in full and the creditors were proved at ₹ 32,000 and were taken over by A. Expenses of dissolution came to ₹ 900.

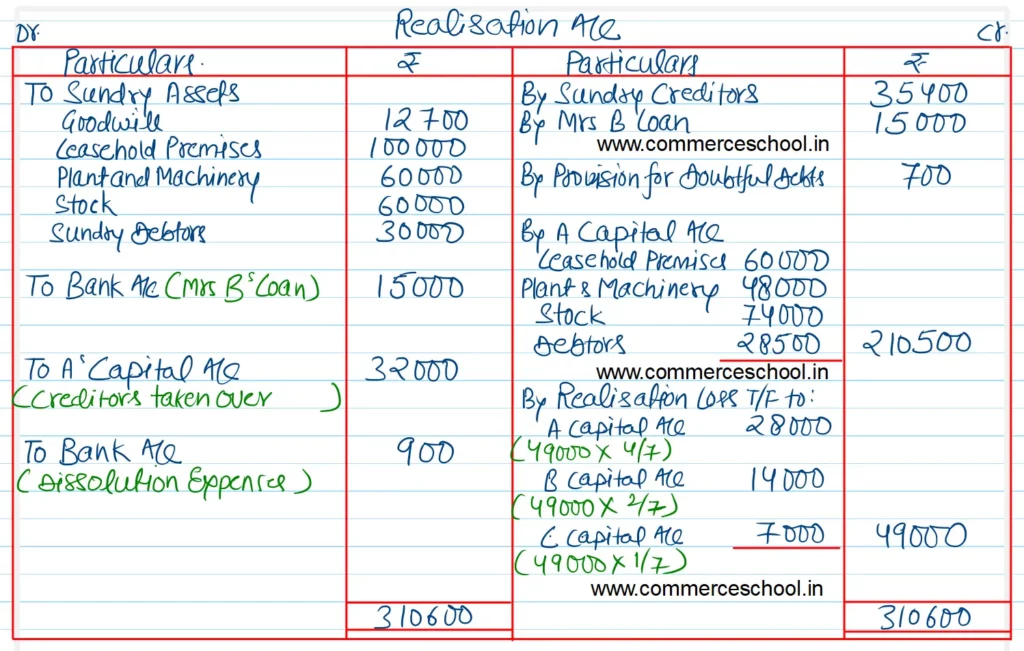

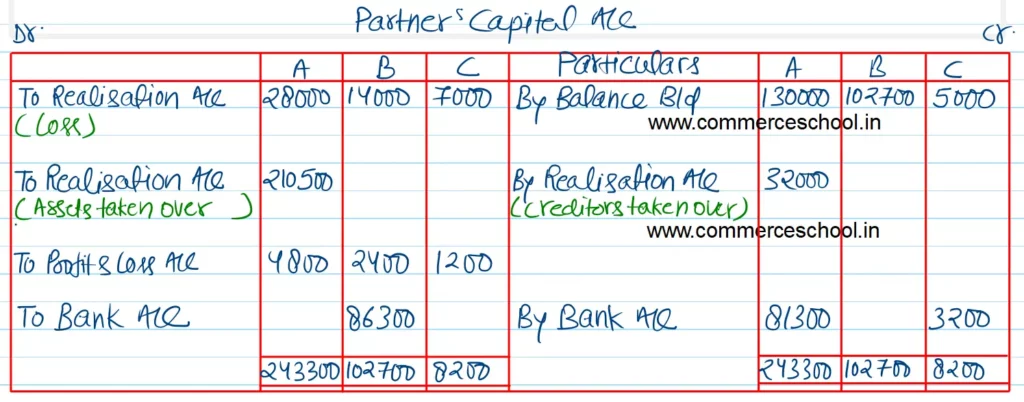

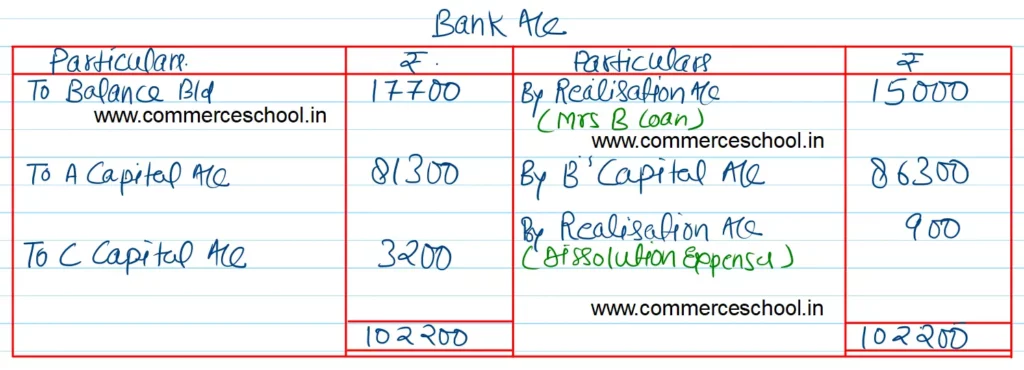

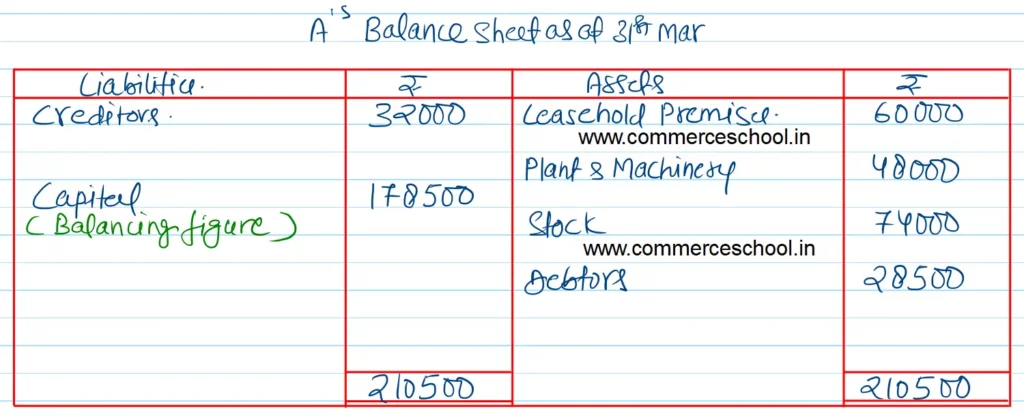

Prepare necessary accounts to close the books of the firm and prepare the Balance Sheet of A.

[Ans. Loss on Realisation ₹ 49,000; Cash brought in by A ₹ 81,300 and By C ₹ 3,200; Cash paid to B ₹ 86,300; Total of Bank A/c ₹ 1,02,200; B/S Total ₹ 2,10,500.]

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |