Q. 75 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 75 of Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25)

L, M and N were partners sharing profits and losses in the ratio of 5 : 3 : 2. Their Balance Sheet as at 1.4.2022 was as under:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 20,000 | Cash at Bank | 28,000 |

| Reserves | 9,000 | Debtors | 22,000 |

| Capitals: L M N | 50,000 30,000 20,000 | Stock | 20,000 |

| Machinery | 47,000 | ||

| Investments | 12,000 | ||

| 1,29,000 | 1,29,000 |

N died on 5th November, 2022 and according to the partnership deed his executors were entitled to be paid as under:

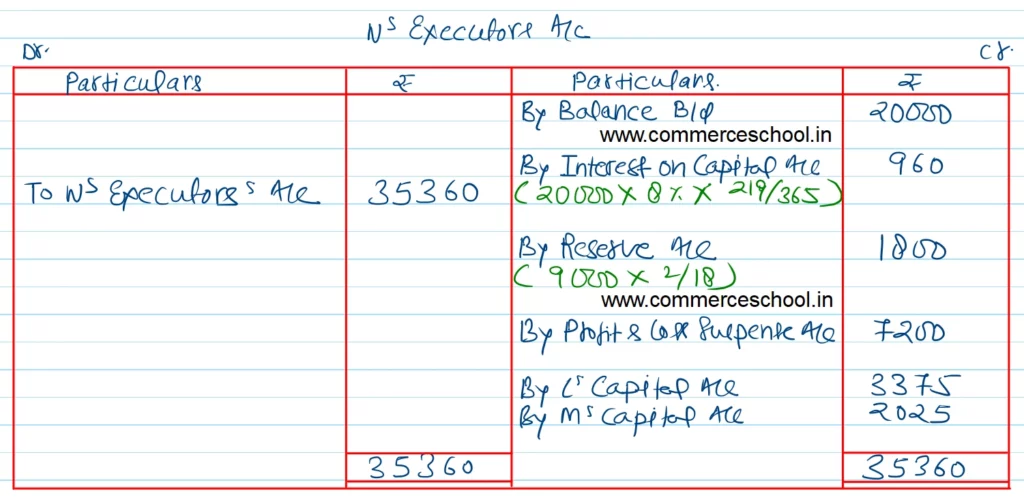

(a) The capital to his credit at the time of his death and interest thereon @ 8% per annum.

(b) His share of Reserves.

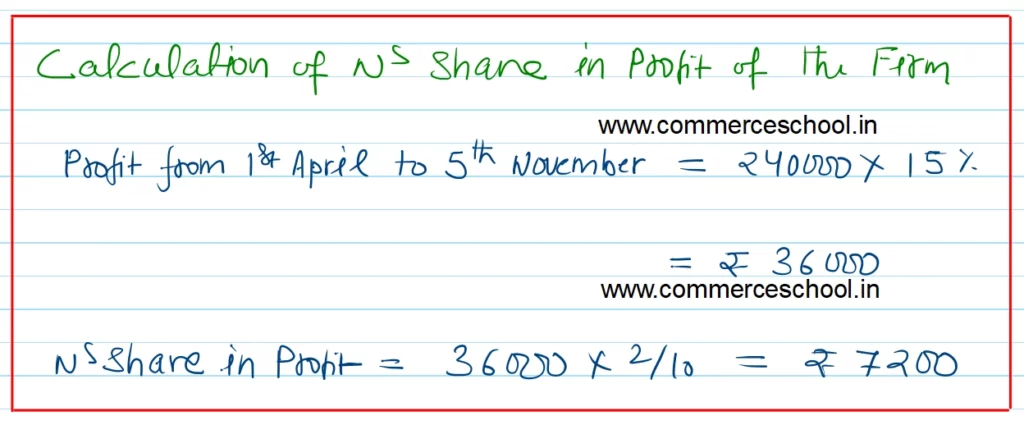

(c) His share of profits for the intervening period will be based on the sales during that period, which were calculated as ₹ 2,40,000. The rate of profit during past 4 years had been 15% on sales.

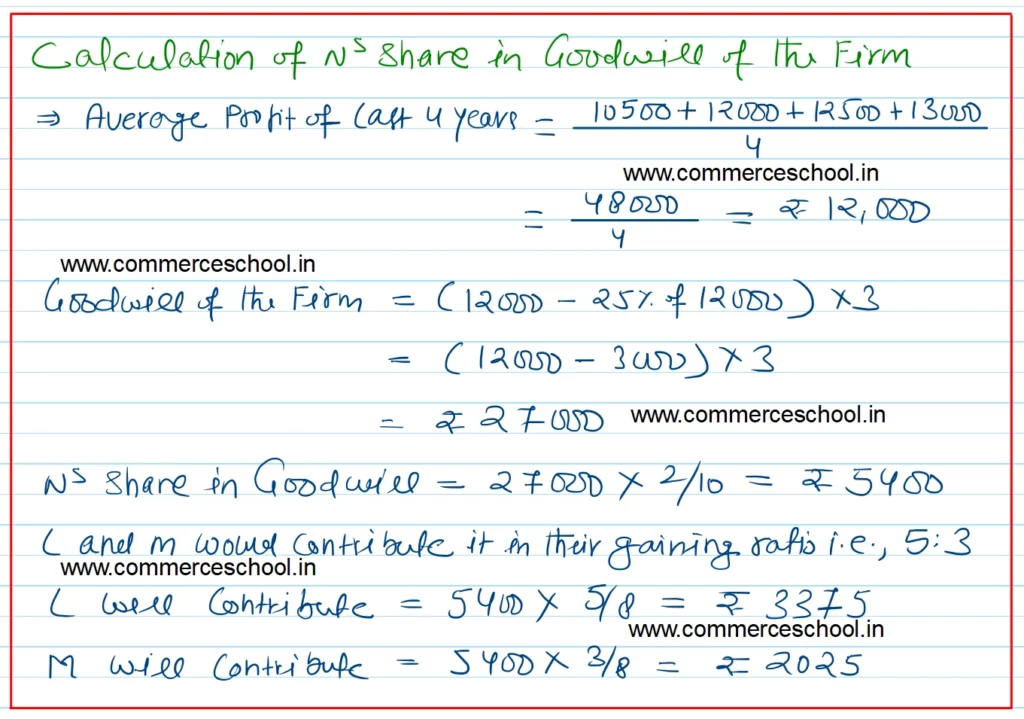

(d) Goodwill according to his share of profit to be calculated by taking thrice the amount of the average profit of the last four years less 25%. The profits of the previous years were:

| 2019 | ₹ 10,500 |

| 2020 | ₹ 12,000 |

| 2021 | ₹ 12,500 |

| 2022 | ₹ 13,000 |

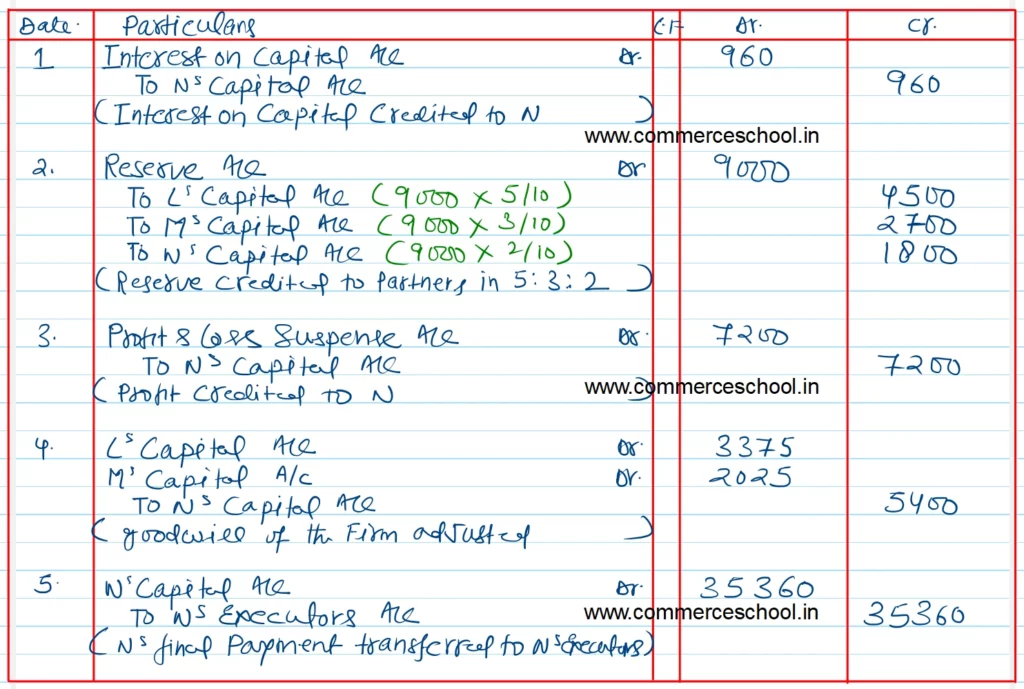

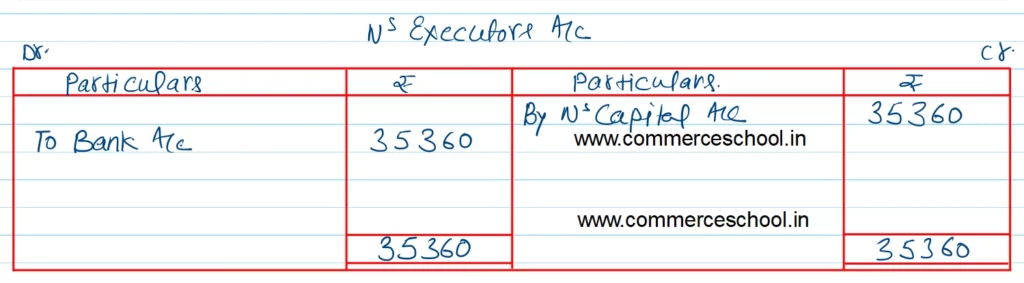

The investments were sold at par and his executors were paid out. Pass the necessary journal entries and write the account of the executors of N.

[Ans. Amount paid to N’s executors ₹ 35,360.]

Hint:

Interest on Capital : 20,000 x 8/100 x 219/365 = ₹ 960.

Solution:-