Q. 40 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 40 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

A, B and C are in partnership sharing profits in the ratio of 3 : 2 : 1. On 28th February, 2023 C retires from the firm. Their Balance Sheet on this date was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 1,20,000 | Bank | 25,000 |

| Outstanding Expenses | 10,000 | Debtors | 1,65,000 |

| Profit & Loss Account | 1,50,000 | Stock | 2,50,000 |

| Capital Account: A B C | 5,00,000 3,00,000 2,00,000 | Investments | 3,00,000 |

| Fixed Assets | 5,40,000 | ||

| 12,80,000 | 12,80,000 |

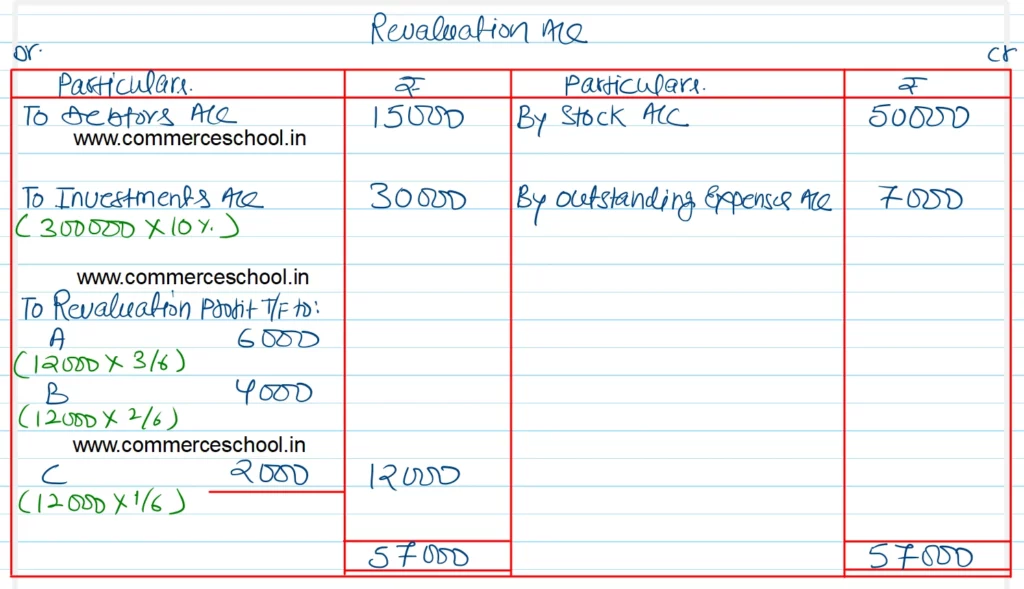

The following was agreed upon:

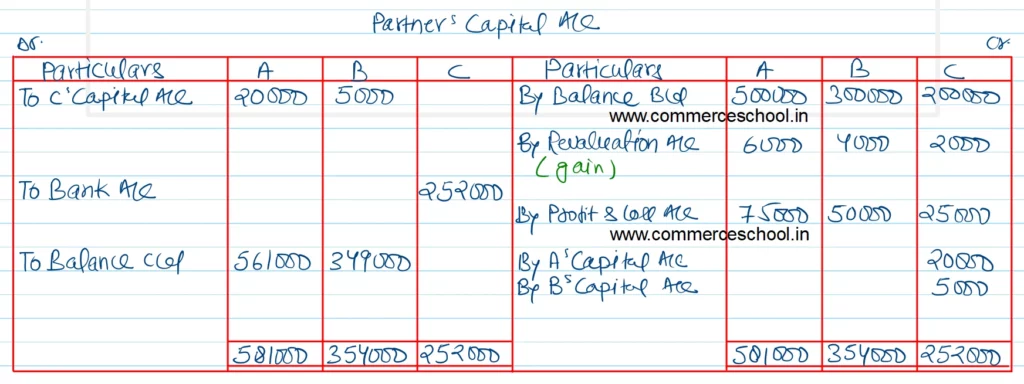

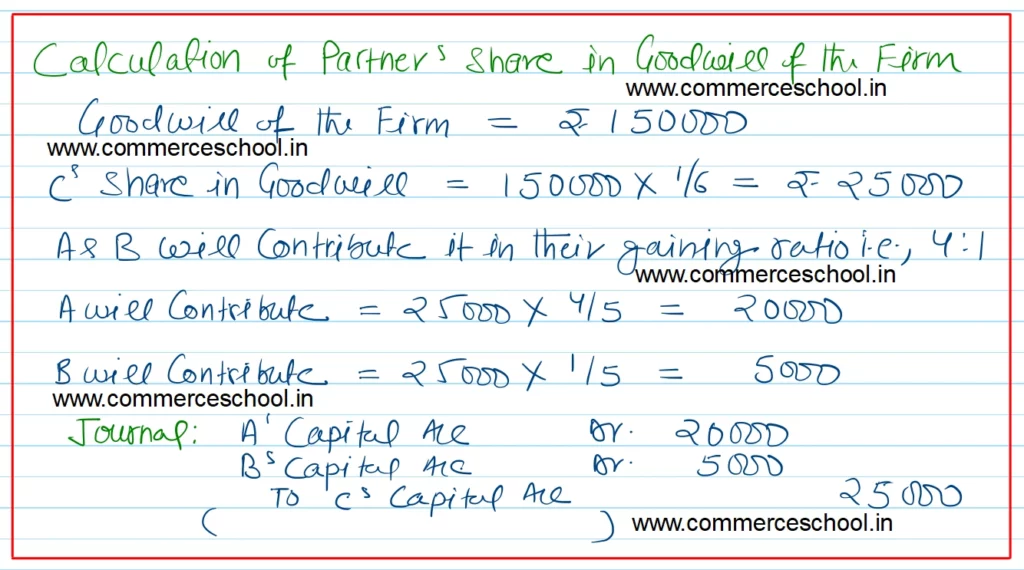

(i) Goodwill of the firm is valued at ₹ 1,50,000. C sells his share of goodwill to A and B in the ratio of 4 : 1.

(ii) Stock is revalued at ₹ 3,00,000 and debtors are revalued at ₹ 1,50,000.

(iii) Outstanding expenses be brought down to ₹ 3,000.

(iv) Investments are sold at a loss of 10%.

(v) C is paid off in full.

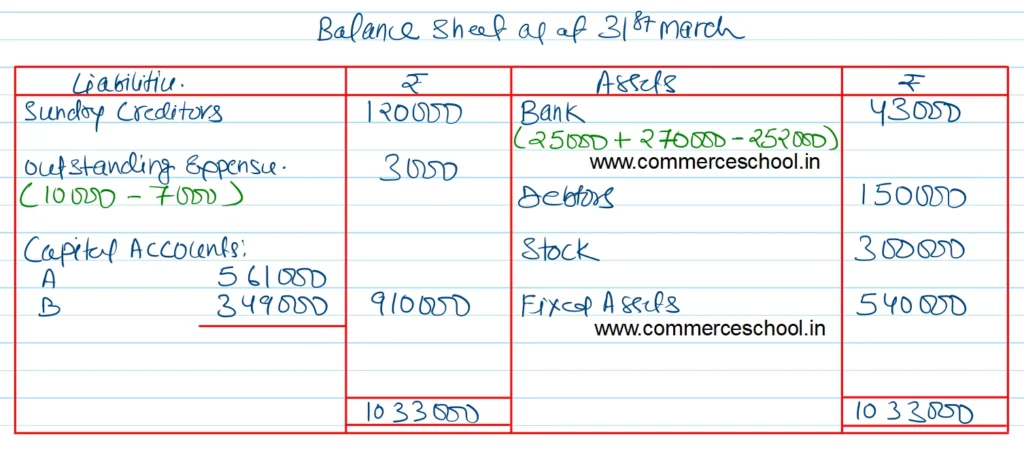

Prepare Revaluation Account, Capital Accounts and the Balance Sheet of the new firm.

[Ans. Gain on Revaluation ₹ 12,000; Amount paid to C ₹ 2,52,000; A’s Capital ₹ 5,61,000; B’s Capital ₹ 3,49,000; B/S Total ₹ 10,33,000; Bank Balance ₹ 43,000.]

Solution:-