Q. 74 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 74 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

You are given the Balance Sheet of A, B and C who are partners sharing profits in the ratio of 2 : 2 : 1 as at March 31, 2022.

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 40,000 | Goodwill | 30,000 |

| Reserve Fund | 25,000 | Fixed Assets | 60,000 |

| Capitals: A B C | 30,000 25,000 15,000 | Stock | 10,000 |

| Sundry Debtors | 20,000 | ||

| Cash at Bank | 15,000 | ||

| 1,35,000 | 1,35,000 |

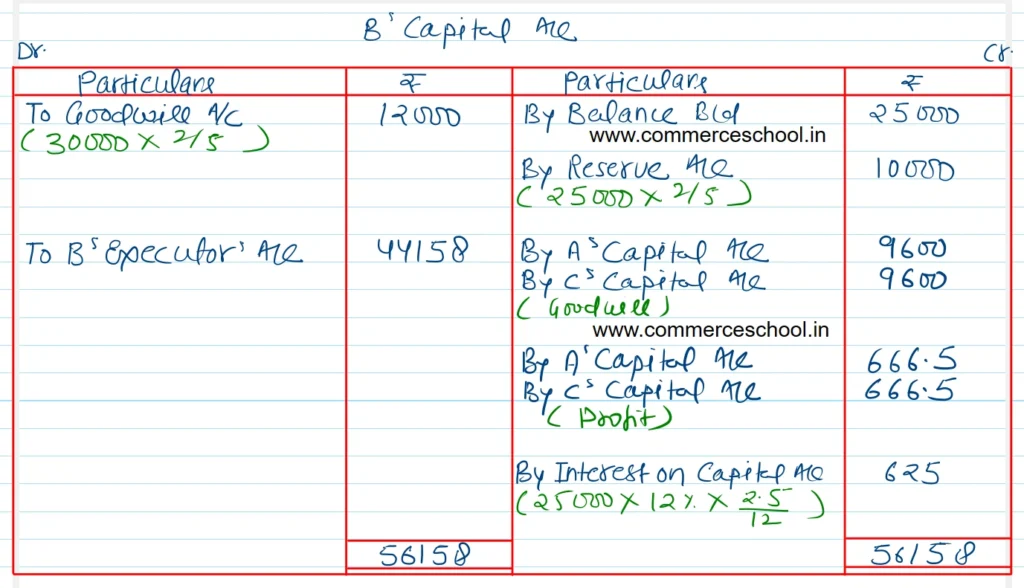

B died on June 15, 2022. According to the deed, his legal representatives are entitled to:

(a) Balance in Capital Account;

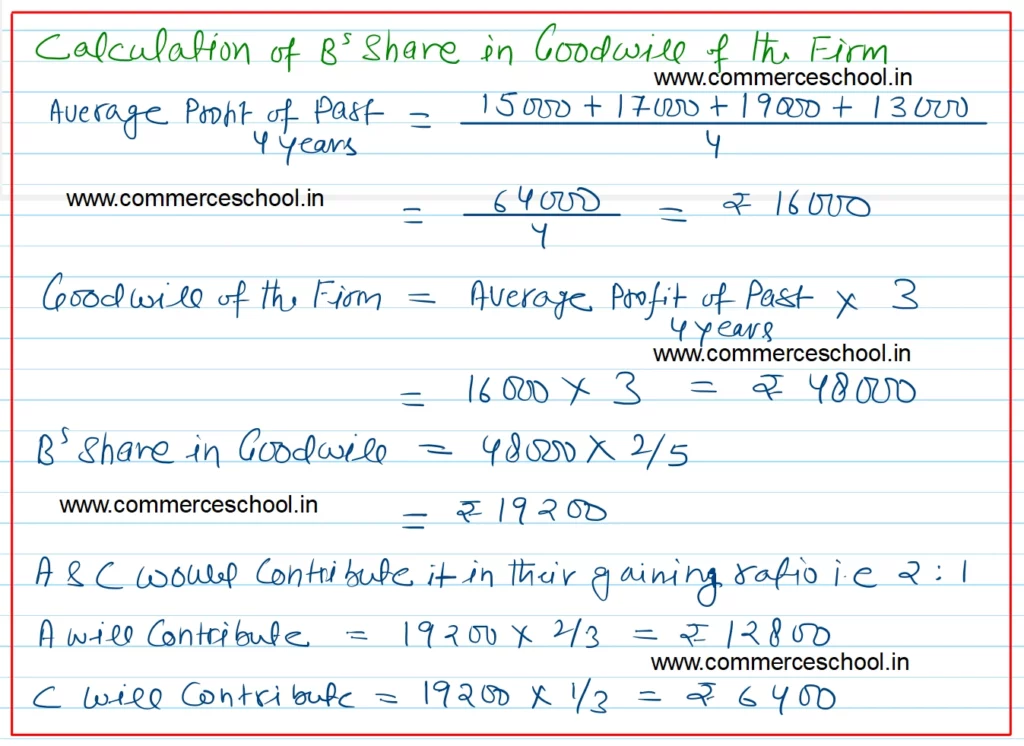

(b) Share of goodwill valued on the basis of thrice the average of the past 4 year’s profits;

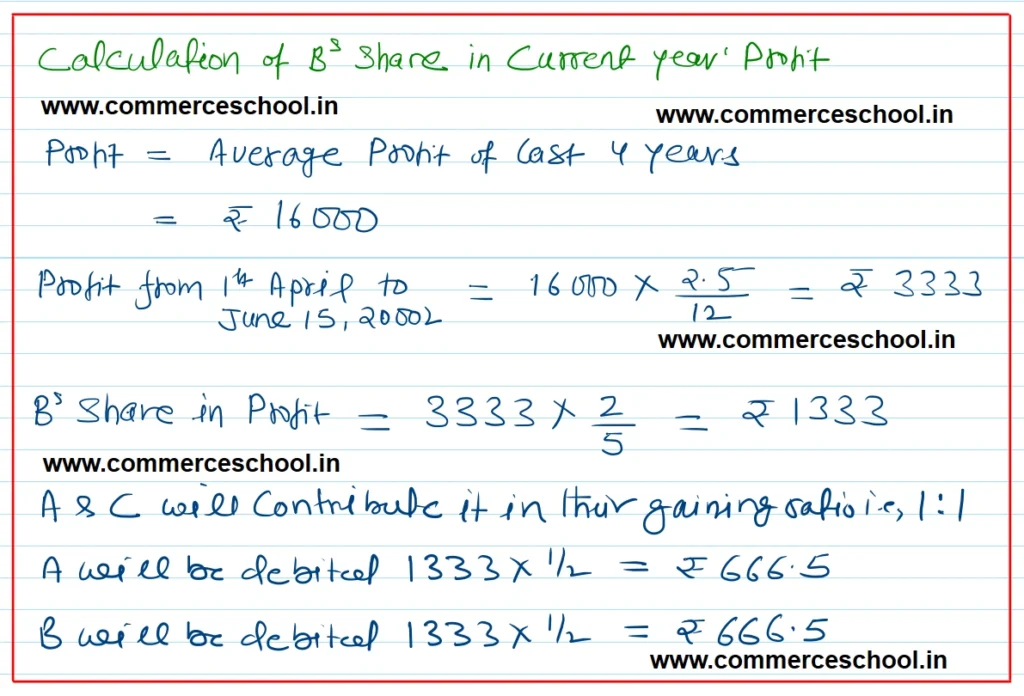

(c) Share in profits up to the date of death on the basis of average profits for the past 4 years;

(d) Interest on capital account @ 12% p.a.

Profits for the years ending on March 31 of 2019, 2020, 2021, 2022 respectively were ₹ 15,000, ₹ 17,000, ₹ 19,000 and ₹ 13,000.

B’s legal representatives were to be paid the amount due. A and C continued as partners by taking over B’s share equally. Work out the amount payable to B’s legal representatives.

[Ans. Amount paid to B’s representatives ₹ 44,158.]

Hints: (1) Share in profits for 2.5 months ₹ 1,333.

(2) B’s share of profit ₹ 1,333 will be credited to B and debited to A and C in their gaining ratio i.e., equally.

Solution:-

sir in this question the gaining ratio is given 1:1 but you have divided the goodwill and the share of profit of the deceased partner amongst the continuing partners in the wrong gaining ratio so kindly look towards it

Thanks for informing, i have corrected it