Q. 38 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 38 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

Following is the Balance Sheet of X, Y and Z as at 31st March, 2022. They share profits in the ratio of 3 : 3 : 2.

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 2,50,000 | Cash at Bank | 50,000 |

| General Reserve | 80,000 | Bills Receivable | 60,000 |

| Partners Loan A/cs: X Y | 50,000 40,000 | Debtors Less: Provision for Bad Debts | 76,000 |

| Capital A/cs: X Y Z | 1,00,000 60,000 50,000 | Stock | 1,24,000 |

| Fixed Assets | 3,00,000 | ||

| Advertisement Suspense A/c | 16,000 | ||

| Profit and Loss A/c | 4,000 | ||

| 6,30,000 | 6,30,000 |

On 1st April, 2022 Y decided to retire from the firm on the following terms:

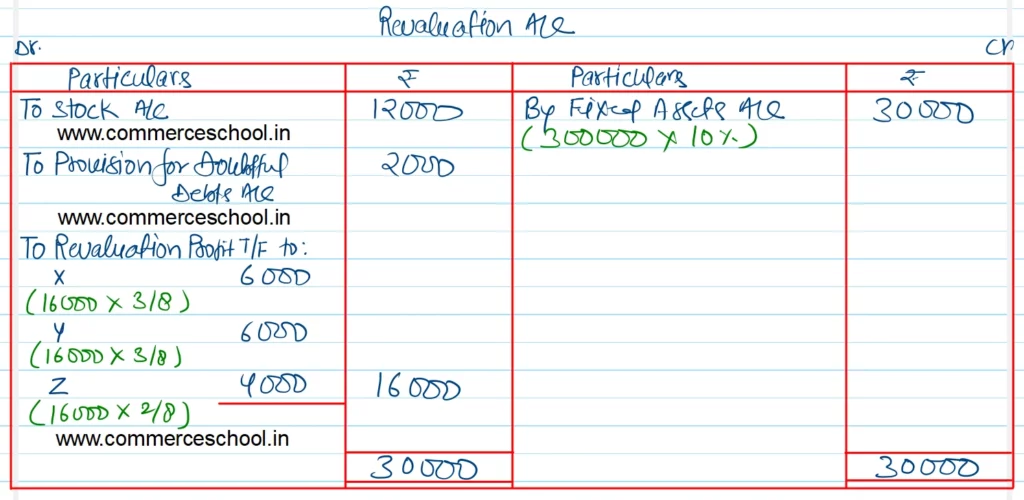

(a) Stock to be depreciated by ₹ 12,000.

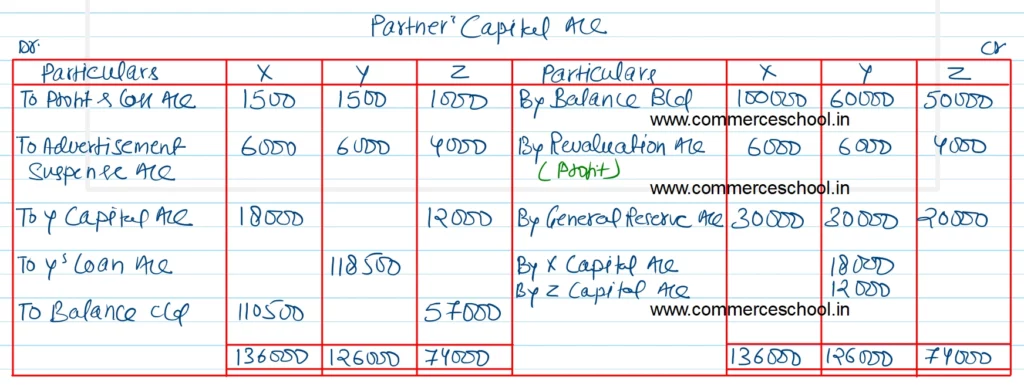

(b) Advertisement Suspense Account to be written off.

(c) Provision for Bad and Doubtful Debts to be increased to ₹ 6,000.

(d) Fixed Assets be appreciated by 10%.

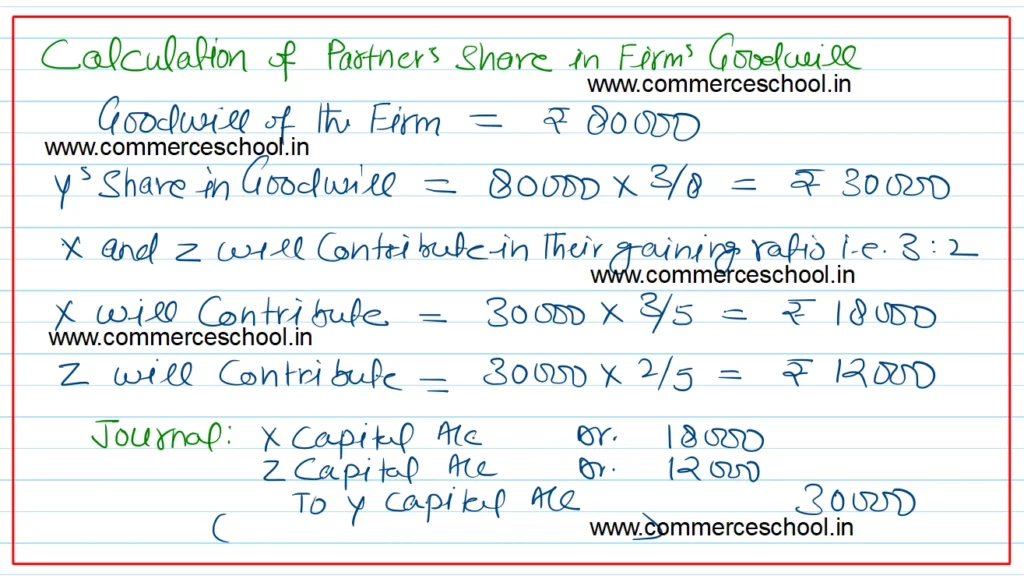

(e) Goodwill of the firm be valued at ₹ 80,000 and the amount due to the retiring partner be adjusted in X’s and Z’s Capital Accounts.

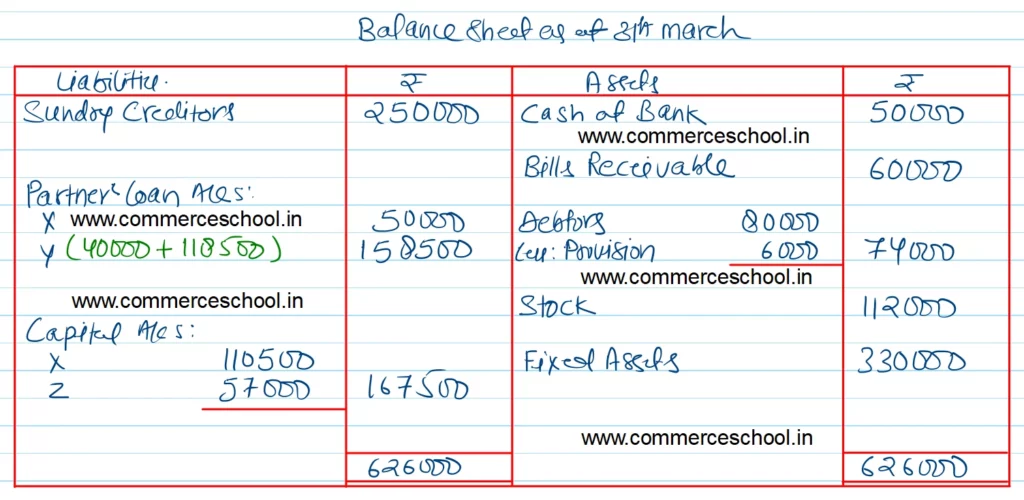

Prepare the Revaluation Account, Partner’s Capital Accounts and the Balance sheet to give effect to the above.

[Ans. Gain on Revaluation ₹ 16,000; Y’s Loan A/c ₹ 1,58,000 (i.e. ₹ 40,000 + ₹ 1,18,500); Capital X ₹ 1,10,000 and Z ₹ 57,000; B/S Total ₹ 6,26,000.]

Solution:-