Q. 69 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 69 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

Tripti, Atishay and Radhika were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance Sheet as at 31-3-2024 was as follows:

Balance Sheet of Tripti, Atishay and Radhika as at 31st March

| Liabilities | ₹ | Assets | ₹ |

| Capitals: Tripti Atishay Radhika | 3,00,000 2,00,000 1,00,000 | Plant and Machinery | 5,00,000 |

| Profit for the year 2023-24 | 2,00,000 | Stock | 3,10,000 |

| General Reserve | 50,000 | Sundry Debtors | 60,000 |

| Creditors | 60,000 | Cash at Bank | 40,000 |

| 9,10,000 | 9,10,000 |

Tripti died on 30th June, 2024. According to the partnership deed, the executors of the deceased partner are entitled to:

(a) Balance in partner’s capital account.

(b) Salary @ ₹ 12,500 per quarter.

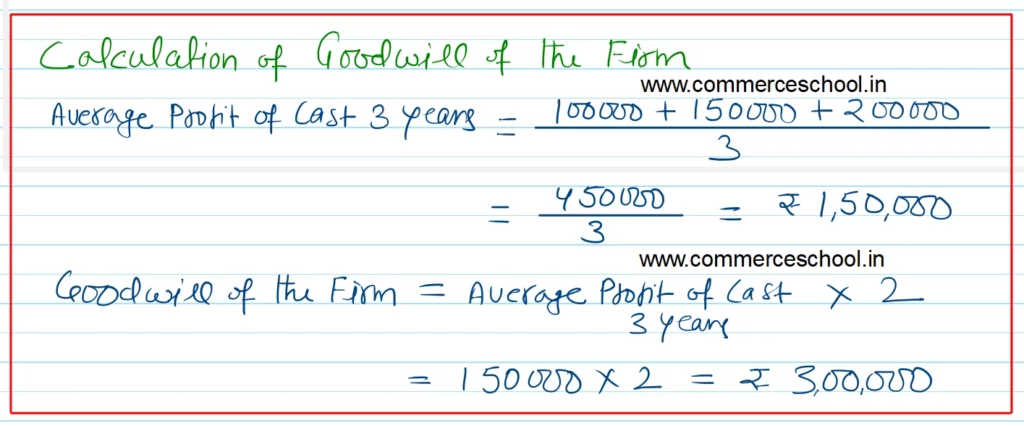

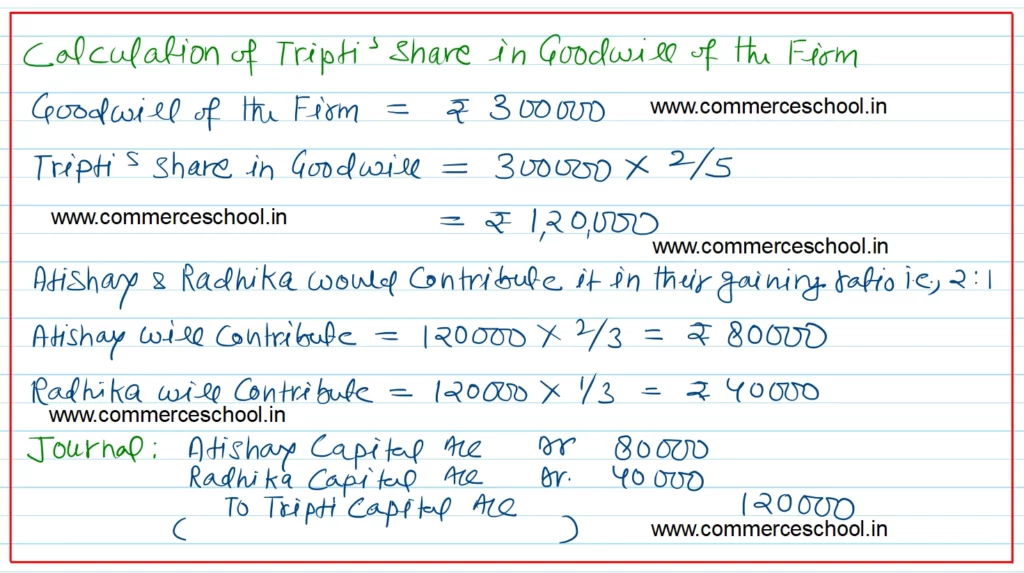

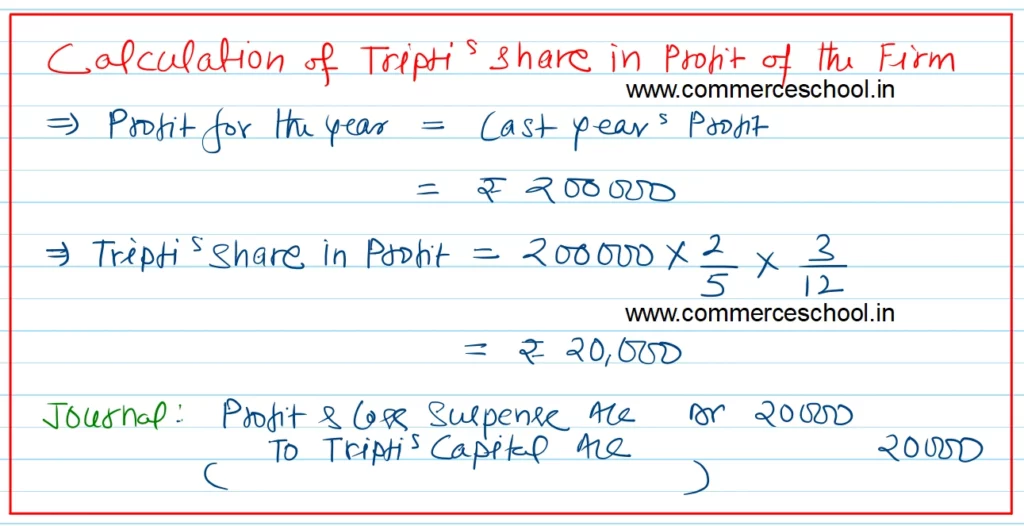

(c) Share of goodwill calculated on the basis of twice the average of past three year’s profits and share of profits from the closure of the last accounting year till the date of death on the basis of last year’s profit. Profits for 2021-22 and 2022-23 were ₹ 1,00,000 and ₹ 1,50,000 respectively.

(d) Tripti withdrew ₹ 20,000 on 1st May, 2024 for her personal use.

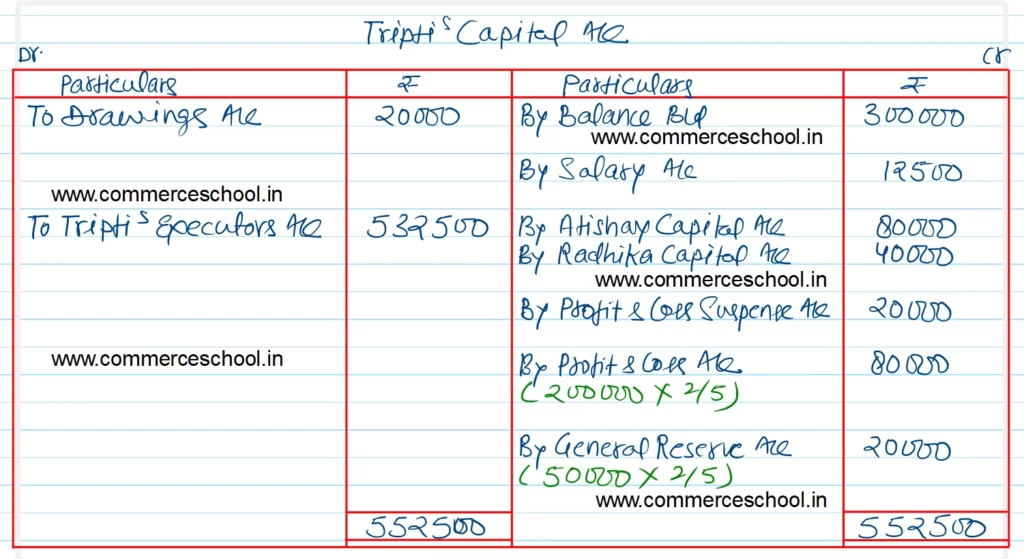

Prepare Tripti’s Capital Account to be rendered to her executors.

[Ans. Amount due to Tripti’s Executors ₹ 5,32,500.]

Hint: Average Profit = 1/3 (1,00,000 + 1,50,000 + 2,00,000 given in the Balance sheet).

Solution:-

not write