Q. 17 DK Goel Cash Flow Statement Solutions Class 12 CBSE (2024-25)

Solution of question number 17 of Cash Flow Statement chapter 7 of DK Goel Class 12 CBSE (2024-25).

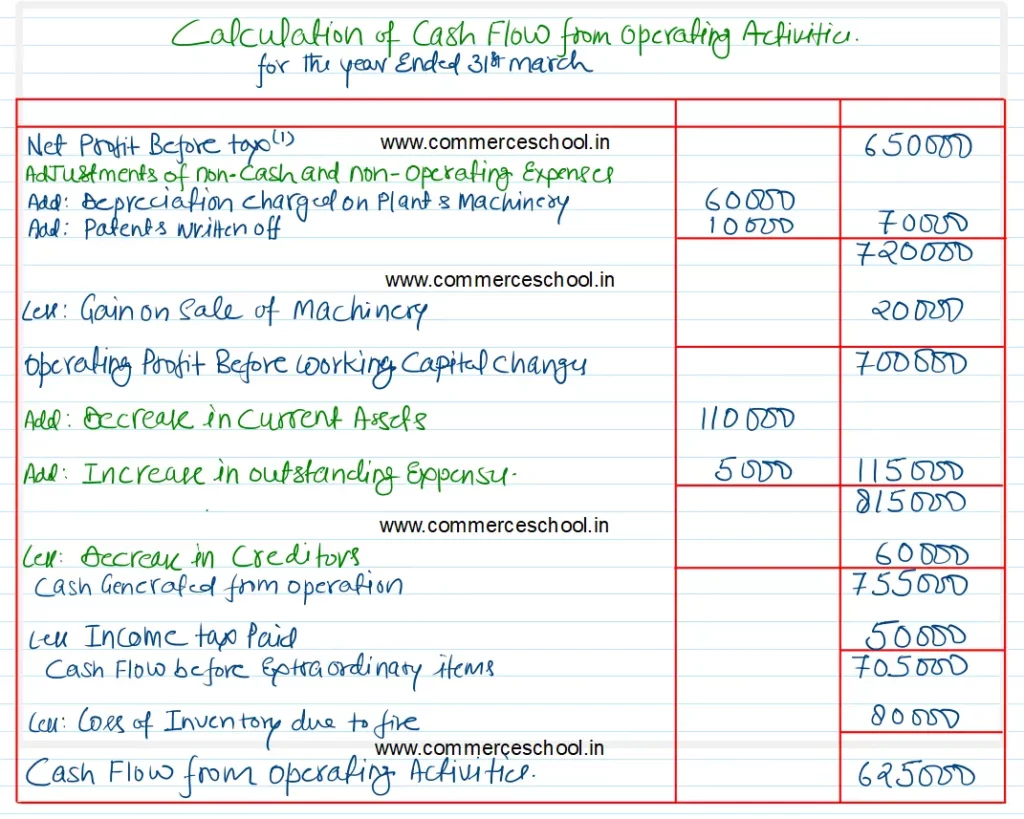

Calculate Cash Flow from Operating Activities from the following information:

| ₹ | |

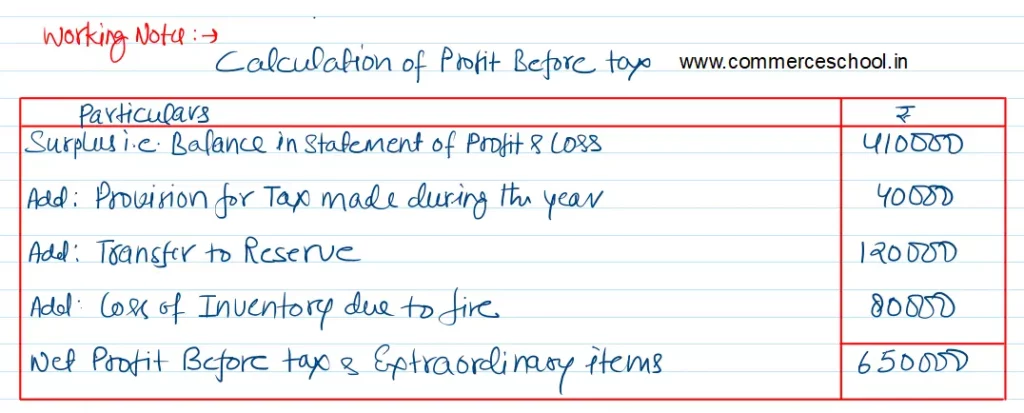

| Surplus i.e., Balance in Statement of Profit & Loss | 4,10,000 |

| Transfer to Reserve | 1,20,000 |

| Provision for Tax made during the current year | 40,000 |

| Depreciation Charged on Plant and Machinery | 60,000 |

| Patents Written Off | 10,000 |

| Gain on Sale of Machinery | 20,000 |

| Decrease in Current Assets | 1,10,000 |

| Decrease in Creditors | 60,000 |

| Increase in Outstanding Expenses | 5,000 |

| Loss of Inventory due to fire | 80,000 |

| Income Tax Paid | 50,000 |

[Ans. Cash Flow from Operating Activities ₹ 6,25,000.]

Solution:-

Notes:-

(i) Net Profit before tax and Extraordinary items ₹ 6,50,000.

(ii) Loss of Inventory due to Fire is an extraordinary item. First it will be added to Net Profit while calculating Net profit before tax and Extraordinary Items and towards the end it will be deducted to compute Cash Flow from Operating Activities.

List of all Solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Solutions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Solutions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Solutions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Solutions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |