Q. 23 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 23 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

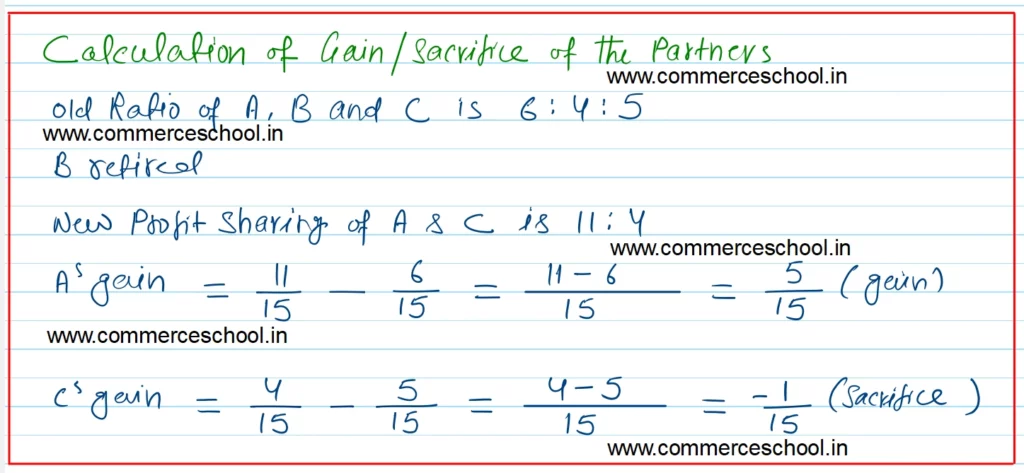

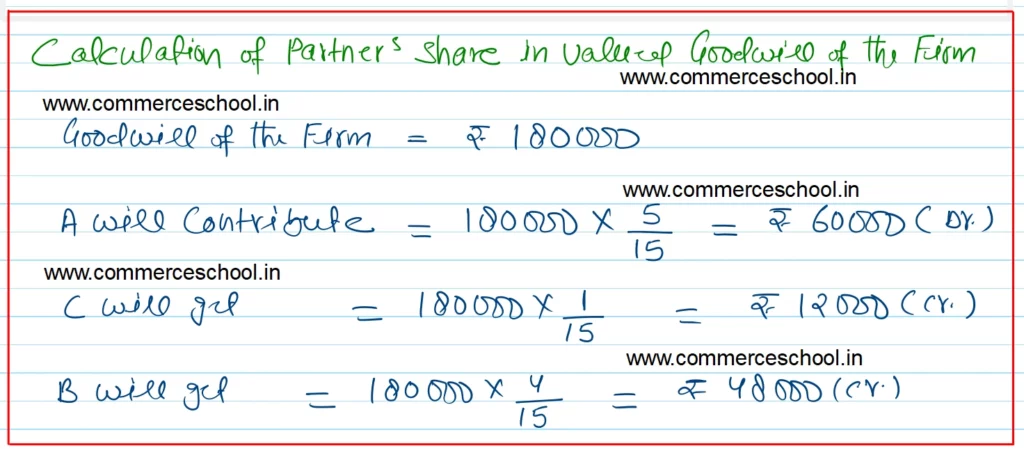

Q. 23 (A). A, B and C were partners sharing profits in the ratio of 6 : 4 : 5. Their capitals were A – ₹ 1,00,000, B – ₹ 80,000 and C – ₹ 60,000. On 1st April 2023, B retired from the firm and the new profit sharing ratio between A and C was decided as 11 : 4. On B’s retirement the goodwill of the firm was valued at ₹ 1,80,000. Showing your calculations clearly pass necessary journal entry for the treatment of goodwill on B’s retirement.

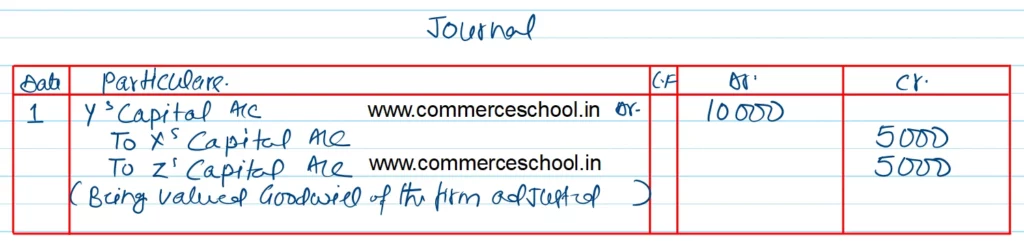

[Ans. Only A gains 5/15. C has also sacrificed 1/15. Hence A will be debited by ₹ 60,000 and B and C will be credited by ₹ 48,000 and ₹ 12,000 respectively.]

Solution:-

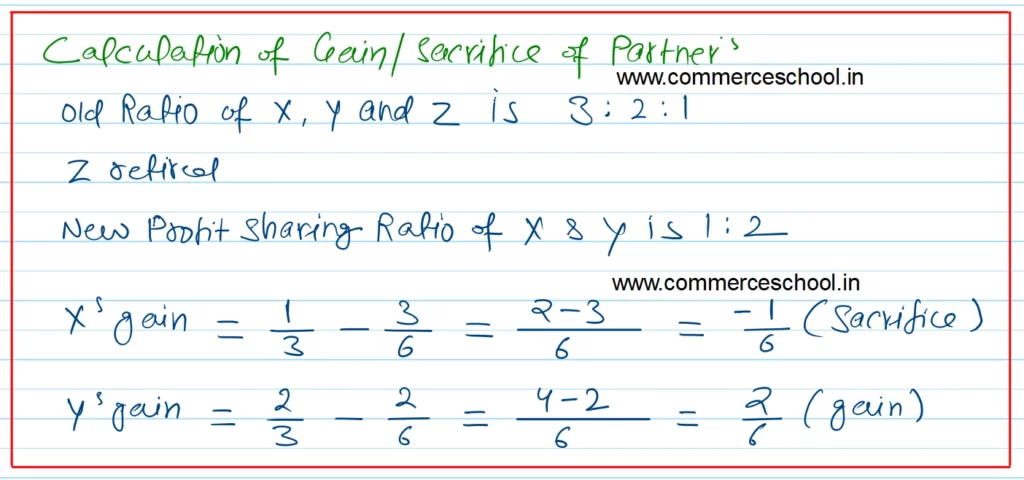

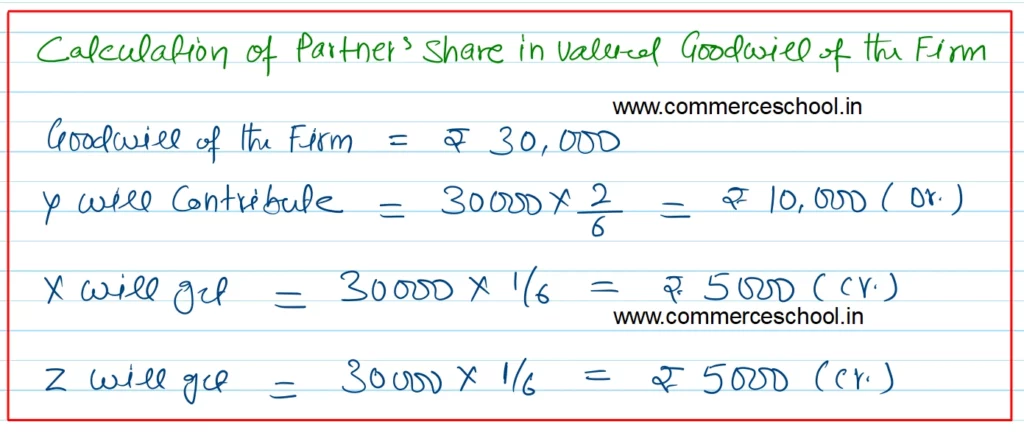

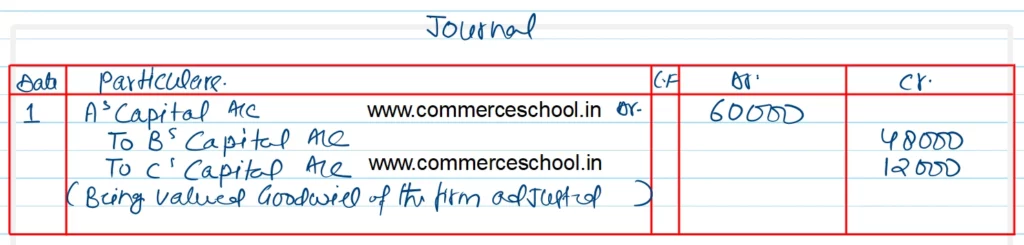

Q. 23 (B). X, Y and Z were partners in a firm sharing profits in the ratio of 3 : 2 : 1. Z retired and the new profit sharing ratio between X and Y was 1 : 2. On Z’s retirement the goodwill of the firm was valued at ₹ 30,000. Pass necessary journal entry for the treatment of goodwill on Z’s retirement.

[Ans. Only Y gains 2/6, X has also sacrificed 1/6. Hence Y will be debited from ₹ 10,000 and X and Z will be credited from ₹ 5,000 each.]

Solution:-